Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

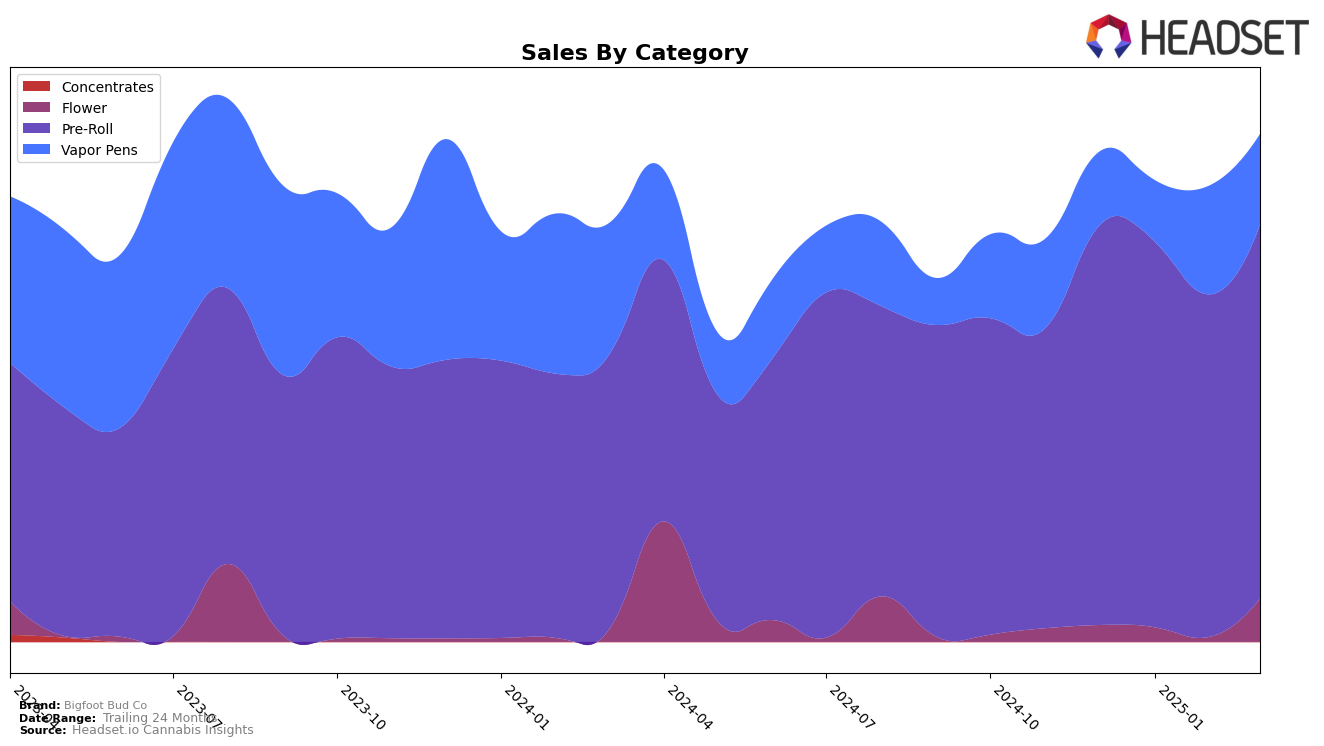

In the state of Oregon, Bigfoot Bud Co's performance in the Pre-Roll category has shown some fluctuations over the past few months. Starting from December 2024, the brand held the 19th position, which slightly improved to 18th in January 2025. However, by March 2025, it slipped to the 21st spot. This movement indicates a slight decline in their ranking, which could be a signal for the brand to reassess its strategies in this category. Notably, a drop in sales from December to February could be contributing to this downward trend, despite a slight recovery in March.

In contrast, Bigfoot Bud Co's performance in the Vapor Pens category in Oregon has shown a more positive trajectory. Although the brand started outside the top 30 in December 2024, it made significant progress by climbing to the 48th rank by February 2025. This upward movement suggests an increasing consumer interest or effective marketing strategies in this category. Despite a slight dip in March to the 54th position, the overall improvement from December is notable. This positive trend in Vapor Pens, compared to the Pre-Roll category, may offer insights into shifting consumer preferences or competitive dynamics within the state.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, Bigfoot Bud Co has experienced fluctuating rankings, moving from 19th in December 2024 to 21st by March 2025. This shift is indicative of a competitive environment where brands like Cascade Valley Cannabis and Entourage Cannabis / CBDiscovery have maintained a presence within the top 20, despite their own ranking fluctuations. Notably, Cascade Valley Cannabis and Entourage Cannabis / CBDiscovery have shown resilience by consistently returning to the top 20, suggesting strong brand loyalty or effective marketing strategies. Meanwhile, Piff Stixs and Smokes / The Grow have struggled to break into the top 20, with Smokes / The Grow consistently ranking outside it. This competitive pressure highlights the need for Bigfoot Bud Co to innovate and differentiate to regain and sustain a higher market position, as sales trends suggest a potential for recovery if strategic adjustments are made.

Notable Products

In March 2025, Jack Herer Pre-Roll (Half Gram) emerged as the top-performing product for Bigfoot Bud Co, leading the sales with 4,182 units sold. This product showed a significant rise in popularity, as it was not ranked in the previous months. Following closely, Leftovers Pre-Roll (0.5g) secured the second position, with Gelato #33 Pre-Roll (0.5g) coming in third. Crystal Cookies Pre-Roll (0.5g) and Super Lemon Haze Pre-Roll (1g) rounded out the top five, ranking fourth and fifth, respectively. The notable surge in sales for these products indicates a growing consumer preference for pre-rolls from Bigfoot Bud Co in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.