Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

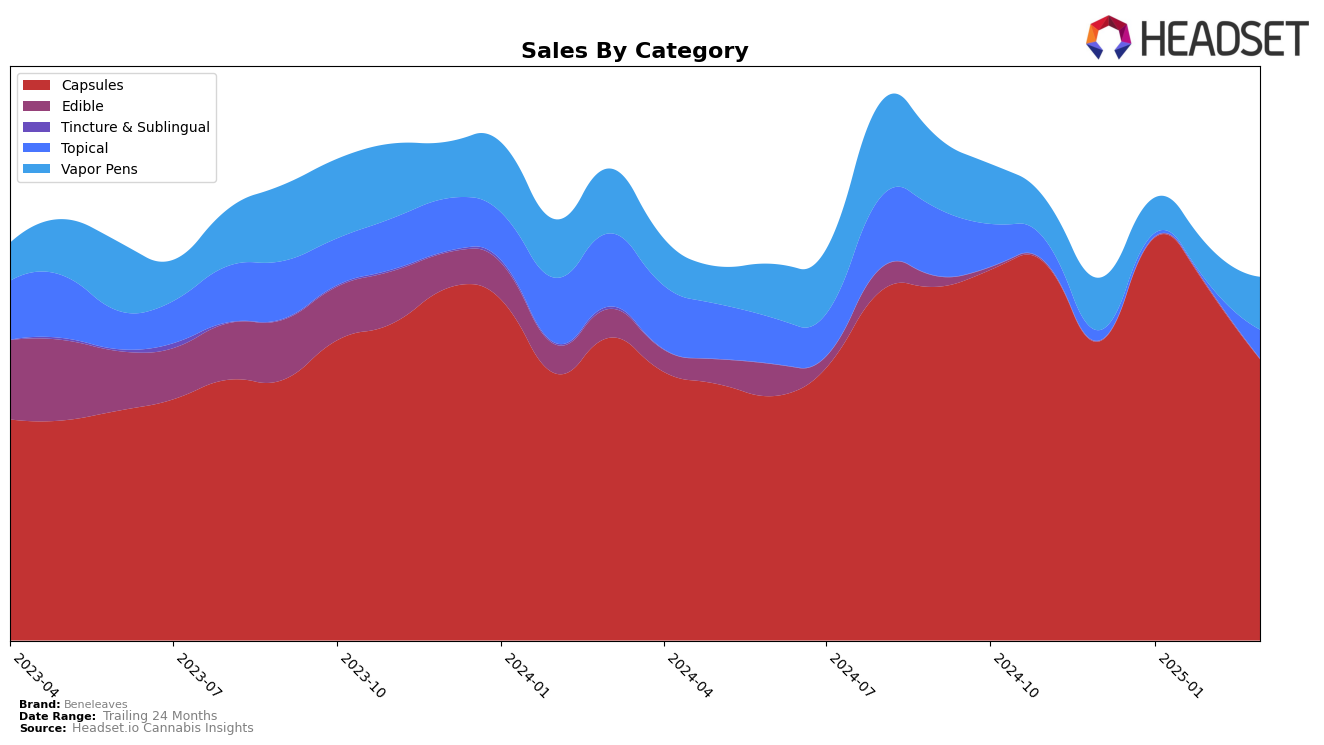

Beneleaves has shown commendable consistency in the Ohio market, particularly in the Capsules category, where they maintained the top position from December 2024 through March 2025. This indicates a strong foothold and consumer preference for their capsule products. However, in the Vapor Pens category, Beneleaves has not been able to break into the top 50, with rankings fluctuating between 51 and 64 over the same period. Despite this, there is a positive trend as they moved from 64 in January to 51 in March, suggesting a potential upward trajectory if this momentum continues.

In the Topical category within Ohio, Beneleaves is a new entrant, appearing in the rankings only by March 2025 at the 6th position. This sudden emergence could indicate a strategic push or a new product launch that resonated well with consumers. The absence of rankings in the preceding months highlights either a late entry or a previous lack of visibility in this category. The performance in Capsules and the recent entry into Topicals suggest a diversified approach to product offerings, which could be key to sustaining their market presence in the face of competition.

Competitive Landscape

In the Ohio capsules market, Beneleaves has consistently maintained its position as the leading brand from December 2024 through March 2025, demonstrating a robust market presence despite fluctuations in sales. Notably, Beneleaves has outperformed competitors like Butterfly Effect - Grow Ohio and Main Street Health, which have held steady at the second and third ranks, respectively, during the same period. While Beneleaves experienced a decline in sales from January to March 2025, it still retained its top rank, indicating strong brand loyalty and market dominance. In contrast, Butterfly Effect - Grow Ohio also saw a sales dip but remained a solid second, and Main Street Health maintained its third position despite a consistent decrease in sales over the months. This competitive landscape highlights Beneleaves' ability to sustain its leadership amidst varying market conditions.

Notable Products

In March 2025, the top-performing product for Beneleaves was the RSO Capsules 22-Pack (660mg) in the Capsules category, which climbed to the number one rank with sales reaching 1653 units. This product consistently maintained the third position in the previous months before rising to the top. The CBD/THC Entourage Effect Capsules 22-Pack dropped to the second position, despite being the leader for the past three months. Hypnos Indica Capsules 11-Pack, also in the Capsules category, held the third rank, showing a decline from its previous second-place standing in January 2025. Notably, the Hybrid RSO Capsules 11-Pack made its entry into the rankings at the fourth position, indicating a new competitive presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.