Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

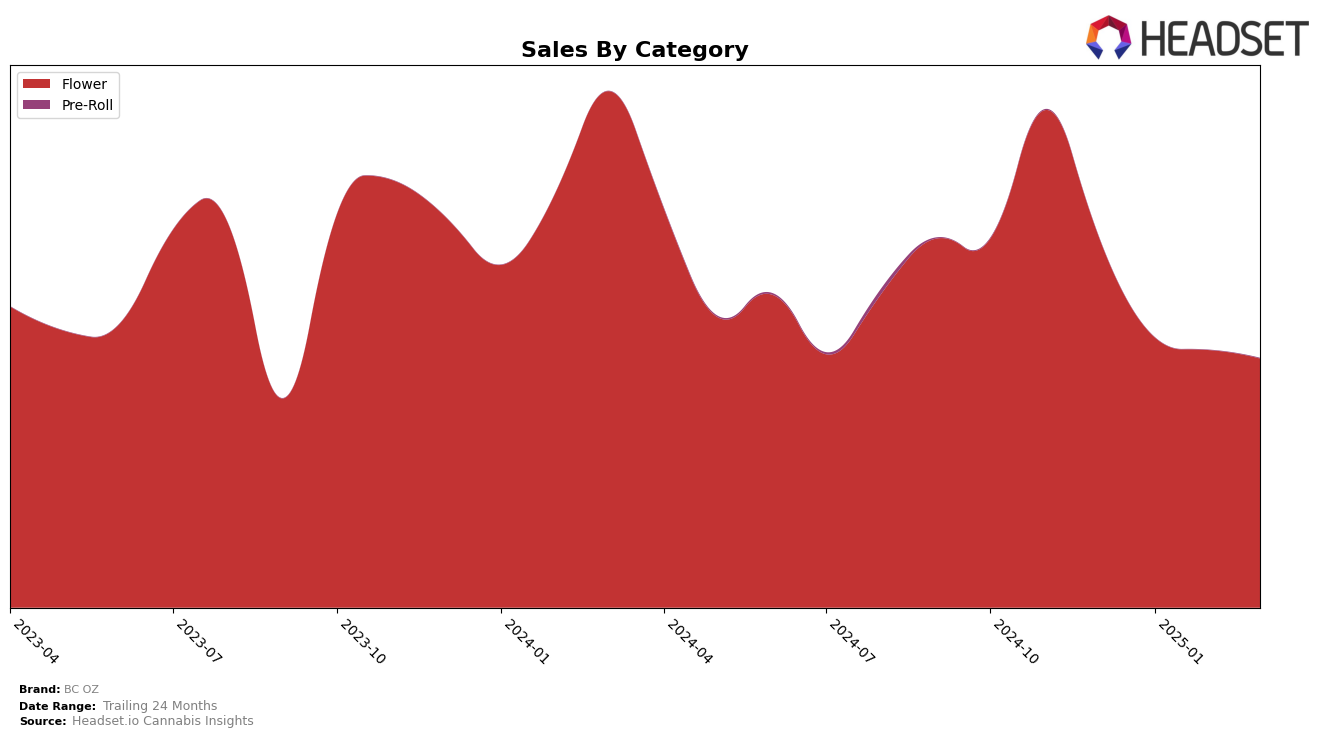

In the province of British Columbia, BC OZ's performance in the Flower category has shown some fluctuations over the months from December 2024 to March 2025. The brand started strong with a ranking of 6th in December, but experienced a decline, dropping to 11th by March. This downward trend is mirrored in their sales figures, which saw a decrease from approximately 892,771 in December to around 626,922 by March. The consistent presence in the top 30, however, indicates that BC OZ maintains a significant market presence in British Columbia's competitive Flower category, despite the recent challenges.

In Ontario, BC OZ has struggled to secure a top position in the Flower category, with rankings consistently outside the top 30. Starting at 48th in December 2024 and briefly dropping to 79th in February 2025, the brand did show some recovery by March, climbing to the 61st position. Despite the challenges in ranking, it's notable that their sales in Ontario saw a rebound in March, increasing to 158,688 from a low in February. This suggests that while BC OZ is not yet a leading contender in Ontario, there is potential for growth if they can capitalize on the recent upward trend in sales.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, BC OZ experienced notable fluctuations in its ranking and sales over the months from December 2024 to March 2025. Starting strong in December 2024 with a rank of 6, BC OZ saw a dip to 9 in January 2025, a recovery to 7 in February, and then a decline to 11 by March. This movement indicates a competitive pressure from brands like 1964 Supply Co, which maintained a relatively stable presence, and Pure Sunfarms, which showed resilience with a consistent top 10 ranking. Notably, Versus demonstrated a significant upward trend, moving from 19 in December to 10 in February, posing a potential threat to BC OZ's market share. Meanwhile, DEALR made a remarkable leap from being outside the top 20 in January to securing the 9th position by March, highlighting the dynamic nature of the market. These shifts underscore the importance for BC OZ to strategize effectively to maintain its competitive edge amidst the evolving market dynamics in British Columbia's Flower category.

Notable Products

In March 2025, the top-performing product from BC OZ was Blackberry Sour (7g), maintaining its position as the number one ranked product for the second consecutive month with sales of 1066 units. Guava Trainwreck (28g) made a strong debut, securing the second spot. Snow Cone (14g) slipped from second to third place compared to February, with sales decreasing to 859 units. Horchata (28g) entered the rankings at fourth place, while Space Jam (28g) fell from fourth to fifth position. Overall, the rankings reflect a dynamic shift with new entries and changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.