Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

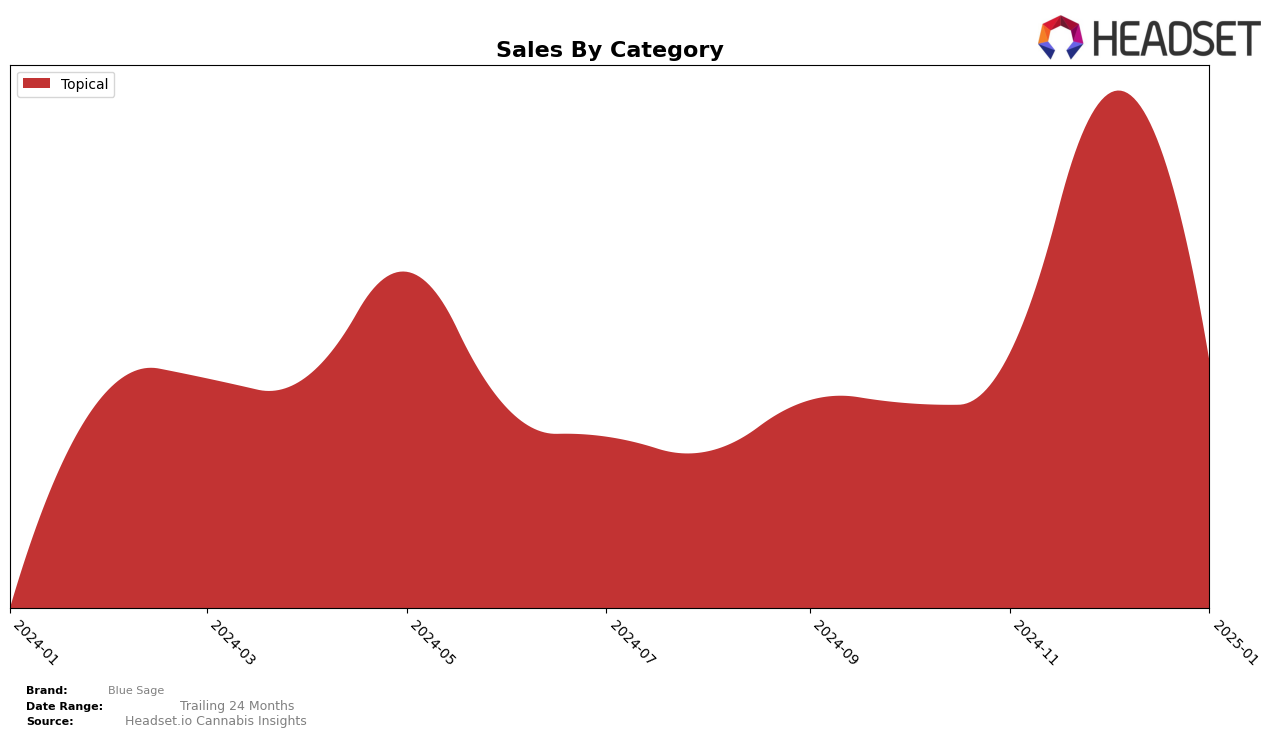

Blue Sage has shown a notable entrance into the Topical category in California as of January 2025, achieving a rank of 12. This is a significant development considering the brand was absent from the top 30 rankings in the previous months of October, November, and December 2024. The emergence of Blue Sage in this category suggests a strategic focus on expanding their product offerings or enhancing their market presence in the Topical category, which could be indicative of growing consumer interest or effective marketing strategies. The absence of Blue Sage in the rankings prior to January could be seen as a missed opportunity in the earlier months, but their current ranking highlights potential for future growth and stability in this segment.

While Blue Sage's rise in the Topical category in California is noteworthy, the lack of ranking in other states and categories suggests that the brand's influence is currently geographically concentrated or that they are focusing their efforts on specific markets. The absence of rankings outside California may indicate potential areas for expansion or the need for increased market penetration strategies. Understanding the dynamics of Blue Sage's performance in California could provide insights into their success factors, which might be replicable in other states. The brand's ability to capture a top 30 spot in a competitive market like California's Topical category could serve as a benchmark for potential strategies in other regions.

Competitive Landscape

In the competitive landscape of California's topical cannabis market, Blue Sage has shown notable progress, particularly in January 2025, when it emerged in the rankings at 12th position. This marks a significant entry, as Blue Sage was absent from the top 20 in the preceding months, indicating a positive trend in its market presence. In comparison, OM consistently maintained its 11th position from October to December 2024, only dropping to 12th in January 2025, suggesting a slight decline in its dominance. Meanwhile, Dr. May held steady at 12th place in October and November 2024, before disappearing from the top 20, highlighting potential volatility. Wild Bill's and Opi-Not both appeared in the rankings in November and January, respectively, with Wild Bill's at 14th and Opi-Not at 14th, indicating a more sporadic presence. Blue Sage's recent ranking suggests a growing acceptance and potential for increased sales, positioning it as a rising contender in the market.

Notable Products

In January 2025, Orange Chai Cream (404mg THC, 50ml) emerged as the top-performing product for Blue Sage, reclaiming its first-place ranking with sales reaching 62 units. Citrus Cedar Cream (897mg THC, 118ml) and The Original Cream (696mg THC, 118ml) both secured the second position, maintaining their strong presence from previous months. Notably, Citrus Cedar Cream (393mg THC, 50ml) saw a significant drop, falling from the first position in December 2024 to third in January 2025. The Original Cream (322mg THC, 50ml), despite its previous performance, also tied for third place in January. Overall, the topical category continues to dominate the sales for Blue Sage, with slight shifts in product rankings over recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.