Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

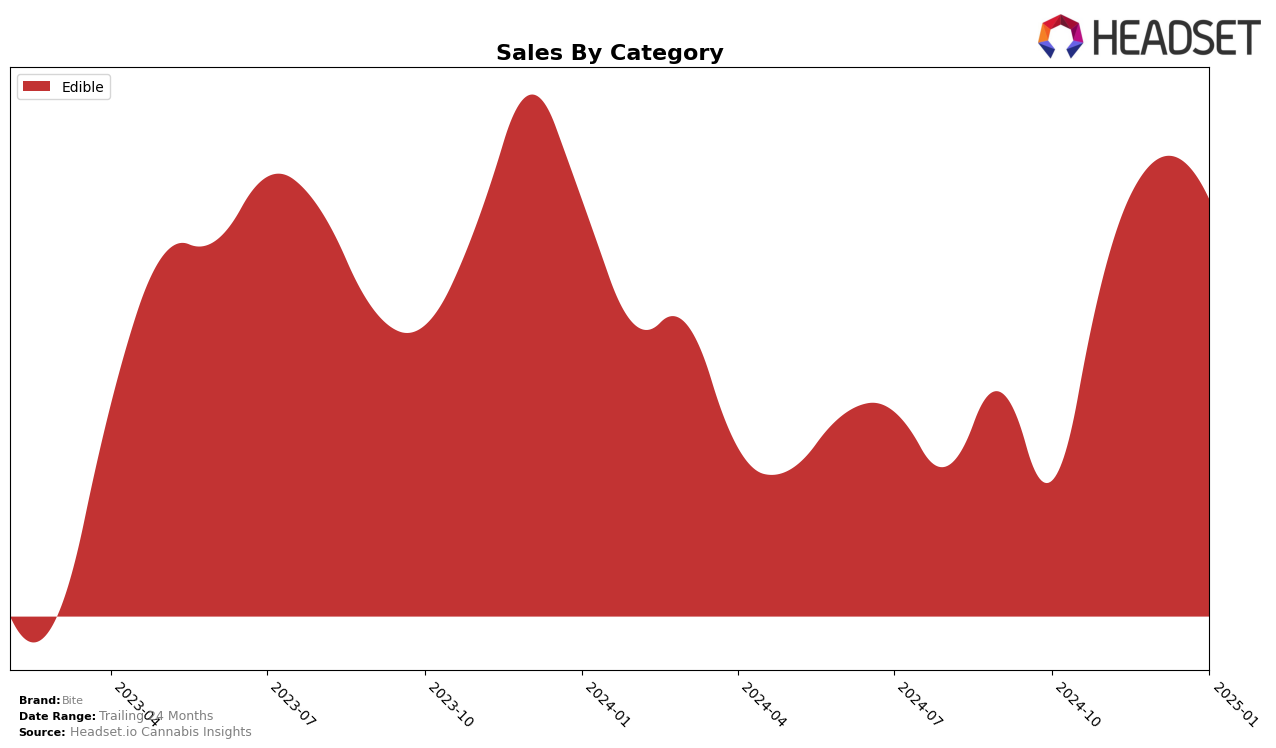

Bite has demonstrated a consistent upward trajectory in the Edible category within the state of Massachusetts. Starting from a rank of 24 in October 2024, the brand improved its position each subsequent month, reaching the 17th spot by January 2025. This steady climb suggests a growing consumer preference and increasing market penetration for Bite's edibles in Massachusetts. Notably, this ranking improvement is accompanied by a significant rise in sales, with November 2024 seeing a particularly sharp increase, indicating successful marketing or product strategies during that period.

While the performance in Massachusetts is noteworthy, it's important to highlight that Bite's presence in other states or provinces is not captured within the top 30 rankings across the same timeframe, which could be a point of concern or an opportunity for growth. The absence from the top 30 in other markets might suggest either a lack of distribution or competition that outpaces Bite's current offerings. Nonetheless, the brand's upward movement in Massachusetts could serve as a strategic model to replicate in other regions, potentially unlocking new opportunities for expansion and increased market share.

Competitive Landscape

In the Massachusetts edible market, Bite has shown a notable upward trend in rankings from October 2024 to January 2025, moving from 24th to 17th place. This improvement in rank is indicative of a positive trajectory in sales performance, as Bite's sales figures have increased significantly over this period. However, Bite still faces stiff competition from brands like Encore Edibles and Hashables, which consistently rank higher, maintaining positions within the top 20 throughout the same timeframe. Lost Farm remains a strong competitor, consistently holding a top 13 rank, suggesting a stable market presence. Despite these challenges, Bite's upward movement in rank suggests a growing consumer interest and market penetration, positioning it as a brand to watch in the coming months.

Notable Products

In January 2025, Bite's top-performing product was the Sleepy Blue Raspberry Gummies 20-Pack, which climbed to the number one position with sales reaching 2880 units. This product showed a consistent rise from its fifth-place ranking in October 2024. The Social Watermelon Gummies 20-Pack, although dropping from its previous top rank, still held a strong second place with 2552 units sold. High Strawberry Kiwi Gummies maintained a stable position, ranking third, while UP Peach Mango Gummies improved to fourth place. Mellow Meyer Lemon Gummies, despite leading in October, fell to fifth place, indicating a shift in customer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.