Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

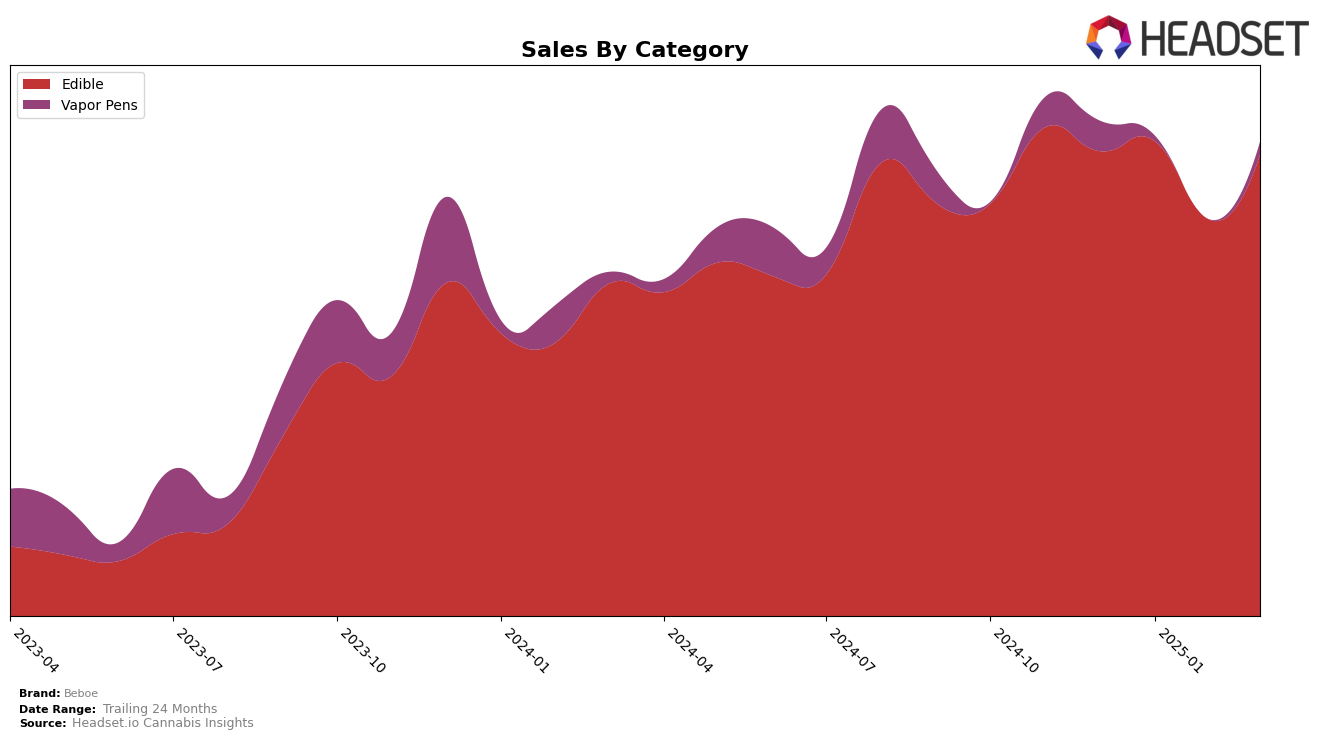

Beboe has demonstrated a varied performance across different states and categories, with noteworthy trends in the Edible category. In Illinois, the brand maintained a steady position within the top 20, although there was a slight decline in sales from December 2024 to March 2025. Meanwhile, in Maryland, Beboe showed a strong presence, climbing to the 9th position in January 2025, and maintaining a top 10 status thereafter, which indicates a positive reception and increasing consumer interest. On the other hand, in Massachusetts, Beboe's performance improved from being ranked 35th in December 2024 to 30th by March 2025, suggesting a gradual but steady increase in popularity.

In the Vapor Pens category, Beboe's performance varied significantly across states. In Illinois, the brand did not break into the top 30, indicating a challenging market presence in this category. Conversely, in Nevada, Beboe consistently ranked within the top 30, with a peak at 23rd in February 2025, reflecting a stronger foothold in the state. However, in New York, Beboe's ranking remained outside the top 50, which suggests limited market penetration and potential growth opportunities. These mixed results highlight the brand's varying success and challenges in capturing market share across different regions and product categories.

Competitive Landscape

In the Maryland edible market, Beboe has shown a notable upward trajectory in its ranking and sales performance over recent months. Starting from a rank of 15 in December 2024, Beboe climbed to 9th place by January 2025, before slightly fluctuating to 11th in February and stabilizing at 10th in March. This improvement is significant when compared to competitors like Strane, which experienced a decline from 11th to 14th place over the same period, and HiColor, which also saw a drop from 10th to 12th before recovering slightly. Despite the competitive pressure from brands like Smokiez Edibles and Jams, which consistently held higher ranks, Beboe's sales have shown a positive trend, particularly in March 2025, where it surpassed Strane in sales volume. This indicates a strengthening market position for Beboe, suggesting that its product offerings are resonating well with consumers in Maryland.

Notable Products

In March 2025, the top-performing product for Beboe was the THC/CBG 1:1 Sparkling Pear Cloud 9 Gummies 20-Pack, maintaining its rank at number one as it has consistently done since December 2024. The THC/CBN 5:1 Sweet Dreams Raspberry Plum Berry Gummies 20-Pack held its position at second place, showing a notable sales figure of 8750.0. The CBD/THC 2:1 Sour Golden Peach Remedy Gummies 20-Pack climbed to the third position after a previous absence from the rankings in February. Anytime Huckleberry Gummies 20-Pack remained stable at fourth place, despite fluctuating ranks in earlier months. Lastly, the CBD/THC 1:1 Downtime Blackberry Gummies 20-Pack re-entered the rankings at fifth place, having been absent in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.