Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

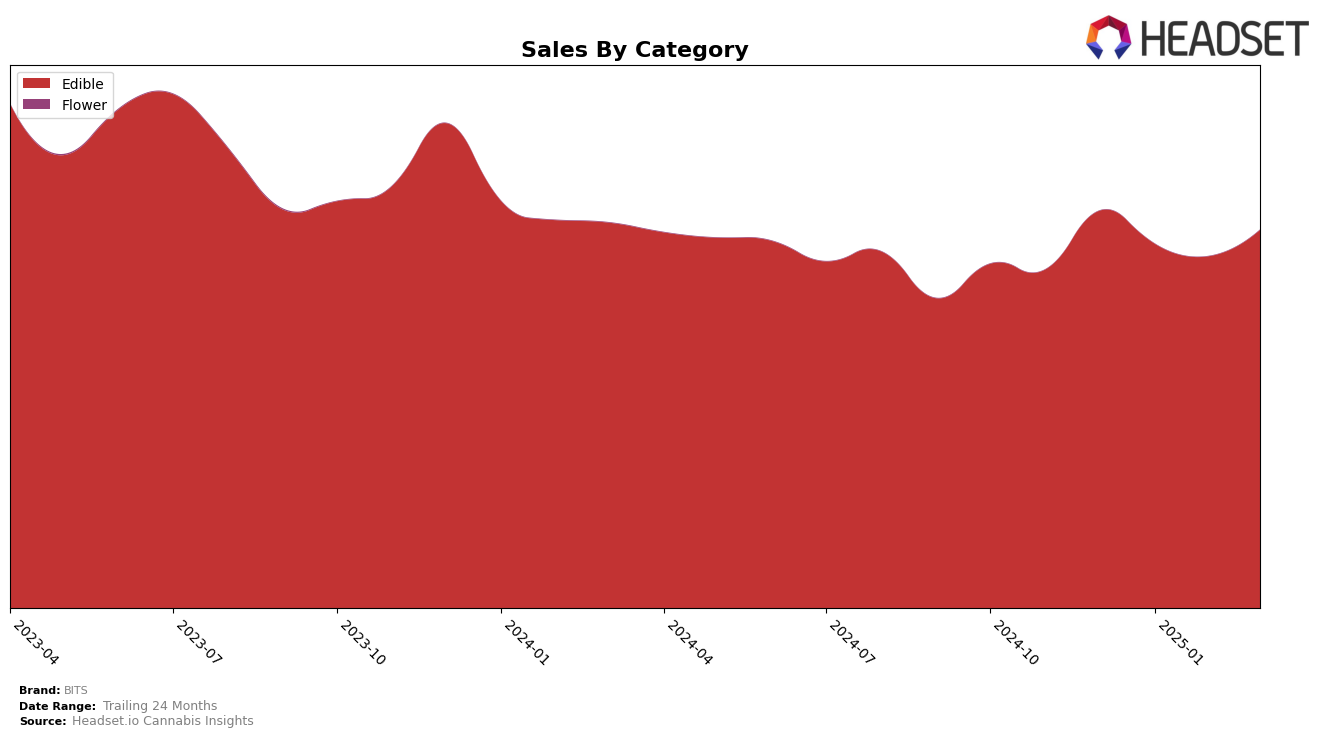

BITS has shown varied performance across different states in the Edible category. In Arizona, BITS maintained a consistent ranking at 18th place from December 2024 to February 2025, but experienced a slight drop to 22nd in March 2025. This movement indicates a potential challenge in maintaining its market position in Arizona. Meanwhile, in Massachusetts, BITS has struggled to break into the top 30, with its ranking slipping from 33rd in December 2024 to 36th in March 2025. This trend suggests that BITS is facing stiff competition in Massachusetts, which could be a point of concern for its market strategy there.

In contrast, BITS has demonstrated strong performance in New Jersey, consistently ranking within the top 5 throughout the observed months, peaking at 4th place in March 2025. This consistent high ranking reflects BITS's robust market presence and consumer preference in New Jersey. Similarly, in Illinois, BITS managed to maintain a stable position around the 20th spot, showing resilience despite a slight dip in sales in January and February 2025 before rebounding in March. This stability in Illinois suggests a steady consumer base that could be leveraged for future growth. However, the absence of BITS in the top 30 in some other states highlights areas where the brand may need to focus on improving its market penetration and competitive strategies.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New Jersey, BITS has demonstrated notable resilience and adaptability from December 2024 to March 2025. Initially ranked 5th in December, BITS experienced a slight dip to 6th place in January, only to recover and secure the 4th position by February and maintain it through March. This upward trajectory indicates a positive shift in consumer preference or effective marketing strategies. In contrast, Gron / Grön consistently held the 2nd position, showcasing a stable market presence, while Wana maintained its 3rd place ranking throughout the same period. Meanwhile, Ozone experienced a decline, dropping from 4th to 5th place by February, which may have provided BITS the opportunity to advance. The competitive dynamics, particularly the shifts in rankings, highlight BITS's potential for growth amidst strong competitors, suggesting that strategic enhancements could further bolster its market position.

Notable Products

In March 2025, the top-performing product for BITS was the CBD/THC 1:1 Elderberry Wellness Gummies 20-Pack, maintaining its number one rank from previous months with sales of 15,587 units. The CBN/THC 1:1 Pomegranate R&R Gummies 20-Pack climbed to the second position, showing a consistent improvement from fourth place in December 2024. Acai Affection Gummies 20-Pack held steady in third place, maintaining its rank from February 2025. The CBC/THC 1:1 Dragonfruit LOL Gummies 20-Pack also showed steady performance, ranking fourth. Guava Go Gummies 20-Pack dropped from second in December 2024 to fifth in March 2025, indicating a decline in its sales ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.