Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

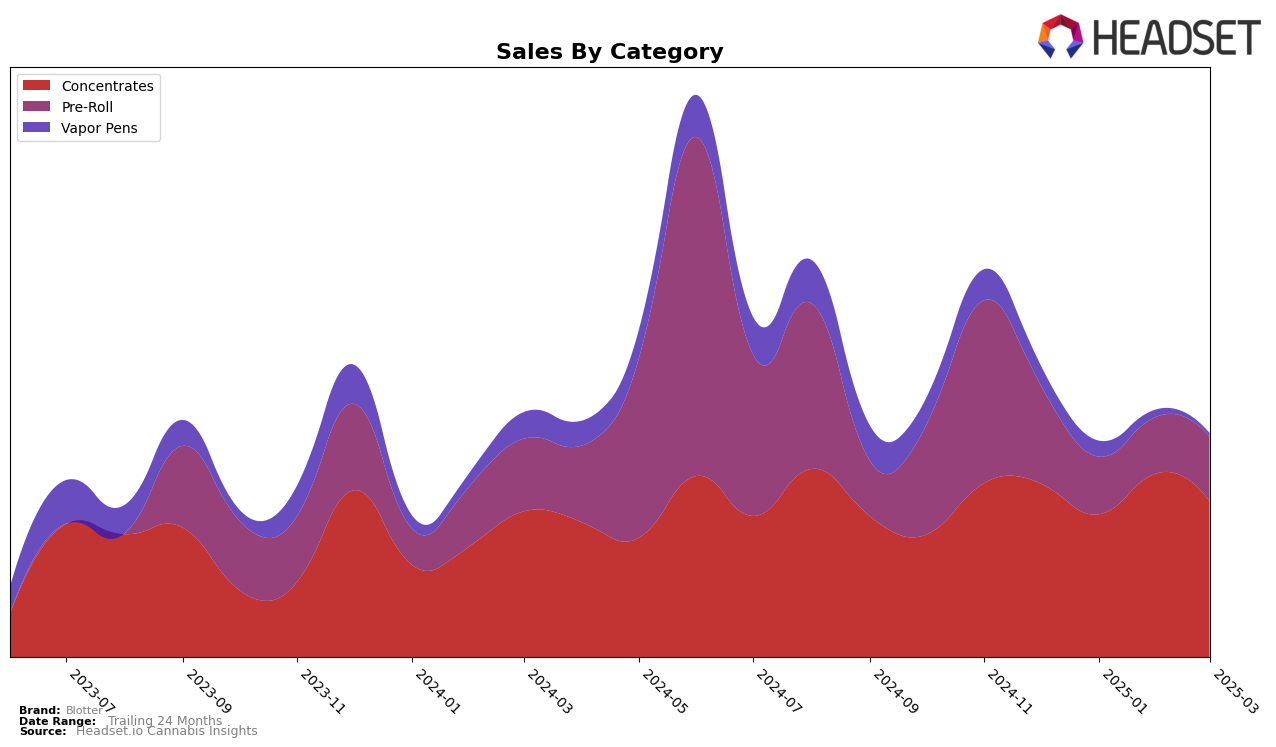

Blotter's performance in the New York market shows notable trends across different product categories. In the Concentrates category, Blotter has maintained a consistent presence in the top 10, with rankings fluctuating between 6th and 8th place from December 2024 to March 2025. Despite a dip in sales in January, the brand saw a resurgence in February, indicating a potential recovery or successful marketing strategy that month. However, in the Pre-Roll category, Blotter has struggled to break into the top 30, with rankings hovering in the 50s and 60s. This suggests that while Blotter is a strong contender in Concentrates, it faces challenges in gaining traction in Pre-Rolls within New York.

In the Vapor Pens category, Blotter's presence in New York is less prominent, with rankings not reaching the top 30 in February and March 2025. This absence highlights a potential area for growth or strategic realignment to enhance visibility and sales in the Vapor Pens market. The sales figures for Vapor Pens in December 2024 and January 2025 were relatively low compared to other categories, indicating that this segment might not be a current focus for Blotter. Such insights suggest that while Blotter has a foothold in Concentrates, there is room for improvement and strategic opportunities in both the Pre-Roll and Vapor Pens categories to strengthen its overall market presence in New York.

Competitive Landscape

In the competitive landscape of the New York concentrates market, Blotter has experienced some fluctuations in its ranking over the past few months, indicating a dynamic competitive environment. As of March 2025, Blotter holds the 8th position, a slight drop from its 6th place in December 2024. This shift can be attributed to the performance of competitors like Glenna's, which improved its rank to 5th in March 2025, and Olio, which consistently maintained a strong presence, climbing to 6th in February 2025. Despite these challenges, Blotter's sales figures have shown resilience, with a notable peak in February 2025, although they slightly dipped in March. Meanwhile, New York Honey (NY Honey) and Silly Nice have remained stable but lower in rank, suggesting that Blotter remains a key player amidst a competitive field, albeit with room for strategic adjustments to regain its higher ranking.

Notable Products

In March 2025, the top-performing product for Blotter was Lucys Naked - Super Boof Diamond Infused Pre-Roll 5-Pack (2.5g), which climbed to the number one spot from third place in February, with sales reaching 375 units. Papaya Bomb Live Resin Sugar (1g) also saw a significant rise, moving from fifth to second place, indicating a growing preference among consumers. Fruit Smoothie Live Resin Sugar (1g) dropped from first to third, despite maintaining strong sales figures. Biscotti Live Resin Sugar (1g) entered the rankings for the first time in March, securing the fourth position. Lemon Cake Live Resin Sugar (1g) slipped from third in December and January to fifth in March, suggesting a shift in consumer tastes within the concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.