Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

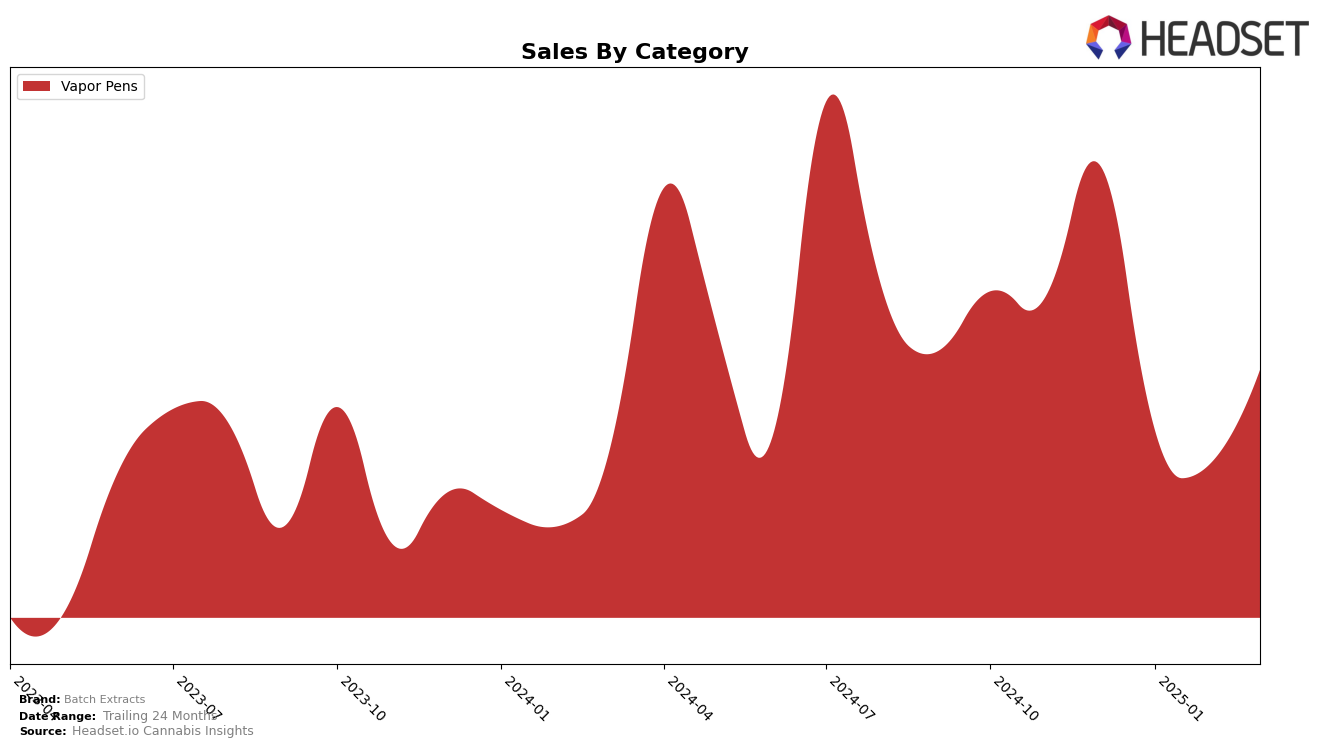

Batch Extracts has shown varied performance across different states and categories, particularly in the Vapor Pens category. In Colorado, the brand maintained a steady presence with a consistent ranking at 5th place from January to March 2025, after starting at 3rd in December 2024. This stability in rankings could be indicative of a solid customer base or effective market strategies, despite a noticeable decline in sales from December to January. In contrast, the brand's performance in Michigan suggests a more challenging market environment, as it only appeared in the top rankings during December 2024 and January 2025, with a significant jump from 93rd to 70th place. However, failing to maintain a top 30 position beyond January might imply difficulties in sustaining market momentum or competitive pressures from other brands.

In Missouri, Batch Extracts demonstrated a promising upward trend in its rankings within the Vapor Pens category, moving from 38th in December 2024 to 26th by March 2025. This progression could suggest effective market penetration and growing consumer preference, as reflected in the increasing sales figures over the period. The brand's ability to climb the rankings in Missouri while struggling to maintain a foothold in Michigan highlights the diverse challenges and opportunities present in different markets. Such disparities in performance across states might be attributed to varying consumer preferences, regulatory environments, or promotional strategies, offering a rich area for further exploration and analysis.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Batch Extracts has experienced notable fluctuations in its market position, particularly from December 2024 to March 2025. Initially ranked 3rd in December 2024, Batch Extracts saw a decline to the 5th position by January 2025, where it remained steady through March 2025. This shift can be attributed to the strong performance of competitors like PAX, which consistently held the 3rd position and even saw a significant increase in sales by March 2025. Meanwhile, Craft / Craft 710 maintained its 4th rank with a robust upward sales trend, further intensifying the competition. Despite these challenges, Batch Extracts' sales remained relatively stable from February to March 2025, indicating resilience in a highly competitive market. This analysis highlights the importance for Batch Extracts to strategize effectively to reclaim its higher ranking and capitalize on growth opportunities within the Colorado vapor pen market.

Notable Products

In March 2025, the top-performing product for Batch Extracts was the Dazzleberry Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank since December 2024 with sales of 3137 units. The Razzlemon Distillate Cartridge (1g) reclaimed its second position after briefly dropping to third in February, showing a significant sales boost. Goodness Grapecious Distillate Cartridge (1g) slipped to third place from its second-place rank in February, indicating a slight decrease in sales momentum. Shwazzberry Distillate Cartridge (1g) consistently held the fourth position across all months, demonstrating steady performance. Peachy Keen Distillate Cartridge (1g) remained in fifth place since its entry into the rankings in February, showing a gradual increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.