Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

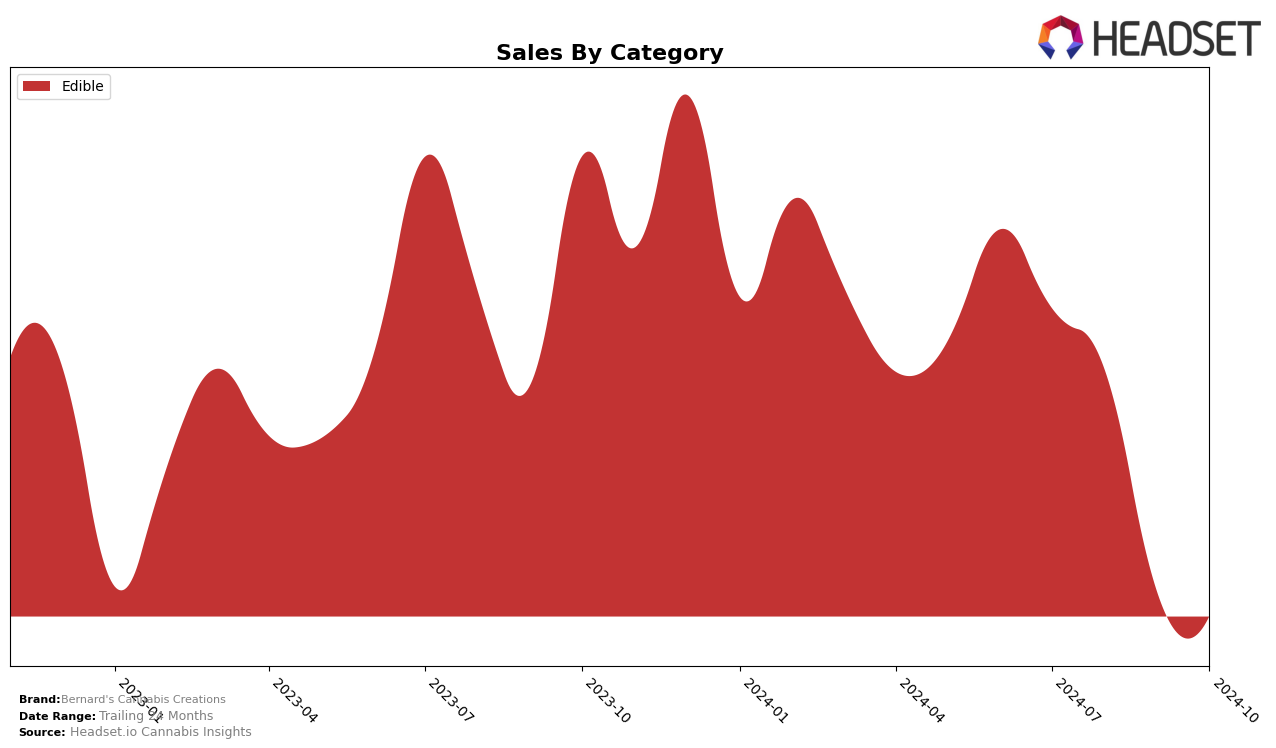

Bernard's Cannabis Creations has shown varied performance across different categories and regions in recent months. In the Edible category within Alberta, the brand has experienced a noticeable decline in its ranking. Starting in July 2024 at 15th place, the brand slipped to 16th in August and further down to 26th by September and October. This downward trend is mirrored by a decrease in sales from $39,423 in July to just over $10,000 by October, indicating potential challenges in maintaining market share in this category. The consistent drop out of the top 20 suggests competitive pressures or shifts in consumer preferences that the brand may need to address.

Interestingly, Bernard's Cannabis Creations did not appear in the top 30 rankings for other categories or states, which could be a point of concern or an opportunity for growth, depending on the strategic goals of the brand. The absence from top rankings in other regions might imply that their market presence is limited or that they are focusing their efforts primarily in Alberta. For stakeholders, this could be a signal to either diversify their offerings or strengthen their marketing strategies in underperforming areas. The data suggests that while Bernard's Cannabis Creations has a foothold in Alberta's Edible market, there is significant room for improvement and expansion into other segments and regions.

Competitive Landscape

In the competitive landscape of the Edible category in Alberta, Bernard's Cannabis Creations has experienced a notable decline in both rank and sales over the past few months. Starting from a rank of 15 in July 2024, Bernard's Cannabis Creations dropped to 26 by October 2024, indicating a significant challenge in maintaining its market position. This decline is contrasted by the performance of competitors such as Wana, which maintained a strong presence, consistently ranking in the top 4, and Olli, which, despite fluctuations, managed to improve its rank slightly from 20 to 19 before dropping out of the top 20 in September. Additionally, The Hazy Camper and Token have shown more stable rankings, with The Hazy Camper moving up to 25 in October. This competitive pressure suggests that Bernard's Cannabis Creations may need to reassess its strategies to regain its foothold in the Alberta Edible market.

Notable Products

In October 2024, the top-performing product from Bernard's Cannabis Creations was the Hazelnut Praline Milk Chocolate Bar (10mg), which climbed from second place in September to secure the top spot. The Rice Crisp Milk Chocolate Bar (10mg) made a notable leap to second place, improving from its third-place ranking in September. The Strawberry White Chocolate Bar (10mg) experienced a slight drop, moving from first in September to third in October with sales figures reaching 403 units. Assorted Nut Butter Cups 4-Pack (10mg) entered the rankings for the first time in October, securing the third position. Hazelnut Butter Chocolates Cups 4-Pack (10mg) maintained a stable presence, ranking fourth in October after debuting in the rankings in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.