Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

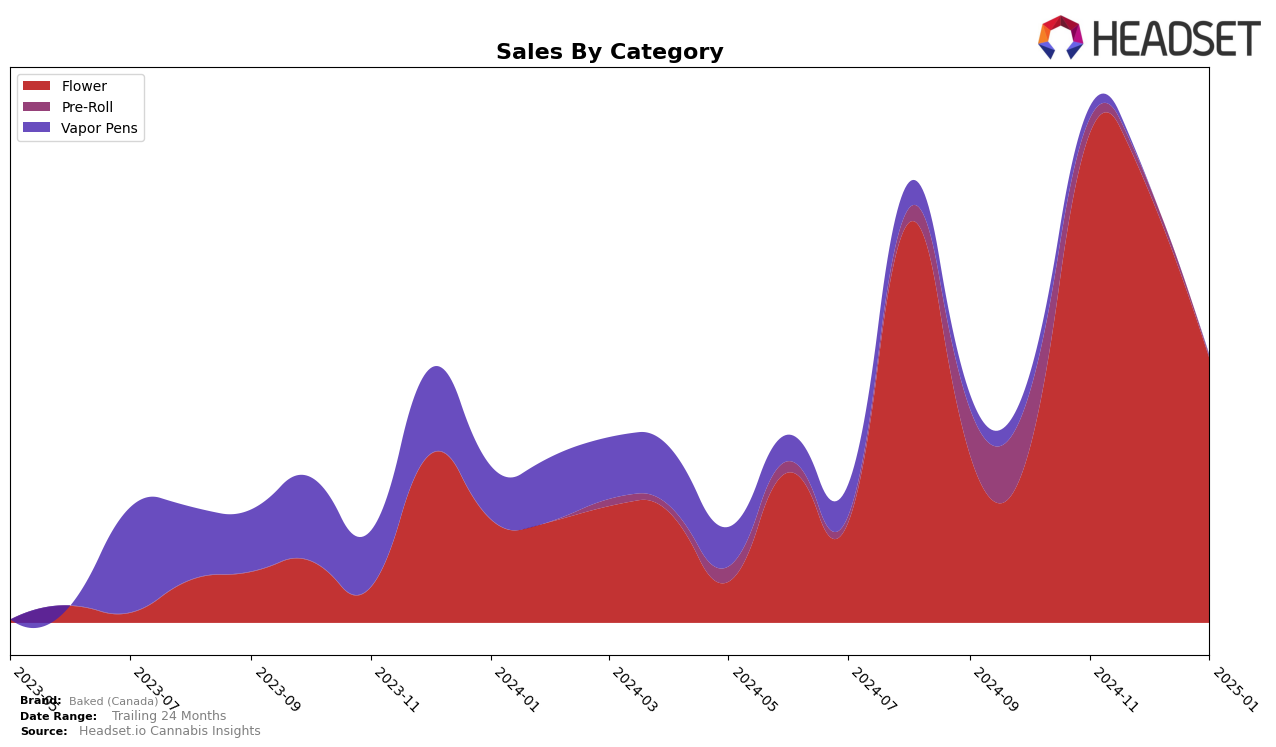

Baked (Canada) has shown notable performance in the Alberta cannabis market, particularly within the Flower category. The brand experienced a significant climb in rankings from October 2024 to November 2024, moving from 46th to 14th place. This upward trend continued into December 2024, albeit with a slight dip to 18th, before dropping to 28th in January 2025. This fluctuation indicates a dynamic presence in the market, with a peak in sales during November 2024. Baked (Canada)'s initial absence from the top 30 in the Pre-Roll and Vapor Pens categories suggests potential areas for growth or strategic reevaluation.

In the Pre-Roll and Vapor Pens categories, Baked (Canada) did not make it into the top 30 rankings during the analyzed months, which could be seen as a challenge for the brand. The absence from these categories highlights an opportunity for Baked (Canada) to diversify and strengthen its product offerings. Despite this, the brand's performance in the Flower category in Alberta demonstrates a strong foothold that could be leveraged to improve its standings in other categories. The data suggests that while Baked (Canada) has successfully captured a segment of the market, there is room for expansion and increased visibility across different product lines.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Baked (Canada) has experienced notable fluctuations in its market position over the past few months. After a significant leap in rank from 46th in October 2024 to 14th in November 2024, Baked (Canada) maintained a strong presence, ranking 18th in December 2024. However, by January 2025, the brand's rank slipped to 28th, indicating a potential challenge in sustaining its earlier momentum. This volatility contrasts with competitors like Boaz, which maintained a steady rank around 27th, and Versus, which showed a slight decline from 19th to 26th over the same period. Meanwhile, Cookies re-entered the top 30 in January 2025, suggesting a resurgence in their market strategy. These dynamics highlight the competitive pressures Baked (Canada) faces, emphasizing the need for strategic adjustments to regain and stabilize its market position.

Notable Products

In January 2025, PSC (28g) from Baked (Canada) maintained its top position in the Flower category with sales of 1075 units, continuing its reign as the best-selling product since November 2024. The Blueberry Cookies Infused Pre-Roll 3-Pack (1.5g) climbed to the second position in the Pre-Roll category, showcasing a consistent upward trend from its fifth position in November 2024. The Blueberry Terp Cartridge (1g) held steady at third place in the Vapor Pens category, maintaining the same rank as in the previous month. Meanwhile, the Pineapple Upside Down Terp Cartridge (1g) secured the fourth position in January 2025, showing a slight decline from its third-place rank in November and December 2024. Notably, the Pineapple Upside Down Cake Infused Pre-Roll 3-Pack (1.5g) was absent from the rankings in January 2025, despite being a top contender in earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.