Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

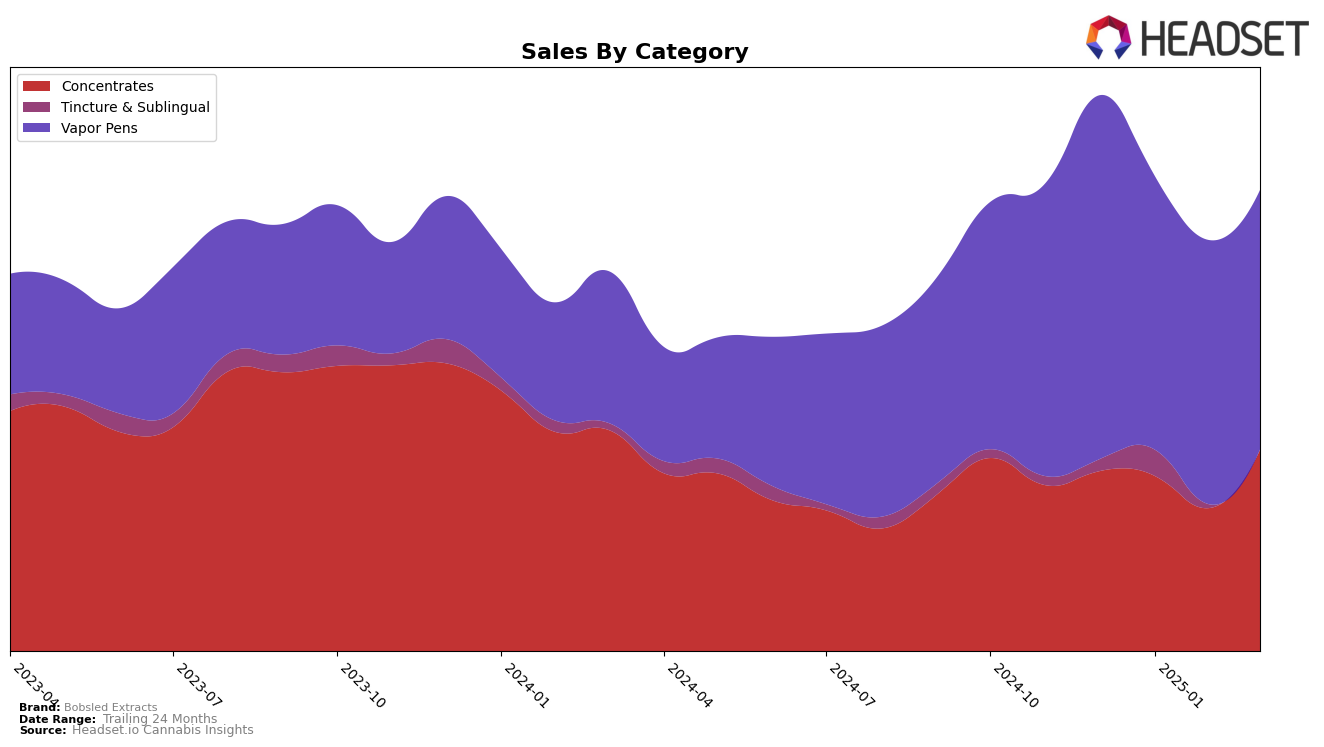

Bobsled Extracts has shown a dynamic performance in the Oregon market across different product categories. In the Concentrates category, the brand demonstrated resilience by maintaining a solid presence within the top 10, fluctuating between ranks 4 and 6 over the four-month period from December 2024 to March 2025. Notably, March 2025 saw a significant recovery in sales, reaching $300,637, which suggests a strong rebound from the previous month's dip. This upward movement in ranking and sales indicates a robust demand for their concentrates in the state, positioning them as a key player in this category.

In contrast, Bobsled Extracts faced challenges in the Tincture & Sublingual category, where their ranking slipped from 6th in December 2024 to 11th by March 2025, falling out of the top 10. This decline might be attributed to increased competition or shifts in consumer preferences. Meanwhile, their performance in the Vapor Pens category remained relatively stable, albeit outside the top 10, with ranks ranging from 14th to 18th. Despite a steady sales trend, maintaining a position outside the top 15 could imply the need for strategic adjustments to enhance their market share in this segment. Overall, while Bobsled Extracts continues to perform well in some categories, there are areas where strategic focus could potentially yield better outcomes.

Competitive Landscape

In the competitive landscape of Vapor Pens in Oregon, Bobsled Extracts has experienced fluctuating rankings, reflecting a dynamic market presence. Starting at 14th place in December 2024, Bobsled Extracts saw a dip to 18th in January 2025, briefly climbed to 16th in February, and then settled back to 18th in March. This movement suggests a challenging market environment, where competitors like Select and Sessions Cannabis Extract (OR) have maintained relatively stable positions, with Select consistently ranking between 14th and 17th, and Sessions Cannabis Extract (OR) showing a slight improvement from 18th to 16th over the same period. Meanwhile, Private Stash and Feel Goods have been climbing the ranks, indicating increasing competition. Despite these challenges, Bobsled Extracts' sales figures, although lower than some competitors, show resilience, suggesting potential for strategic adjustments to regain higher rankings in the future.

Notable Products

In March 2025, the top-performing product from Bobsled Extracts was Thunderstruck Cured Resin (1g) in the Concentrates category, achieving the number one rank with notable sales of 2,289 units. Lemon Thai Melted Diamonds + Cannabis Terpenes Cartridge (1g) in the Vapor Pens category secured the second position, marking its first appearance in the rankings. Purple Hindu Kush Cured Resin (1g) followed closely, ranking third, also its first recorded rank. Ice Queen Cured Resin Cartridge (1g) and Bay Platinum Cookies Cured Resin (1g) took the fourth and fifth spots, respectively, both making their debut in March rankings. This shift indicates a strong performance in March compared to previous months where these products did not rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.