Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

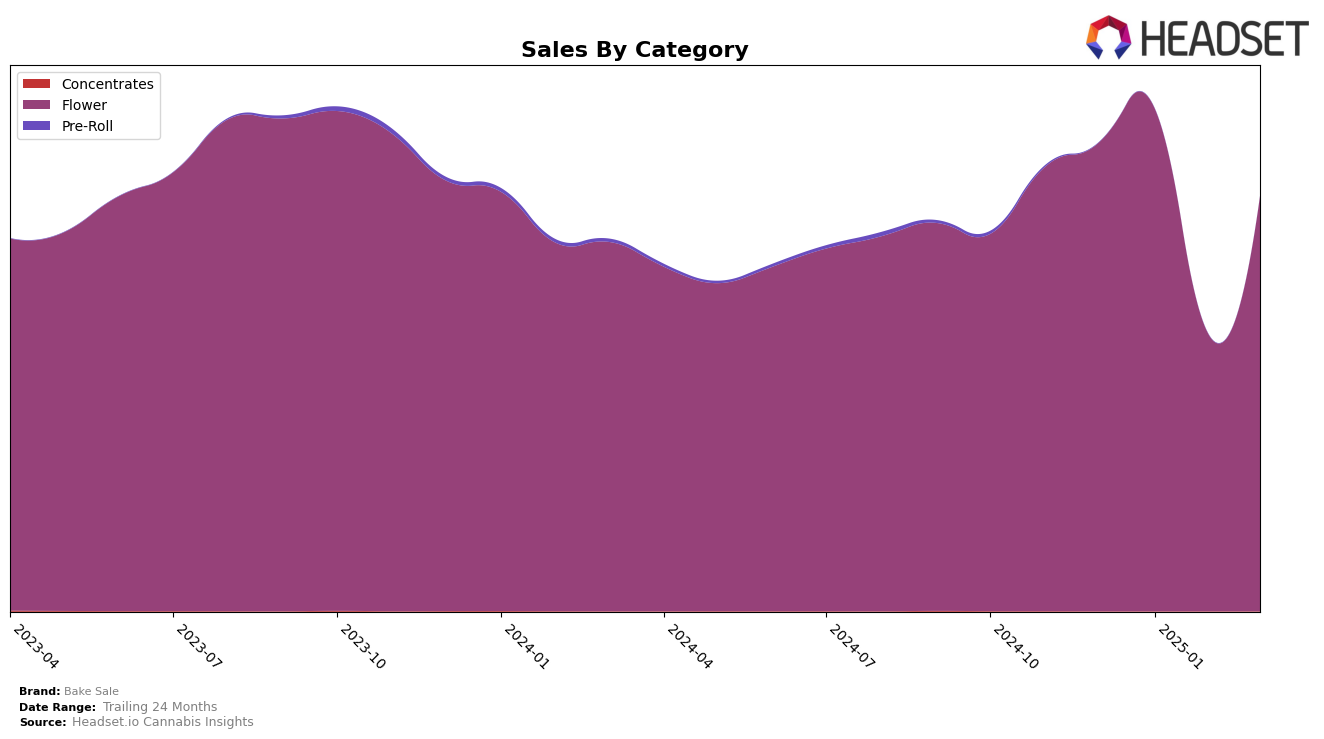

Bake Sale has shown varied performance across Canadian provinces in the Flower category. In Alberta, the brand experienced a slight decline in its ranking from December 2024 to March 2025, moving from 10th to 12th place. Despite this drop, the brand maintained a presence in the top 15, indicating a stable performance in a competitive market. In contrast, British Columbia saw more fluctuation, with Bake Sale initially holding the top position in December 2024 but dropping to 19th in February 2025 before climbing back to 5th in March. This suggests a volatile yet resilient market presence, with the brand managing to recover its standing after a significant dip.

In Saskatchewan, Bake Sale demonstrated impressive growth in the Flower category, leaping from 27th in December 2024 to 2nd in January 2025 and maintaining a strong position through March 2025. This significant improvement highlights the brand's increasing popularity and competitive edge in this province. However, the absence of Bake Sale from the top 30 in other categories or regions during these months could point to areas where the brand might need to enhance its market penetration or diversify its product offerings. These insights into Bake Sale's performance across provinces underscore its strengths and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Bake Sale has experienced significant fluctuations in its rank and sales performance from December 2024 to March 2025. Initially holding the top position in December 2024, Bake Sale saw a dramatic drop to 19th place by February 2025, before rebounding to 5th place in March 2025. This volatility indicates a highly competitive market environment. Meanwhile, BC Smalls consistently performed well, securing the 1st position in January 2025 and maintaining a strong presence in the top three ranks throughout the period. The Loud Plug also demonstrated stability, consistently ranking 4th from January to March 2025. In contrast, Good Supply and Weed Me showed upward trends, with Weed Me notably improving from 13th in January to 7th in March 2025. These dynamics suggest that while Bake Sale remains a strong contender, it faces stiff competition from brands like BC Smalls and The Loud Plug, which have shown more consistent performance in recent months.

Notable Products

In March 2025, the top-performing product from Bake Sale was All Purpose Flower Sativa (28g), which reclaimed the number one rank from its second place in the previous two months, achieving sales of 15,852 units. The All Purpose Flower Indica (28g) dropped to the second position after leading in January and February 2025. All Purpose Flower Sativa (30g) maintained its third-place ranking consistently from February to March. Notably, All Purpose Flower Indica (15g) was not ranked in March 2025, indicating a potential discontinuation or stock issue. The Grab Bag Pre-Roll 10-Pack (4g) did not feature in the rankings from January to March, suggesting a decline in its market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.