Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

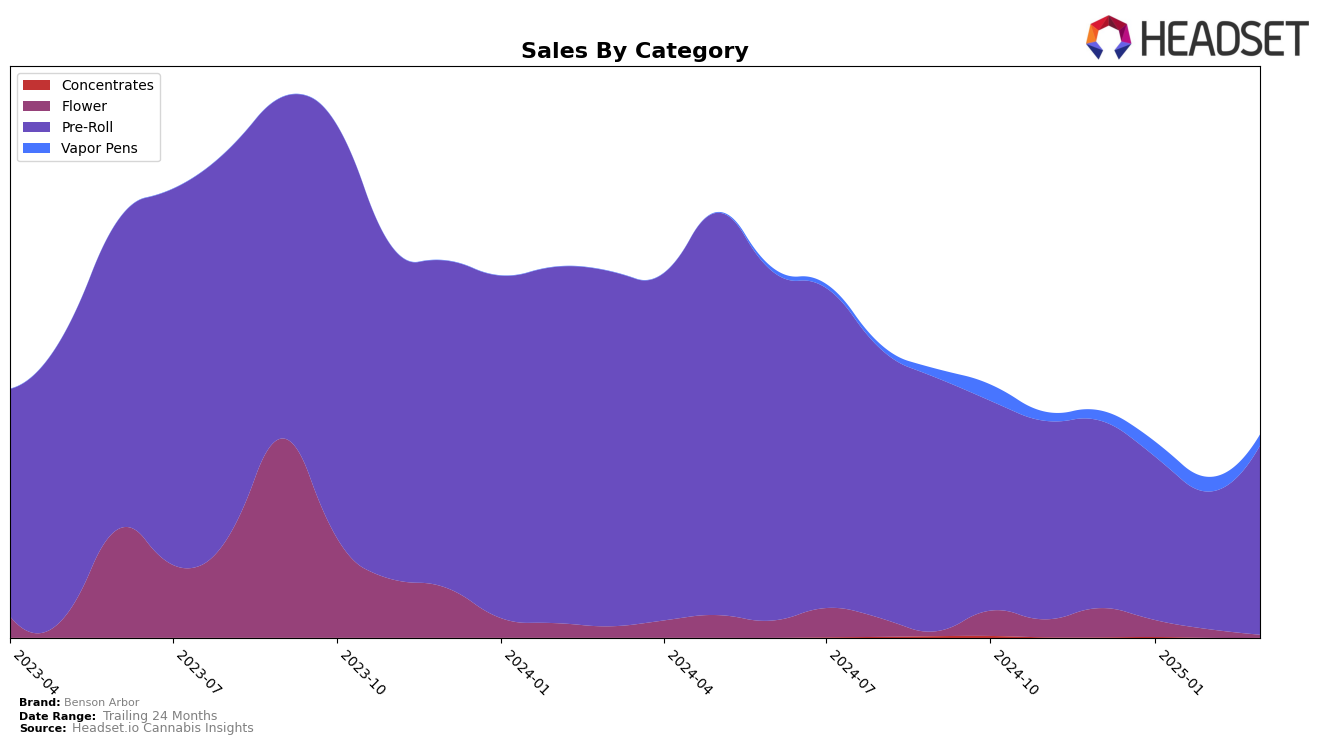

Benson Arbor has shown a notable presence in the Oregon cannabis market, particularly in the Pre-Roll category. Maintaining a strong position, Benson Arbor consistently ranked within the top 10 from December 2024 to March 2025, with a slight dip in February 2025 to rank 10th before rebounding to 7th in March. This pattern suggests resilience and a steady consumer demand for their Pre-Roll products, culminating in a significant sales increase to $330,392 in March. In contrast, their Vapor Pens category performance did not make it into the top 30, indicating a potential area for growth or reevaluation of market strategies.

While Benson Arbor's Pre-Roll category continues to perform robustly, their Vapor Pens have experienced more fluctuation in rankings, moving from 83rd in December 2024 to 65th in January and February 2025, before dropping to 74th by March. This trend reflects a volatile market presence and suggests that while there was an initial improvement at the start of the year, the brand might face challenges in maintaining a competitive edge. The absence from the top 30 in this category across the months could be seen as a missed opportunity to capture a larger share of the market, hinting at the need for strategic adjustments or innovations to enhance their appeal in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of Oregon's pre-roll category, Benson Arbor experienced notable fluctuations in rank and sales from December 2024 to March 2025. Initially holding a strong position at rank 6 in December and January, Benson Arbor saw a dip to rank 10 in February, before recovering to rank 7 in March. This fluctuation suggests a competitive market where brands like STiCKS and Killa Beez consistently maintained higher ranks, with STiCKS climbing to rank 5 by February and March, and Killa Beez holding steady at rank 6 in March. Despite the competition, Benson Arbor's sales showed resilience, with a significant recovery in March, indicating potential for growth and a competitive edge in the market. Meanwhile, Cabana and Kites maintained more stable but lower ranks, suggesting that Benson Arbor's strategic efforts could capitalize on this volatility to regain and potentially surpass its previous standings.

Notable Products

In March 2025, Benson Arbor's top-performing product was Chem Triangle Pre-Roll (1g) in the Pre-Roll category, maintaining its leading position from January with a notable sales figure of 3693. Mental Breakdown Infused Pre-Roll (1g) emerged as the second best, marking its entry into the rankings. Blueberry Pie Hash Diamond Infused Pre-Roll (1g) slipped to third place after topping the charts in February. Chew Toy #13 Pre-Roll (1g) entered the rankings at fourth place, while Orange Fire Pre-Roll (1g) retained its fifth position from January. This month's rankings highlight a dynamic shift with new entries and changes in positions, showcasing the evolving consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.