Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

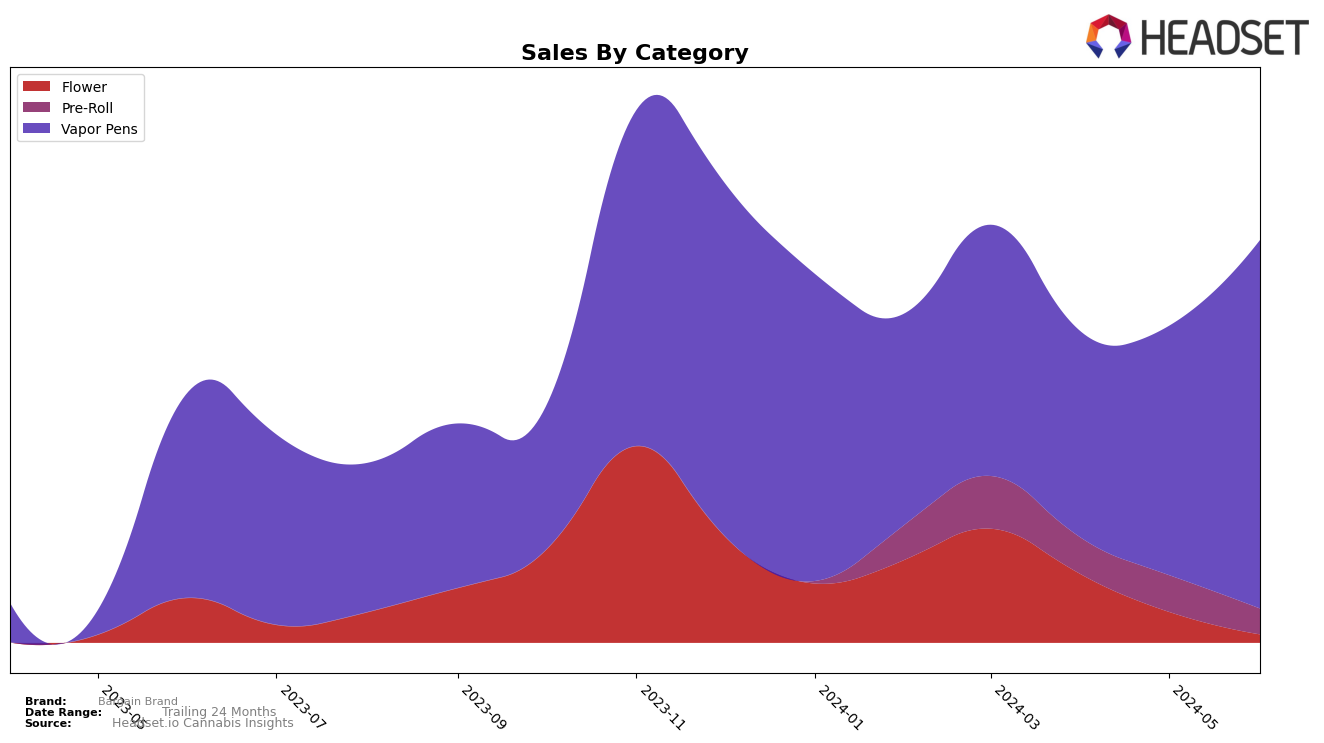

Bargain Brand has shown varying performance across different categories and states. In the Vapor Pens category, the brand has experienced significant movement in Alberta, where it was not ranked in the top 30 in March and April 2024 but made a notable leap to 73rd and then 41st place in May and June, respectively. This upward trend indicates a growing acceptance and popularity of their vapor pens in Alberta. In Ontario, however, Bargain Brand has faced a different trajectory, with rankings fluctuating from 58th in March to 76th in May, and then slightly improving to 64th in June. The brand's sales in Ontario also reflect this inconsistency, with a notable drop from March to May before a recovery in June.

In Saskatchewan, Bargain Brand has had a mixed performance across categories. In the Flower category, the brand appeared in the rankings only in March 2024, placing 75th, and then dropped out of the top 30 for the following months, which could be a concern for their market presence in this category. Conversely, in the Vapor Pens category, Bargain Brand has maintained a more stable performance, consistently ranking in the top 30 from March through June, with a peak at 25th place in both May and June. This consistent presence suggests that while their flower products may not be as competitive, their vapor pens are gaining steady traction among consumers in Saskatchewan.

Competitive Landscape

In the competitive landscape of Vapor Pens in Alberta, Bargain Brand has shown a notable fluctuation in its ranking and sales over recent months. After not being in the top 20 brands for March and April 2024, Bargain Brand made a significant leap to rank 73rd in May and further improved to 41st in June. This upward trend indicates a positive reception and growing market presence. In contrast, Glacial Gold has maintained a relatively stable but lower rank, moving from 50th in March to 44th in June. Meanwhile, Papa's Herb experienced a sharp decline from 24th in April to 37th in June, suggesting potential volatility or challenges in maintaining its market share. RAD (Really Awesome Dope) and Roilty Concentrates also showed fluctuations but remained within a closer range, indicating a more stable performance compared to Bargain Brand's dramatic rise. These dynamics highlight Bargain Brand's potential for rapid growth amidst a competitive market, making it a brand to watch in the coming months.

Notable Products

In June 2024, the top-performing product for Bargain Brand was the Citrus Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the first rank with sales reaching 2053 units. The Banana Split Distillate Cartridge (1g) in the same category, previously holding the top spot for three consecutive months, slipped to second place. The Grape Distillate Cartridge (1g), also in Vapor Pens, maintained its third rank from May 2024. The Fruity & Hazy Sativa Pre-Roll 10-Pack (5g) in the Pre-Roll category remained steady at fourth place, while the Fruity & Hazy Sativa (7g) in the Flower category reappeared at fifth rank after being unranked in May. Notably, the Citrus Distillate Cartridge saw a significant sales increase compared to previous months, contributing to its rise to the top.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.