Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

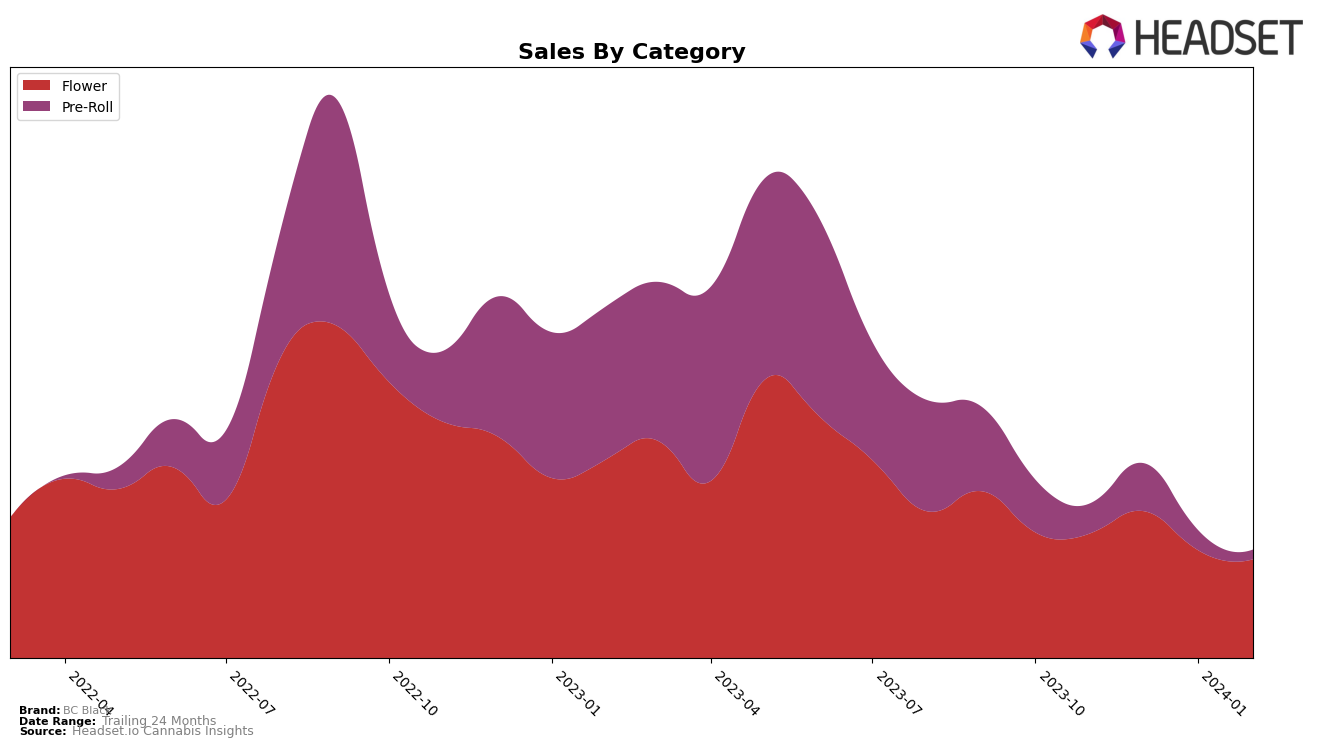

In British Columbia, BC Black has shown a consistent presence in the Flower category, maintaining a position within the top 20 brands from November 2023 to February 2024. The brand's rank slightly fluctuated, starting at 12th in November, dipping to 17th in January 2024, and slightly improving to 15th by February 2024. Despite these rank shifts, BC Black experienced a small increase in sales from November 2023 to December 2023, before seeing a decline in January 2024 and a slight recovery in February 2024. In the Pre-Roll category, the brand made significant strides, moving from a rank outside the top 50 in November to 34th by February 2024, indicating a growing consumer interest and improved market penetration in this segment.

Meanwhile, in Ontario, BC Black's performance tells a different story. The brand struggled to make its mark in the Flower category, only entering the top 100 in December 2023 with a rank of 91st and not securing a spot in the top 20 throughout the observed period. This absence in the top rankings could suggest challenges in gaining traction or competitive pressures in Ontario's Flower market. The Pre-Roll category in Ontario saw BC Black maintaining ranks in the 70s from November 2023 to January 2024, without data available for February 2024, indicating a consistent yet modest presence. The lack of improvement in ranking over these months could point towards a need for strategic changes to enhance their market position in Ontario's Pre-Roll category.

Competitive Landscape

In the competitive landscape of the cannabis flower category in British Columbia, BC Black has experienced a fluctuating performance in terms of rank and sales over the recent months. Initially ranked 12th in November 2023, BC Black saw a slight improvement to 14th in December, before dropping to 17th in January 2024 and then slightly recovering to 15th in February. This indicates a challenging environment, with competitors like 1964 Supply Co consistently outperforming BC Black, maintaining a higher rank and experiencing only a slight decline from 8th to 13th over the same period. Conversely, 3Saints has shown remarkable improvement, moving from 26th to 16th, and surpassing BC Black in February 2024 in terms of rank. Meanwhile, Parcel has been a close competitor, maintaining ranks above BC Black until February 2024, when BC Black managed to slightly outperform Parcel by one rank. The data suggests a highly competitive market where brands like BC Black must continuously innovate and adapt to maintain or improve their market position amidst fluctuating sales and ranks.

Notable Products

In February 2024, BC Black saw the Grape Gatsby Pre-Roll 3-Pack (2.25g) lead its product lineup, achieving the top rank with impressive sales of 2251 units. The Laughing Turtle- Sweet Jesus Pre-Roll 3-Pack (1.5g) followed closely, moving up to the second position, showcasing a notable improvement in its ranking from previous months. White Fire OG Smalls (3.5g) secured the third spot, maintaining a consistent performance by staying within the top three ranks over the recent months. The Crowfoot Cannabis - Blueberry Frost Pre-Roll 5-Pack (2.5g), despite its previous dominance, experienced a slight dip, falling to the fourth rank in February. Lastly, the PureFire - Shockwave Pre-Roll 2-Pack (2g) rounded out the top five, demonstrating steady sales and ranking performance over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.