Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

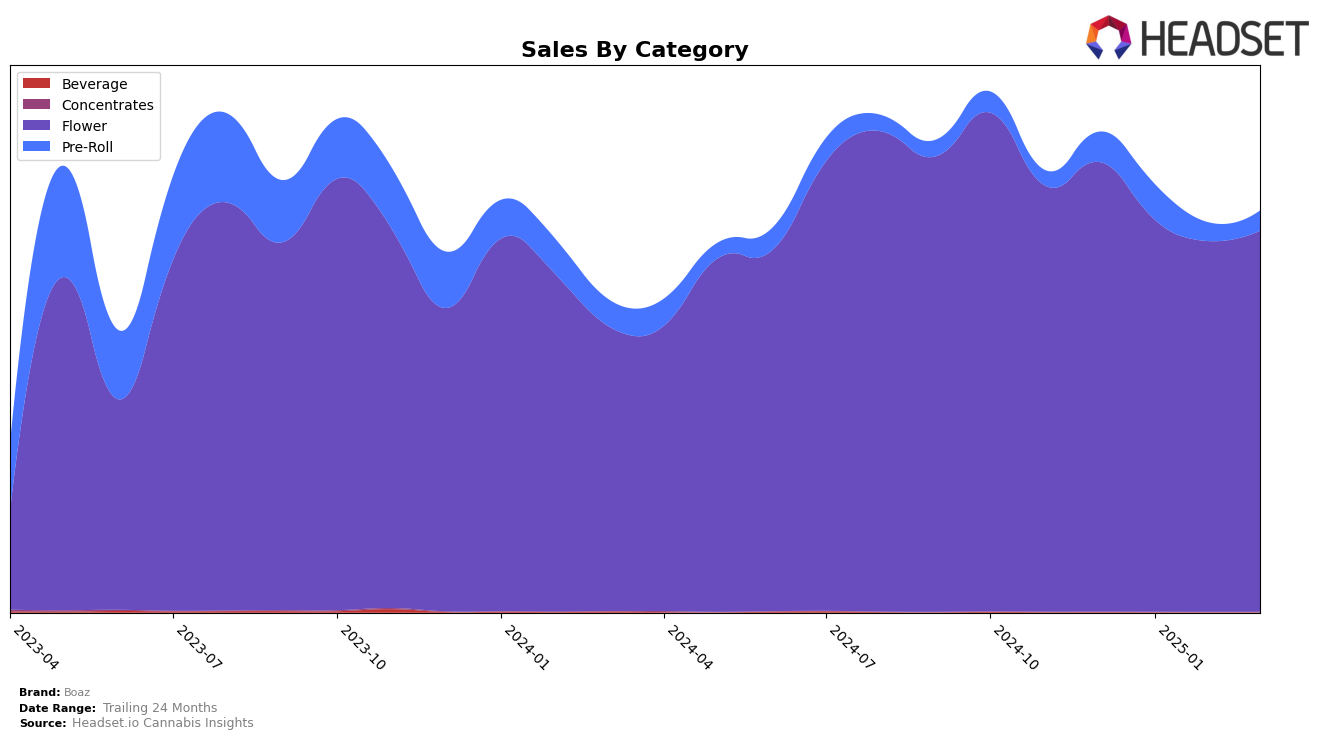

In the province of Alberta, Boaz has shown a consistent presence in the Flower category, maintaining its position within the top 30 brands. From December 2024 to March 2025, Boaz's ranking fluctuated slightly, starting at 28th, moving up to 27th, and then back down to 29th. This suggests a stable yet competitive standing in the market. Despite these minor rank changes, Boaz's sales figures have experienced a downward trend, with sales decreasing from December to February before a slight recovery in March. This performance indicates potential challenges in maintaining growth momentum, possibly due to increased competition or shifting consumer preferences in the Flower category.

Boaz's ability to stay within the top 30 brands in Alberta's Flower category is noteworthy, especially as other brands may have struggled to break into this competitive segment. The absence of Boaz from the top 30 in any other state or province could be seen as a limitation in their market reach or an opportunity for expansion. The consistency in Alberta suggests a strong brand presence and recognition, which could be leveraged for strategic growth in other regions. However, the slight decline in sales over the months indicates that Boaz may need to explore new strategies or product innovations to sustain and enhance its market position. This analysis provides a glimpse into the brand's performance, with more detailed insights available for those interested in deeper market dynamics.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Boaz has experienced fluctuations in its ranking, moving from 28th in December 2024 to 29th by March 2025. Despite a slight decline in sales from December to February, Boaz saw a modest recovery in March. Meanwhile, Common Ground made a significant leap from 77th to 27th, surpassing Boaz by March, indicating a strong upward trend in both rank and sales. Tribal maintained a position close to Boaz, with a slight improvement from 31st to 28th, showcasing a competitive edge with a sales recovery in March similar to Boaz. RIPPED and The Drop also showed dynamic movements, with The Drop climbing significantly from 53rd to 30th. These shifts highlight the competitive pressure Boaz faces in maintaining its market position amidst rapidly changing dynamics in the Alberta Flower market.

Notable Products

In March 2025, Boaz's top-performing product was Windmill Indica Milled (7g), maintaining its position as the best-seller for the fourth consecutive month with a sales figure of 3,572 units. Following closely, Windmill Sativa Milled (7g) and Windmill Hybrid Milled (7g) also retained their consistent ranks at second and third, respectively. Windmill Indica Pre-Roll 2-Pack (1g) and Windmill Sativa Pre-Roll 2-Pack (1g) held steady at fourth and fifth positions. Notably, the sales figures for these products have shown slight fluctuations, but rankings have remained unchanged since December 2024. This consistency in rankings indicates a stable demand for Boaz's milled flower and pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.