Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

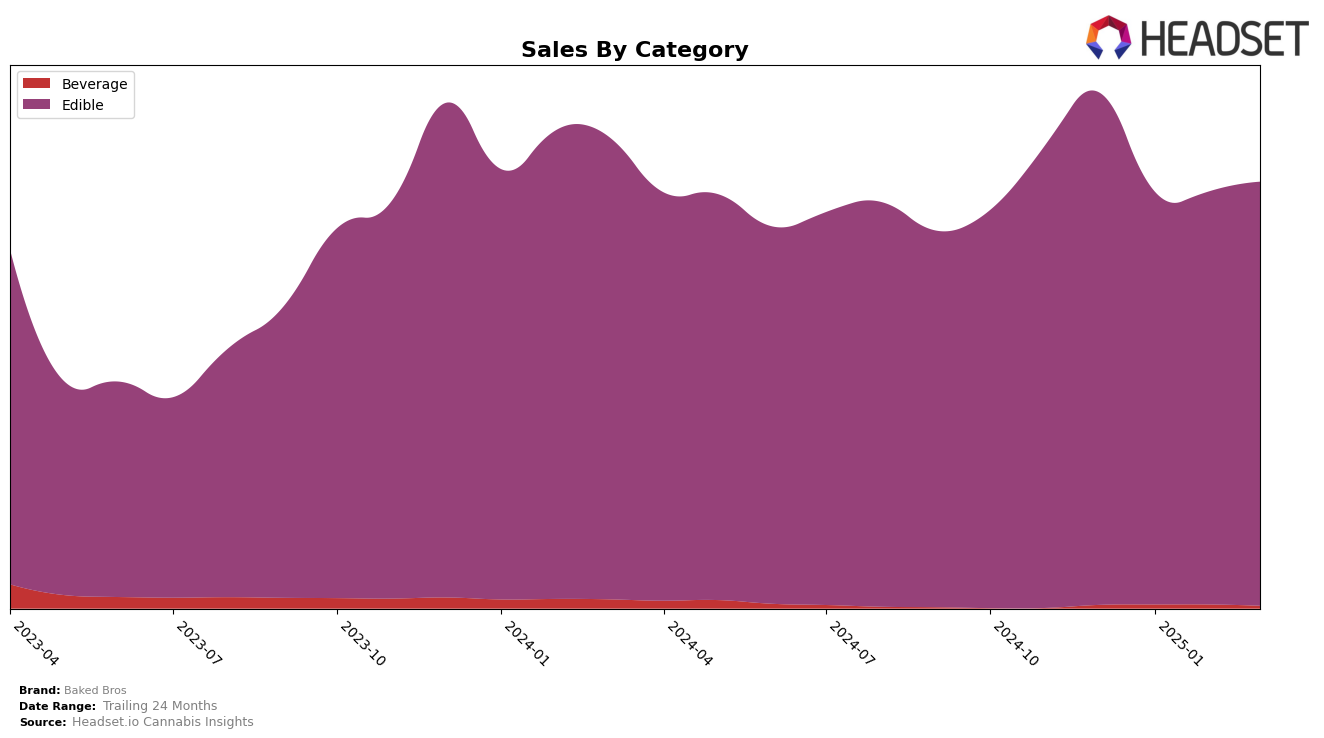

Baked Bros has shown a consistent performance in the Arizona market, particularly in the Edible category. As of December 2024, Baked Bros held a strong position, ranking 2nd, but experienced a slight dip in January 2025 to the 5th position. This dip was followed by a recovery to the 4th position in both February and March 2025. Despite these fluctuations, the brand maintained a presence within the top five, indicating a stable consumer base and effective market strategies. The slight decline in January could suggest seasonal variations or increased competition, but the quick rebound in subsequent months highlights resilience and adaptability.

It is noteworthy that Baked Bros was not listed outside the top 30 brands in any state or category beyond Arizona during this period, suggesting a concentrated market presence. The sales trend shows a decrease from December 2024 to January 2025, followed by a gradual increase in the subsequent months. This trend might reflect strategic adjustments in response to market dynamics or consumer preferences. The overall performance in Arizona underscores the importance of the Edible category for Baked Bros, positioning it as a key player in this segment within the state.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Baked Bros has experienced notable fluctuations in its rank from December 2024 to March 2025. Initially ranked second in December 2024, Baked Bros saw a decline to fifth place in January 2025, before recovering slightly to fourth place in February and maintaining that position in March. This fluctuation in rank is significant when compared to competitors like OGEEZ, which consistently held the second position during the same period, and Gron / Grön, which maintained a strong third place. Meanwhile, Smokiez Edibles experienced more volatility, dropping from third to sixth place by March. Despite these rank changes, Baked Bros' sales remained relatively stable, indicating a resilient customer base. However, the consistent performance of competitors like Wana, which improved its rank to fifth by March, suggests that Baked Bros must innovate and adapt to maintain its competitive edge in this dynamic market.

Notable Products

In March 2025, the top-performing product from Baked Bros was the Sleepy - CBD/THC 2:1 Blackberry Acai x Granddaddy Purple Gummies 10-Pack, maintaining its number one rank for the fourth consecutive month with sales of $20,093. Following closely, the Happy - CBD/CBC/THC 1:1:1 Jack Herer Pomegranate Nectarine Gummies 10-Pack held steady at the second position, although experiencing a slight dip in sales compared to February. The Stoney - CBG/THC 1:1 OG Kush x Prickly Pear Lemonade Gummies 10-Pack also retained its third-place ranking, showing consistent performance over the months. Unwind - THC/CBG/CBC/CBDV 2:2:1:1 Huckleberry Punch Gummies 10-Pack remained fourth, with stable sales figures. Notably, the Very Berry Live Hash Rosin Gummies 10-Pack re-entered the rankings at fifth place, after not being ranked in January and February, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.