Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

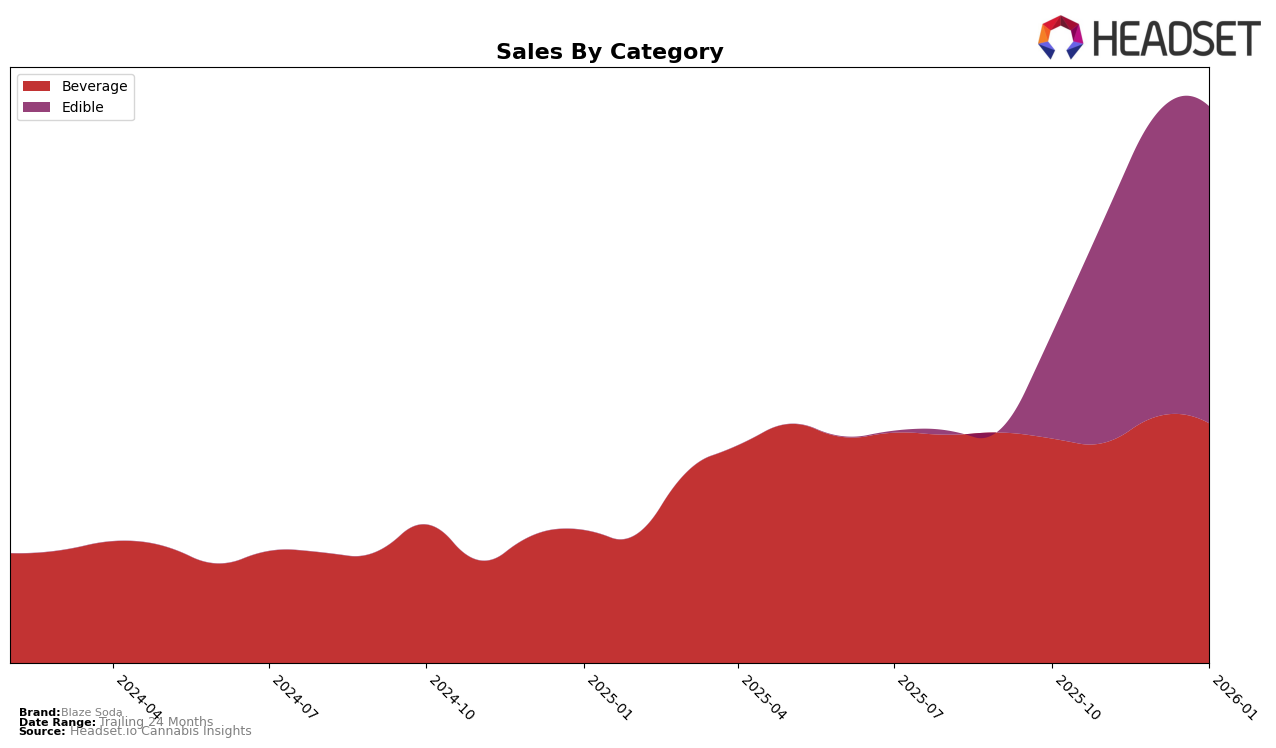

In the state of Washington, Blaze Soda has shown a consistent performance in the Beverage category, maintaining a steady 7th rank from November 2025 through January 2026. This stability in ranking suggests a solid footing in the market, with sales peaking in December 2025. However, the Edible category presents a more dynamic picture for Blaze Soda. The brand made significant strides, jumping from the 26th position in October 2025 to 18th by November, where it has remained stable through January 2026. This upward movement in the Edible category indicates a growing acceptance and popularity of Blaze Soda's edible offerings within the state.

It's noteworthy that Blaze Soda's absence from the top 30 brands in certain states and categories could indicate areas where the brand has potential for growth or faces stiff competition. The brand's performance in Washington reflects a strong presence in the Beverage category, while the improvement in the Edible category could suggest effective marketing strategies or consumer preference shifts. These insights offer a glimpse into Blaze Soda's market dynamics, highlighting the importance of strategic positioning and adaptation to consumer trends in different regions.

Competitive Landscape

In the competitive landscape of the Washington Edible market, Blaze Soda has demonstrated a notable upward trajectory in its rankings and sales performance over the past few months. After not being in the top 20 in October 2025, Blaze Soda surged to the 18th position by November 2025 and maintained this rank through January 2026. This rise is indicative of a significant increase in consumer interest and market penetration, as evidenced by the brand's sales more than doubling from October to January. In contrast, Verdelux and Honu have shown stability in their rankings, with Verdelux improving slightly to 16th place by January 2026, while Honu experienced a slight decline to 17th place. Meanwhile, Mari's consistently held the 19th position, indicating a steady but less dynamic market presence compared to Blaze Soda. The data suggests that Blaze Soda's innovative approach or product offerings may be resonating well with consumers, allowing it to climb the ranks and potentially challenge more established brands in the Washington Edible market.

Notable Products

In January 2026, Blaze Soda's top-performing product was Orange Cream Pie Soda (100mg THC, 6oz), maintaining its number one rank consistently from October 2025 with sales of 2500 units. The CBN/CBD/THC 2:2:1 Pomegranate Acai Gummies 10-Pack rose to the second position from fourth place in December 2025, showing a notable increase in popularity. The CBD/CBN/THC 2:2:1 Blue Raspberriezzz Gummies 10-Pack, although dropping from second to third place, remained a strong performer. Baja Tropical Lime Live Resin Soda slipped to fourth place from its third position in December 2025. POG Soda held steady in fifth place, continuing its performance from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.