Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

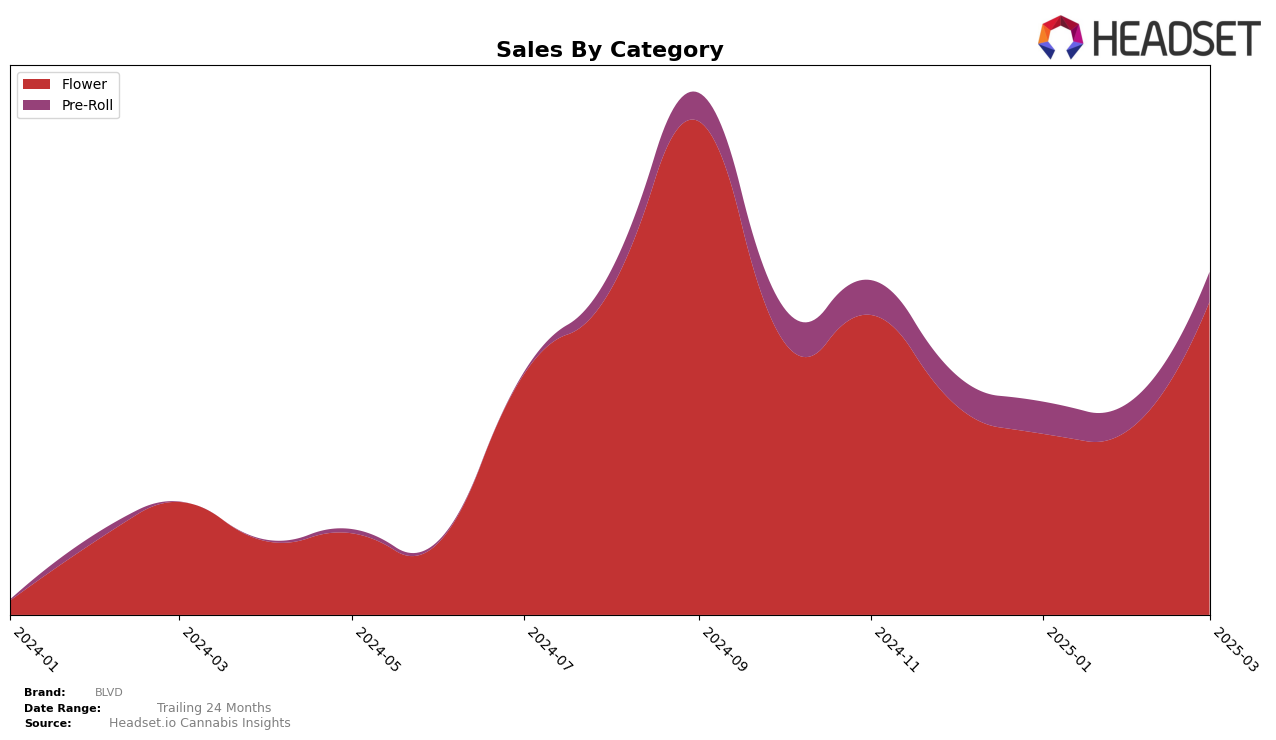

In the Nevada market, BLVD has shown a promising upward trend in the Flower category. Despite not being in the top 30 brands at the end of 2024, BLVD climbed to the 30th position by March 2025. This movement indicates a significant improvement in their market presence, especially considering their sales increased from $111,359 in February 2025 to $186,660 in March 2025. Such growth suggests that BLVD is gaining traction and potentially capturing a larger share of consumer interest in this category.

Conversely, BLVD's performance in the Pre-Roll category in Nevada has been less favorable. The brand has consistently ranked outside the top 30, with rankings fluctuating between 46th and 57th place from December 2024 to March 2025. Although the sales figures for Pre-Rolls saw a slight increase in January 2025, the overall trend suggests challenges in establishing a strong foothold in this category. This disparity in performance between categories highlights the brand's varied success across its product lines, indicating potential areas for strategic focus and improvement.

Competitive Landscape

In the competitive landscape of the Nevada flower category, BLVD has shown a notable upward trend in rank from December 2024 to March 2025, moving from 41st to 30th position. This improvement is significant given the competitive pressure from brands like SeCHe, which maintained a steady rank around the high 20s, and Superior (NV), which experienced a decline from 12th to 28th. BLVD's sales trajectory also reflects a positive shift, with a substantial increase in March 2025, surpassing its February sales and closing the gap with competitors like Remedy, which saw a steady rise in sales despite fluctuating ranks. This indicates that BLVD's strategies are effectively capturing market share, positioning it as a rising player in the Nevada flower market.

Notable Products

In March 2025, the top-performing product from BLVD was 702 Headband (3.5g) in the Flower category, climbing to the number one rank with sales reaching 1863 units. Cap Junkie (3.5g), also in the Flower category, secured the second position, maintaining a strong presence after moving up from fourth place in February. Greyhound Pre-Roll (1g) made its debut in the rankings, achieving third place in the Pre-Roll category, indicating a strong market entry. Cap Junkie Pre-Roll (1g) improved its standing to fourth place from fifth in February, showing a positive sales trajectory. Naked City Gushers (3.5g) rounded out the top five, although it fell from third place in February, suggesting a slight dip in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.