Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

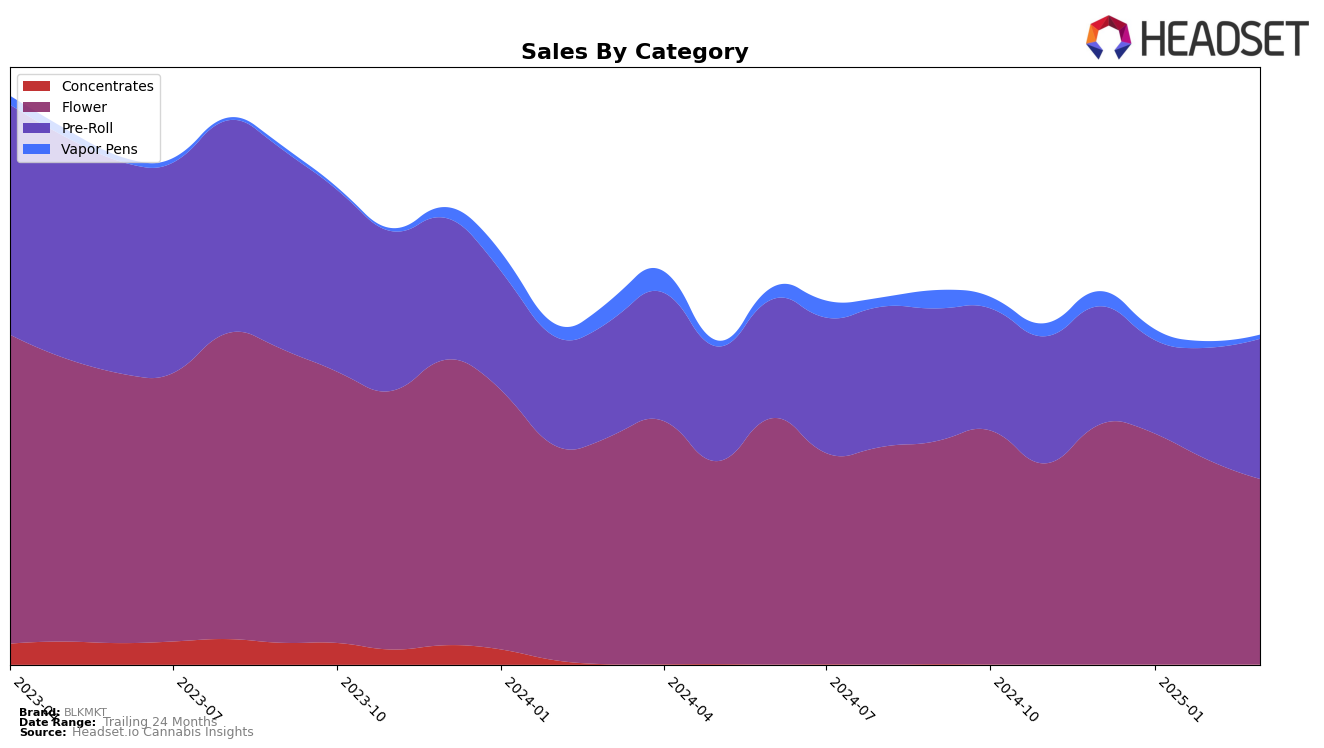

In the British Columbia market, BLKMKT has shown varied performance across different product categories. In the Flower category, the brand experienced a significant climb from being outside the top 30 in December 2024 to reaching the 28th position by January 2025, only to dip slightly to 34th by March 2025. This fluctuation indicates a dynamic market presence, with a notable peak in January. Meanwhile, in the Pre-Roll category, BLKMKT made impressive strides, advancing from 60th place in December to 31st by March, suggesting a strengthening foothold in this segment. The Vapor Pens category, however, saw BLKMKT fall out of the top 30 rankings after December, highlighting a potential area for improvement or strategic reevaluation.

In Ontario, BLKMKT's performance in the Flower category has been relatively stable, maintaining a consistent presence around the 25th to 27th rankings from December 2024 through March 2025. This steadiness suggests a strong and reliable consumer base in the region. On the other hand, the Pre-Roll category in Ontario saw BLKMKT hover around the mid-40s, indicating room for growth in market share. Interestingly, the Vapor Pens category presents a unique challenge, as the brand was ranked 97th in January but did not make it into the top 30 in other months, pointing to a potential opportunity for market penetration. In Saskatchewan, the brand emerged in the Pre-Roll category at 32nd in February, marking its entry into this market segment, which could be a promising development if the trend continues.

Competitive Landscape

In the competitive landscape of the flower category in Ontario, BLKMKT has maintained a relatively stable position, holding the 25th rank in December 2024 and January 2025, before slightly dropping to 27th in February and March 2025. This consistency in ranking, despite a gradual decline in sales over the months, suggests a strong brand presence but highlights potential challenges in increasing market share. In contrast, Tenzo has shown a significant upward trajectory, climbing from 44th in December 2024 to 28th by March 2025, with a notable increase in sales, indicating a growing consumer preference. Similarly, Jonny Chronic improved its position from 32nd to 25th, surpassing BLKMKT in March 2025, driven by a steady rise in sales. Meanwhile, Carmel experienced fluctuations, peaking at 24th in December 2024 but settling at 26th by March 2025, with a recovery in sales towards the end of the period. These dynamics suggest that while BLKMKT remains a key player, competitors like Tenzo and Jonny Chronic are gaining ground, emphasizing the need for strategic initiatives to boost BLKMKT's market position and sales performance.

Notable Products

For March 2025, the top-performing product from BLKMKT is Jealousy Pre-Roll (1g), maintaining its number one rank consistently over the past four months, with sales reaching 8015 units. Rainbow P Pre-Roll (1g) also held steady at the second position, showing a notable increase in sales from February to March. Noir Diamant Blunt (1g) debuted in March with a strong third-place ranking, indicating a successful launch. Upside Down Cake Pre-Roll (1g) improved its position slightly from fifth to fourth, although its sales figures have remained relatively stable. High Society Pre-Roll 5-Pack (2.5g) entered the rankings in fifth place, suggesting growing interest in multi-pack options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.