Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

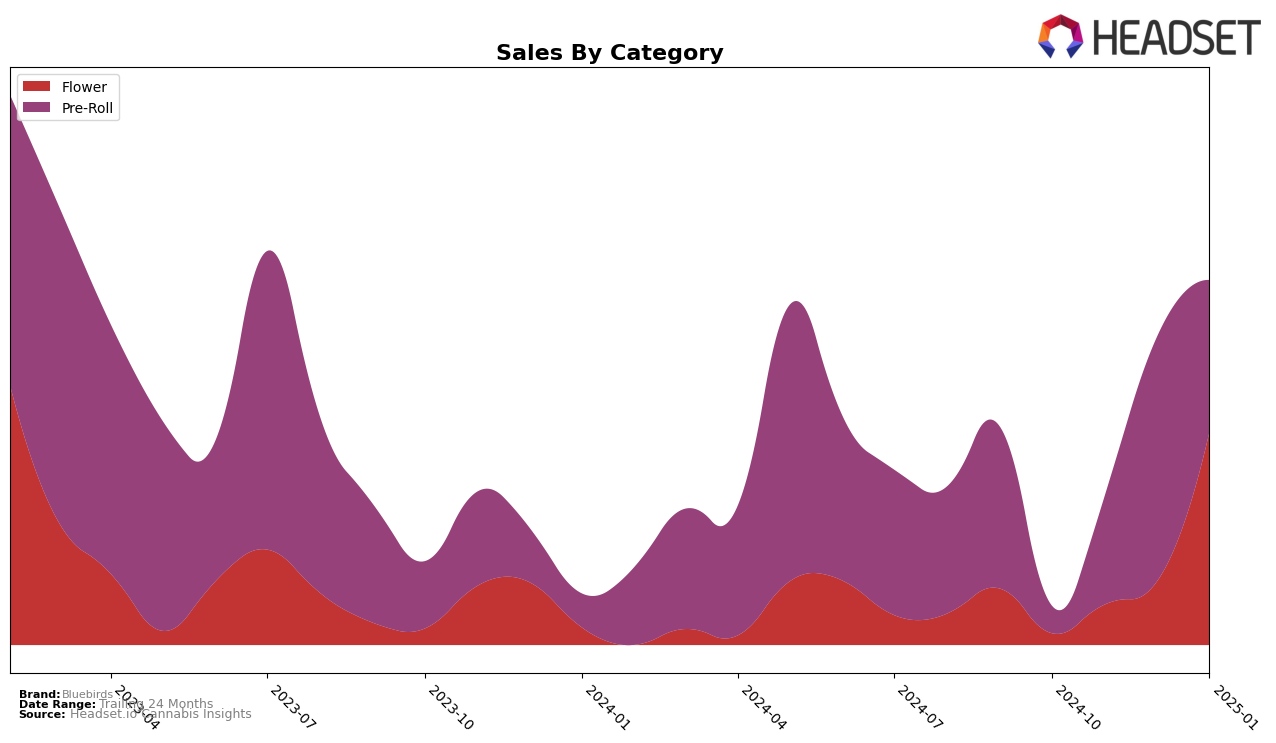

In the state of Nevada, Bluebirds has shown a noteworthy trajectory in the Flower category. While the brand did not make it into the top 30 in October 2024, it has progressively climbed the rankings, reaching the 53rd position by January 2025. This upward movement is accompanied by a significant increase in sales, suggesting a growing consumer interest and possibly indicating successful marketing or product strategies. On the other hand, Bluebirds' absence from the top 30 in October highlights challenges or competition pressures that the brand might have faced earlier in the year. This kind of fluctuation can be crucial for stakeholders to analyze the competitive landscape and consumer preferences in the region.

Conversely, in the Pre-Roll category, Bluebirds experienced a different pattern. Starting outside the top 30 in October 2024, the brand quickly surged to the 19th position by December before slightly dropping to 25th in January 2025. Despite this minor decline, the brand's ability to maintain a presence within the top 30 for consecutive months signifies a stable demand for their Pre-Roll products in Nevada. This consistency might be a reflection of product quality or brand loyalty among consumers. The fluctuations in rankings between months suggest a dynamic market where consumer preferences can shift rapidly, and brands must continuously adapt to maintain their standing.

Competitive Landscape

In the competitive landscape of the Flower category in Nevada, Bluebirds has shown a remarkable upward trajectory in recent months. Starting from outside the top 20 in October 2024, Bluebirds made a significant leap to rank 89th in November, then further climbed to 76th in December, and achieved 53rd place by January 2025. This upward movement is indicative of a strong growth trend in sales, which is particularly notable when compared to competitors like TRYKE and Hippies, both of which have experienced a decline in rank over the same period. Meanwhile, Carbon has shown consistent improvement, moving from 67th to 51st place, suggesting a competitive pressure that Bluebirds has successfully navigated. The dramatic rise in Bluebirds' rank and sales highlights its growing presence and potential to capture more market share in Nevada's Flower category.

Notable Products

In January 2025, Bluebirds saw Gush Mints Pre-Roll (1g) rise to the top as the best-selling product, achieving the number one rank with a notable sales figure of 1055 units. The 8 Bagel Pre-Roll (1g) followed closely in second place, marking its debut in the rankings. Gush Mints (3.5g) secured the third spot, climbing from its previous absence in December 2024. Dante's Inferno (3.5g) entered the scene as the fourth-ranked product, while Amoretto Sour Pre-Roll (1g) dropped to fifth from its fourth position in December 2024. These shifts highlight a dynamic change in consumer preferences, particularly favoring pre-rolls in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.