Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

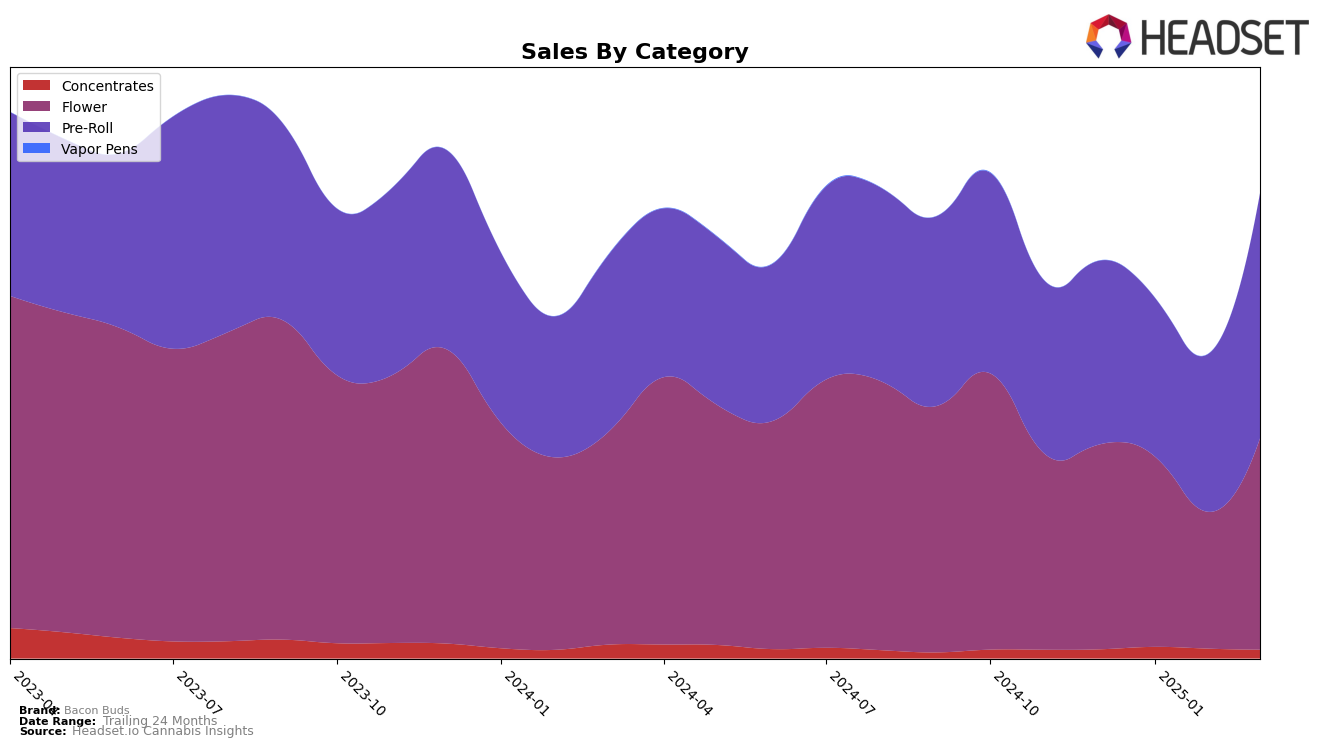

In the state of Washington, Bacon Buds has shown variable performance across different categories. In the Flower category, the brand struggled to maintain a consistent presence within the top rankings. Starting from a rank of 43 in December 2024, it slipped out of the top 50 in February 2025, before rebounding to 36 in March 2025. This fluctuation suggests a competitive market where Bacon Buds faces challenges in sustaining its position. The Pre-Roll category, however, presents a more promising picture. Bacon Buds improved its rank from 25 in December 2024 to 19 by March 2025, indicating a positive trend and possibly stronger consumer preference or effective marketing strategies in this category.

Notably, Bacon Buds did not make it to the top 30 brands in the Flower category for February 2025, which could be a point of concern for stakeholders focusing on this segment. On the other hand, the Pre-Roll category's consistent improvement in rank highlights a potential area for growth and investment. The brand's March 2025 sales in the Pre-Roll category were significantly higher compared to previous months, which might suggest successful promotional efforts or a seasonal demand spike. These insights could be pivotal for strategizing future market approaches and resource allocation in Washington.

Competitive Landscape

In the competitive landscape of Washington's Pre-Roll category, Bacon Buds has shown a notable upward trajectory in recent months. Starting from a rank of 25 in December 2024, Bacon Buds improved its position to 19 by March 2025, indicating a significant climb in the rankings. This positive trend contrasts with brands like Agro Couture, which saw a decline from 14 to 18 over the same period, and Falcanna, which also dropped from 18 to 21. Meanwhile, 1988 maintained a relatively stable position, hovering around the 16th and 17th ranks. The sales figures for Bacon Buds reflect a robust growth, particularly in March 2025, where it outperformed its earlier months, suggesting a successful strategy in capturing market share. This growth is crucial as it positions Bacon Buds as a rising contender against established brands, potentially attracting more consumer interest and loyalty.

Notable Products

In March 2025, Legend of Nigeria Pre-Roll 2-Pack (1g) maintained its top position among Bacon Buds products, achieving sales of 6,238 units. Big Smooth Pre-Roll 2-Pack (1g) improved its ranking from third place in the previous months to second place, showing a significant increase in sales figures. Bootylicious Pre-Roll 2-Pack (1g) dropped to third place despite consistent sales performance. Double D's Pre-Roll 2-Pack (1g) held steady in fourth place, with sales slightly declining compared to previous months. Notably, Pressure Pre-Roll 2-Pack (1g) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.