Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

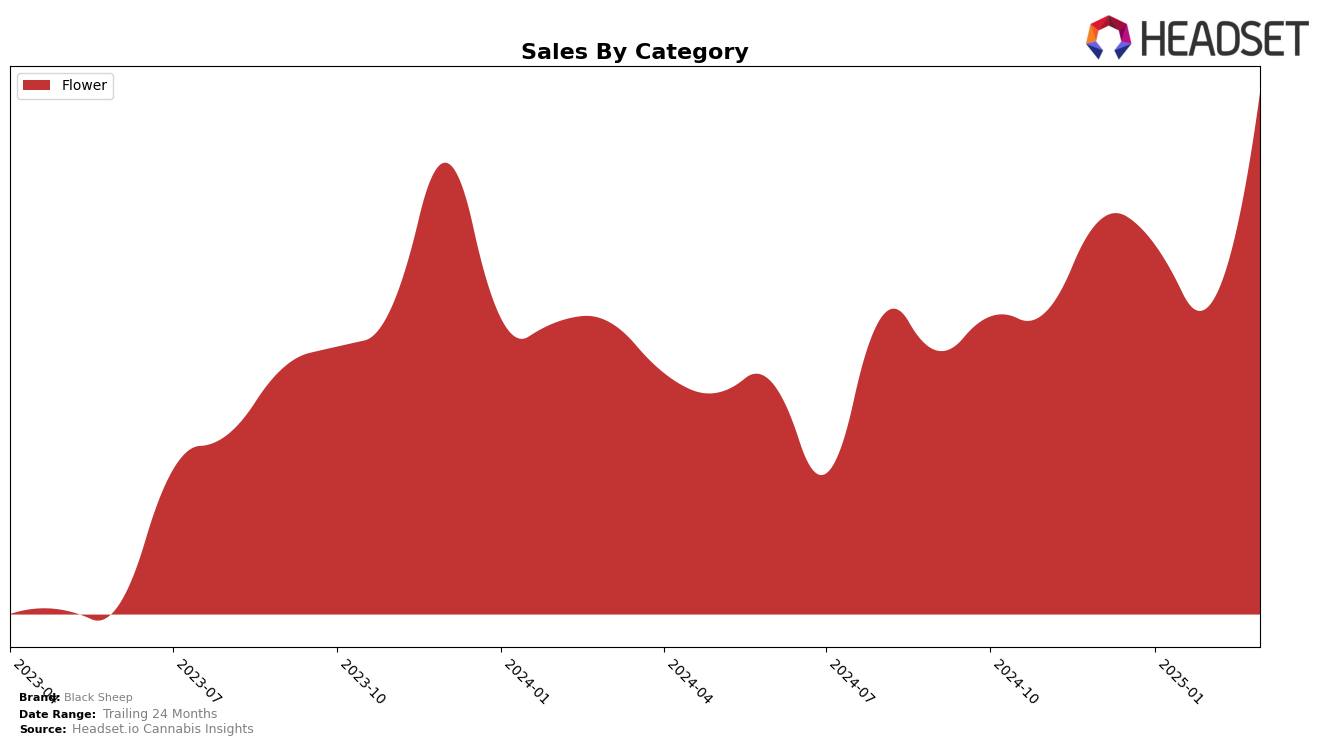

Black Sheep has shown a notable performance in the Ohio market, particularly in the Flower category. The brand's ranking has fluctuated over the months from December 2024 to March 2025, starting at the 25th position in December and improving to the 19th position by March. This upward movement signifies a positive trend, especially considering the competitive nature of the cannabis market. The sales figures reflect this improvement, with a significant increase from $267,634 in February to $487,426 in March, indicating a strong recovery and potential growth trajectory.

Interestingly, Black Sheep's presence in other states or provinces within the same category hasn't been highlighted, suggesting that they might not have made it to the top 30 brands in those areas. This could be seen as a potential area for improvement or an opportunity for expansion. The absence of rankings in other regions could indicate a focus on strengthening their position in Ohio, which seems to be yielding positive results. Understanding the dynamics of this market could provide insights into how Black Sheep might replicate this success in other regions.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Black Sheep has demonstrated notable fluctuations in its market position over the first quarter of 2025. Starting from a rank of 25 in December 2024, Black Sheep experienced a slight decline to 27 in January, maintained a similar position at 26 in February, and then improved significantly to 19 by March 2025. This upward movement in March is particularly significant as it marks Black Sheep's re-entry into the top 20, a position it had not held since December. In contrast, Galenas consistently maintained a strong presence, hovering around the 16th to 18th rank, while Find. showed a steady climb, reaching the 16th position by March. Meanwhile, The Standard experienced a slight dip to the 20th position in March. The most dramatic shift was seen with Triple Seven (777), which surged from outside the top 20 to rank 21 in March, indicating a potential emerging threat. These dynamics suggest that while Black Sheep has managed to regain some ground, it faces stiff competition from both stable and ascending brands in the Ohio flower market.

Notable Products

In March 2025, Zweet King Kush (2.83g) maintained its position as the top-performing product for Black Sheep, with impressive sales of 11,465 units. Gushers (2.83g) followed closely behind, holding steady in the second rank despite a slight decrease in sales compared to February. Han Solo In Platinum (Bulk) rose to third place, showing a notable improvement from its fifth position in February. Permanent Chimera (Bulk) experienced a slight drop, moving from third to fourth place. Master Gelato Kush (2.83g) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.