Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

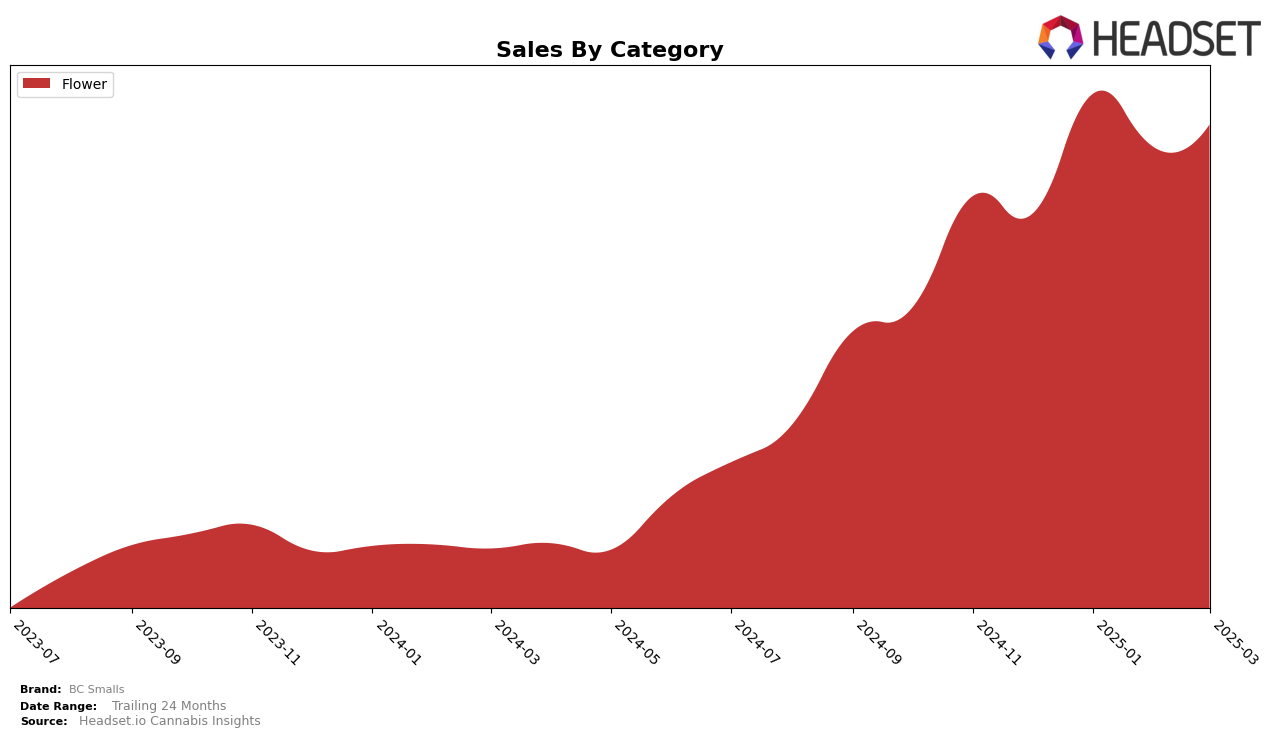

BC Smalls has demonstrated a strong performance in the British Columbia market, particularly in the Flower category. The brand achieved the top rank in January 2025, a notable improvement from its fourth-place position in December 2024. Although there was a slight dip in February and March, BC Smalls maintained a presence in the top three, indicating consistent consumer demand and brand strength in the region. This upward trend is supported by a significant increase in sales from December to January, highlighting the brand's growing popularity and market penetration in British Columbia.

In contrast, the performance of BC Smalls in the Ontario market reveals a different trajectory. Starting from a rank of 90 in December 2024, the brand steadily climbed the ranks to reach 46 by March 2025. This progression, although not placing BC Smalls in the top 30, suggests a positive momentum and increasing recognition among consumers in Ontario. The substantial sales growth from February to March further underscores this trend. However, the absence from the top 30 highlights the competitive nature of the market and the potential need for strategic adjustments to enhance brand visibility and capture a larger market share.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, BC Smalls has demonstrated notable resilience and adaptability. Starting from a rank of 4th in December 2024, BC Smalls surged to the top position in January 2025, showcasing its ability to capture consumer interest effectively. Although it experienced a slight dip to 2nd place in February and 3rd in March 2025, BC Smalls consistently maintained a strong presence in the top tier. In contrast, Big Bag O' Buds consistently held the top spot in February and March, indicating a robust competitive edge. Meanwhile, Bake Sale experienced significant volatility, dropping from 1st in December to 19th in February before rebounding to 5th in March. The steady performance of The Loud Plug and the upward trajectory of The Original Fraser Valley Weed Co. further highlight the dynamic and competitive nature of the market. These shifts underscore the importance for BC Smalls to continue innovating and reinforcing its brand loyalty to maintain its competitive position.

Notable Products

In March 2025, the top-performing product for BC Smalls was Alien Rock Candy Smalls (3.5g) in the Flower category, which climbed from fourth place in February to first place, achieving a sales figure of 6,462 units. Cosmic Slurbert Smalls (3.5g) maintained a strong performance, ranking second with a slight improvement in sales compared to February. Busta Lymes Smalls (3.5g) made a notable leap, moving from unranked in February to third place in March. Ripped Bubba Smalls (3.5g) experienced a decline, dropping from second to fourth place over the same period. Lastly, Orange Zlush Smalls (3.5g) held steady in fifth place, showing consistent sales figures month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.