Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

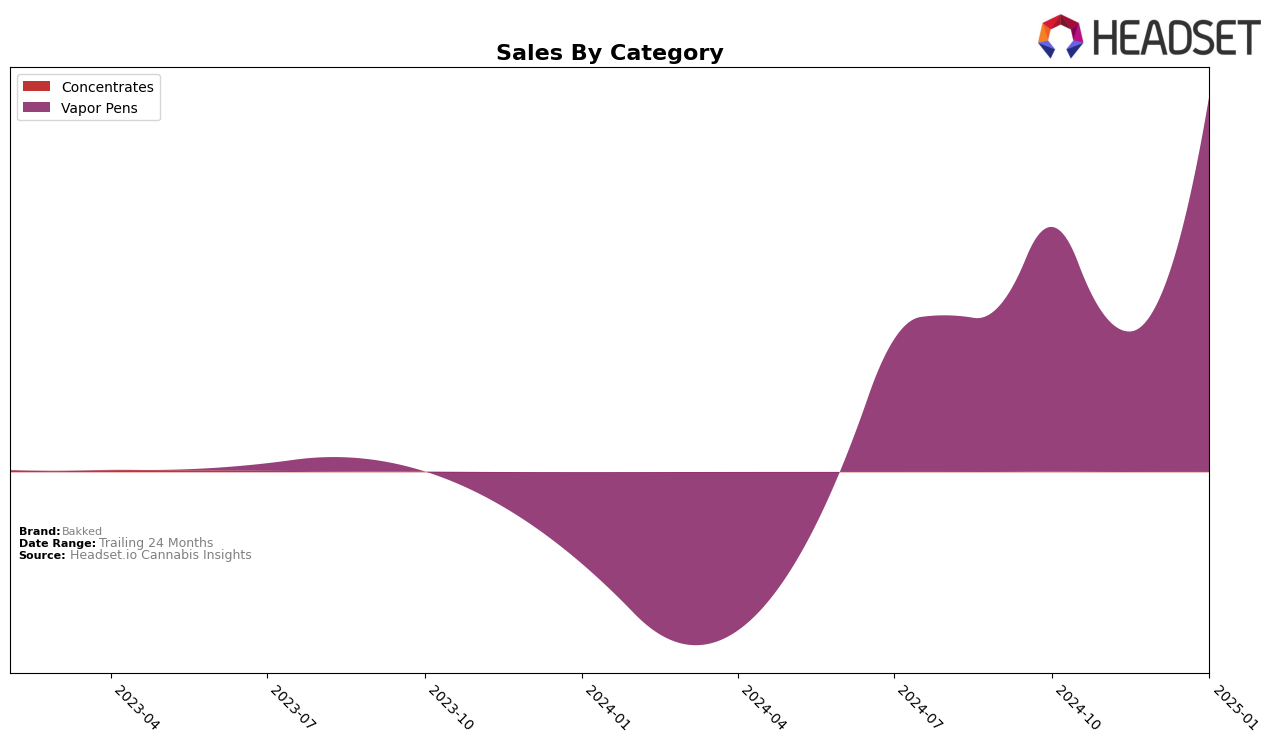

Bakked has shown a notable performance in the Vapor Pens category within the state of Colorado. Over the months from October 2024 to January 2025, Bakked's ranking has fluctuated, initially sitting outside the top 30 in October and November, with ranks of 39 and 48, respectively. However, by January 2025, Bakked made a significant leap, securing the 28th position. This upward movement is indicative of a strategic improvement or market adaptation that has allowed them to break into the top 30, a positive sign for the brand's trajectory in this competitive market.

While the sales figures for Bakked in Colorado show a promising trend with a substantial increase from November 2024 to January 2025, the brand's absence from the top 30 in earlier months suggests there might have been challenges or heightened competition that impacted its ranking. The fact that Bakked was not in the top 30 for two consecutive months highlights areas for potential growth and the need for sustained efforts to maintain their improved position. The brand's ability to climb the ranks in January is a testament to its resilience and potential for further growth in the Vapor Pens category.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Bakked has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked at 39th in October 2024, Bakked saw a decline in its rank to 48th in both November and December, before making a significant leap to 28th in January 2025. This upward movement in January suggests a positive shift in sales momentum, potentially driven by strategic marketing or product enhancements. In contrast, competitors like Dabs Labs and Mile High Xtractions (MHX) maintained more stable rankings, with Dabs Labs consistently improving its rank from 28th to 27th and MHX peaking at 23rd in December before dropping to 30th in January. Meanwhile, Sano Gardens and Edun have shown stronger sales performance, consistently ranking higher than Bakked, although both experienced a decline in January, indicating a potential market shift that Bakked could capitalize on. These dynamics highlight the competitive pressure Bakked faces, yet also underscore its potential for growth in the vapor pen market in Colorado.

Notable Products

In January 2025, the top-performing product for Bakked was the Blueberry Muffin Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the first rank with sales of 4733. The Lemon Cherry Gelato Distillate Cartridge (1g) followed closely in second place, maintaining a consistent presence in the top ranks over the past months. Maui Wowie Distillate Cartridge (1g) dropped from its previous second place in December 2024 to third in January 2025. Notably, the Berry Runtz Distillate Cartridge (1g) moved up to fourth place, while Grape Galaxy Distillate Cartridge (1g) shared the same rank, showing a significant improvement from its fifth-place position in December 2024. Overall, the Vapor Pens category saw dynamic shifts in product rankings, reflecting changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.