Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

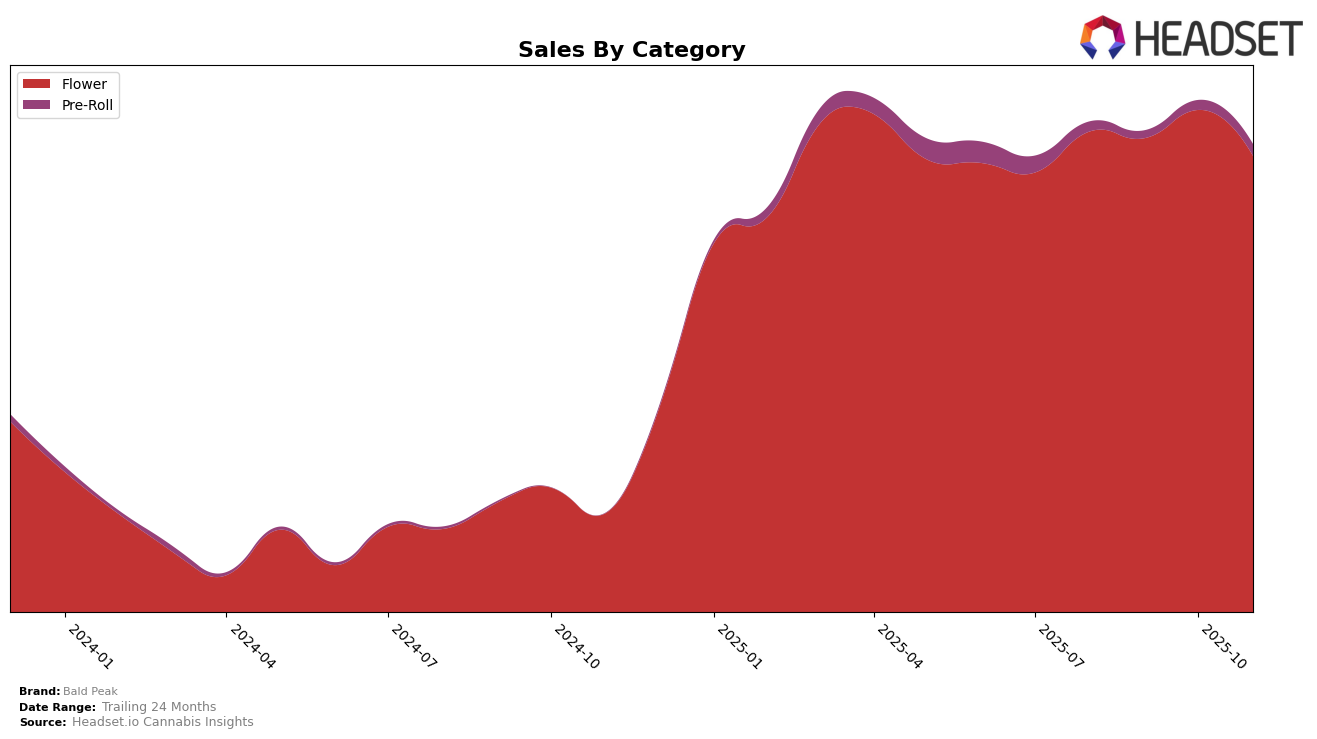

Bald Peak has demonstrated consistent performance in the Flower category within Oregon, maintaining a solid second place ranking from August through November 2025. This stability suggests a strong market presence and customer loyalty in the Flower segment, despite slight fluctuations in sales figures. Notably, sales peaked in October before experiencing a minor decline in November. This consistency in ranking, coupled with the ability to sustain high sales volumes, underscores Bald Peak's robust positioning in the Oregon Flower market.

In contrast, Bald Peak's performance in the Pre-Roll category within Oregon has been more variable. The brand was not ranked in the top 30 in September, which indicates a potential challenge in maintaining a competitive edge in this category. However, a rebound is evident by November, with the brand climbing to the 66th position. This upward movement suggests a possible strategic adjustment or increased consumer interest, but the absence from the top 30 in September highlights areas for improvement. Overall, while Bald Peak shows strength in Flower, its Pre-Roll category presents both challenges and opportunities for growth.

Competitive Landscape

In the Oregon Flower category, Bald Peak has consistently maintained its position as the second-ranked brand from August to November 2025, indicating a stable market presence. Despite this consistency, Bald Peak faces significant competition from PRUF Cultivar / PRŪF Cultivar, which holds the top spot with notably higher sales figures. Meanwhile, Otis Garden has shown remarkable improvement, jumping from 17th place in September to 3rd in November, which could pose a future threat to Bald Peak's ranking if this upward trend continues. Additionally, High Tech has also shown volatility, peaking at 3rd place in October before settling at 4th in November, suggesting a dynamic competitive landscape. These shifts highlight the importance for Bald Peak to strategize effectively to maintain its position amidst evolving market dynamics.

Notable Products

In November 2025, Blueberry Octane (1g) maintained its top position as the leading product for Bald Peak, with sales reaching 2,718 units. Maui Melon Bubblegum (1g) climbed two spots from the previous month to secure the second position, while Caribbean Creme (1g) improved its ranking from fifth to third. Lemon Pastries (1g) entered the top five, debuting in fourth place. Hawaiian Durban Pie (1g) experienced a decline, dropping from second place in October to fifth in November. This shift in rankings highlights a dynamic change in consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.