Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

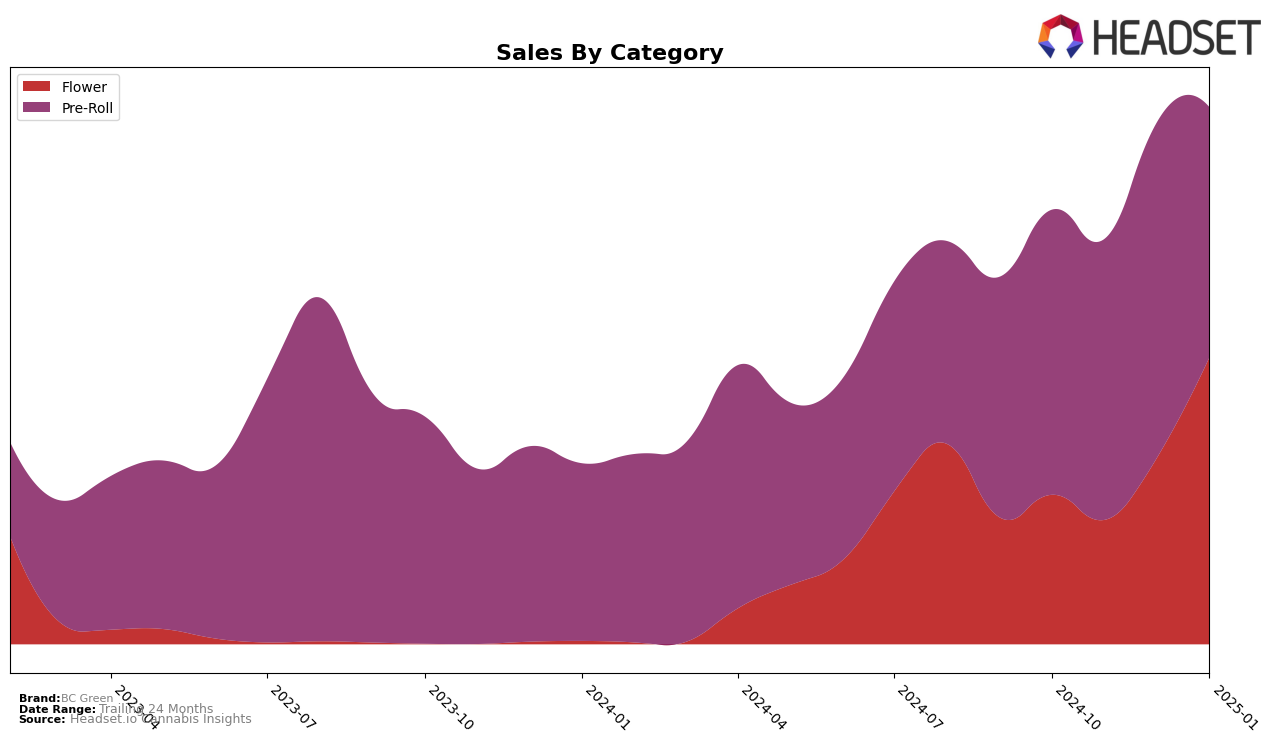

BC Green has shown notable fluctuations in its performance across different categories and provinces, particularly in British Columbia. In the Flower category, the brand has demonstrated a significant upward trend, climbing from a rank of 41 in December 2024 to 26 by January 2025. This movement indicates a strengthening presence in the market, likely due to increased consumer interest or effective product strategies. However, it's important to note that BC Green was not in the top 30 brands in October and November 2024, which suggests that while there is growth, there is still room for improvement to secure a more consistent top-tier position.

In contrast, the Pre-Roll category has seen a different trajectory for BC Green in British Columbia. The brand maintained a relatively stable position, hovering around the mid to late 20s in the rankings from October 2024 to January 2025. Despite a slight dip in January 2025 to rank 29, BC Green has managed to stay within the top 30 across these months. This consistency highlights a steady demand for their Pre-Roll products, albeit without the pronounced upward momentum seen in their Flower category. The sales figures reflect this stability, although there was a noticeable dip in January 2025, suggesting potential seasonal fluctuations or market dynamics at play.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, BC Green has shown a notable upward trajectory in rankings and sales over the past few months. From October 2024 to January 2025, BC Green improved its rank from 40th to 26th, a significant leap that suggests a strong market presence and growing consumer preference. This improvement is particularly impressive when compared to competitors like QWEST, which also improved but remained behind at 28th in January 2025, and BLKMKT, which saw a similar rise to 27th. Meanwhile, Shred and Station House maintained relatively stable positions, with Shred at 25th and Station House at 24th in January 2025. BC Green's sales figures have also shown a positive trend, particularly in January 2025, where it surpassed several competitors, indicating a robust growth trajectory and potential for further market penetration.

Notable Products

In January 2025, the top-performing product for BC Green was the Watermelon Gushers Pre-Roll 3-Pack (1.5g), which climbed to the number one rank with sales reaching 2674 units. Pick Me Up Pre-Roll 10-Pack (5g) maintained its consistent performance, holding steady at the second rank despite a decrease in sales from the previous month. Snowman Infused Pre-Roll 3-Pack (1.5g) remained in the third position, showing a slight decline in sales figures. Notably, the Watermelon Gushers Pre-Roll 10-Pack (5g) emerged in fourth place, while Apples and Gas (28g) entered the rankings at fifth. This marks a significant shift for Watermelon Gushers Pre-Roll 3-Pack, which rose from the fourth position in December 2024 to lead in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.