Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

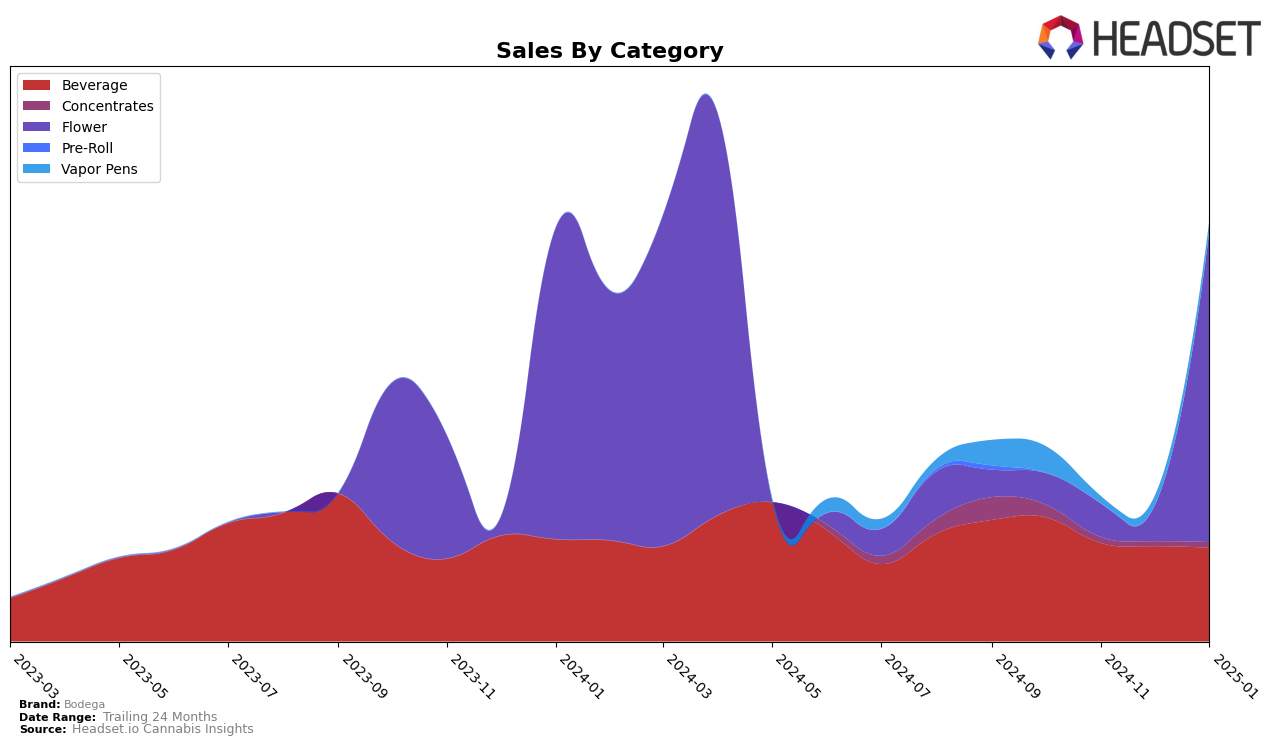

In the competitive landscape of cannabis brands, Bodega has shown notable activity in the California market, particularly within the Beverage category. As of October 2024, Bodega ranked 26th, marking its presence in the top 30 brands. However, the absence of rankings in subsequent months suggests that Bodega struggled to maintain its position, indicating a potential decline in market competitiveness or sales volume. This drop out of the top 30 could be seen as a setback, especially in a state like California where the cannabis market is vibrant and highly competitive.

While the October 2024 sales figure for Bodega in California was recorded at $10,009, the lack of ranking data in the following months highlights a concerning trend. The initial entry into the rankings shows potential, yet the brand's inability to sustain its position could imply challenges such as increased competition, changes in consumer preferences, or strategic missteps. Understanding these dynamics is crucial for stakeholders looking to capitalize on market opportunities or address underlying issues that may be affecting brand performance.

Competitive Landscape

In the competitive landscape of the California beverage category, Bodega has faced significant challenges in gaining traction among top cannabis brands. As of October 2024, Bodega was ranked 26th, indicating a struggle to break into the top 20, a threshold it has yet to cross in subsequent months. In contrast, competitors like Artet and Drink Loud have maintained stronger positions, with Artet improving from 22nd to 21st place between October and November 2024, and Drink Loud holding a steady 21st position in October 2024. This suggests that while Bodega's sales efforts are ongoing, the brand needs to enhance its market strategy to compete more effectively against these established players, who are not only consistently ranked higher but also demonstrate upward momentum in sales and ranking.

Notable Products

In January 2025, Pineapple Cooler Cannabis-Infused Beverage (25mg THC, 12oz) maintained its position as the top-performing product for Bodega, with sales reaching 803 units. The Pear Cooler Cannabis-Infused Beverage (25mg THC, 12oz) also held steady at the second rank, showing consistency across the months. Orange Kush Wax (1g) improved its position slightly, moving up to third place from fourth in December 2024. Cherry Limeade Cooler Cannabis-Infused Beverage (25mg THC, 12oz) experienced a notable drop, falling to fourth place after leading in November 2024. Biodiesel (14g) entered the rankings for the first time, securing the second spot, indicating a strong debut in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.