Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

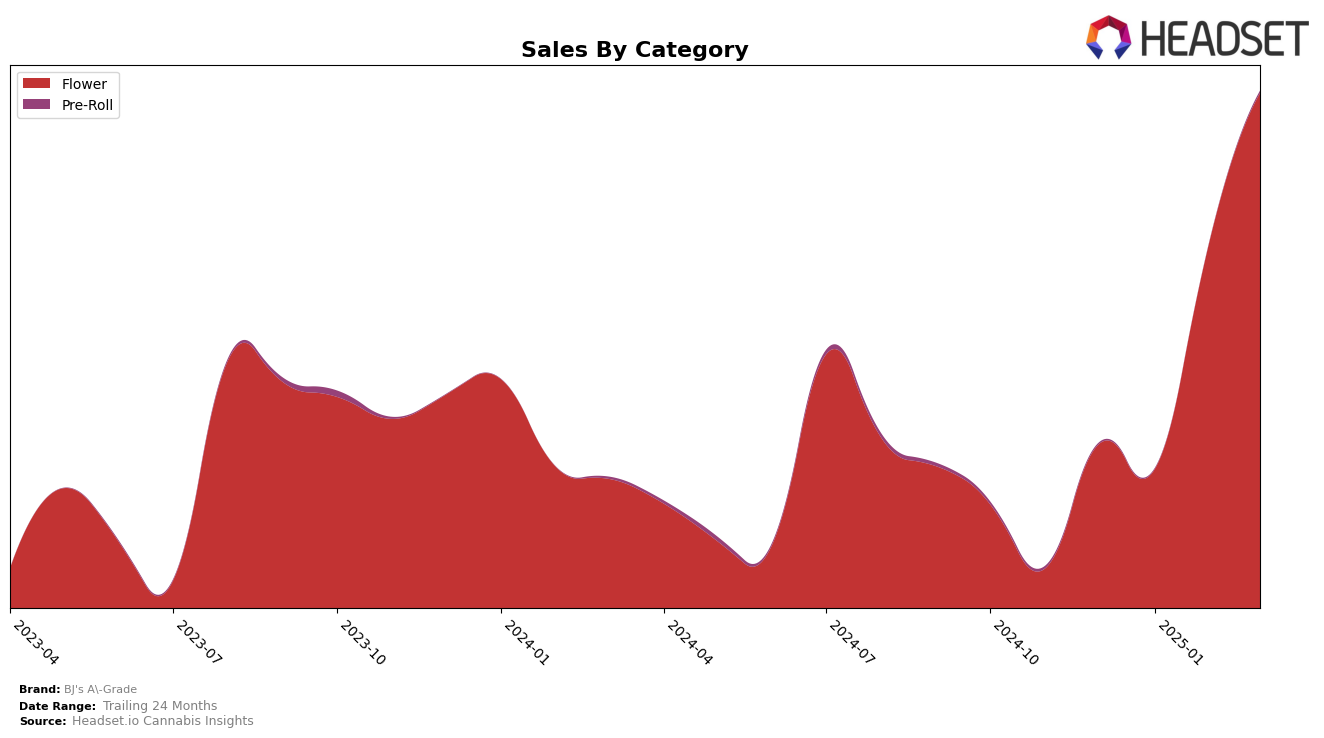

BJ's A-Grade has shown notable progress in the Oregon market, particularly in the Flower category. After not being ranked in the top 30 brands in December 2024 and January 2025, BJ's A-Grade made a significant leap to rank 23rd in February 2025 and improved further to 20th place by March 2025. This upward trajectory indicates a strong performance, as they have successfully broken into the competitive top ranks within a short period. The brand's ability to increase its sales from $206,480 in February to $288,354 in March highlights their growing presence and consumer appeal in the state.

Despite the positive developments in Oregon, BJ's A-Grade's absence from the top 30 brands in other states and categories suggests that there is room for improvement and expansion. The lack of ranking in December and January could have been due to various factors such as market competition or distribution challenges. However, their recent success in Oregon's Flower category could serve as a blueprint for entering other markets or improving in additional categories. Monitoring their strategic moves and market responses in the upcoming months could provide valuable insights into their growth trajectory.

Competitive Landscape

In the competitive landscape of the Oregon flower market, BJ's A-Grade has demonstrated a remarkable upward trajectory in recent months. Starting from a position outside the top 20 in December 2024, BJ's A-Grade surged to rank 23rd in February 2025 and further improved to 20th by March 2025. This ascent is indicative of a significant increase in sales, contrasting with the performance of competitors such as Self Made Farm, which experienced a notable drop from 6th place in December 2024 to 21st by February 2025. Similarly, Oregon Roots fell from 13th in January 2025 to 22nd by March 2025. Meanwhile, Urban Canna and Earl Baker maintained relatively stable positions, with Urban Canna fluctuating between 15th and 19th, and Earl Baker improving slightly from 24th to 19th. The consistent upward movement of BJ's A-Grade highlights its growing market presence and potential to capture further market share in Oregon's competitive flower category.

Notable Products

In March 2025, BJ's A-Grade saw White Widow (Bulk) rise to the top position among their products, achieving the highest rank. Pure Skunk (Bulk) followed closely, moving up from the third position in February to secure second place with sales of 3396 units. AK 47 (Bulk) experienced a slight drop, shifting from second place in February to third in March. Bubba Kush (Bulk) maintained its consistent performance, holding steady at fourth place for two consecutive months. GG x 641 (14g) rounded out the top five, showing stable sales figures since its entry into the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.