Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

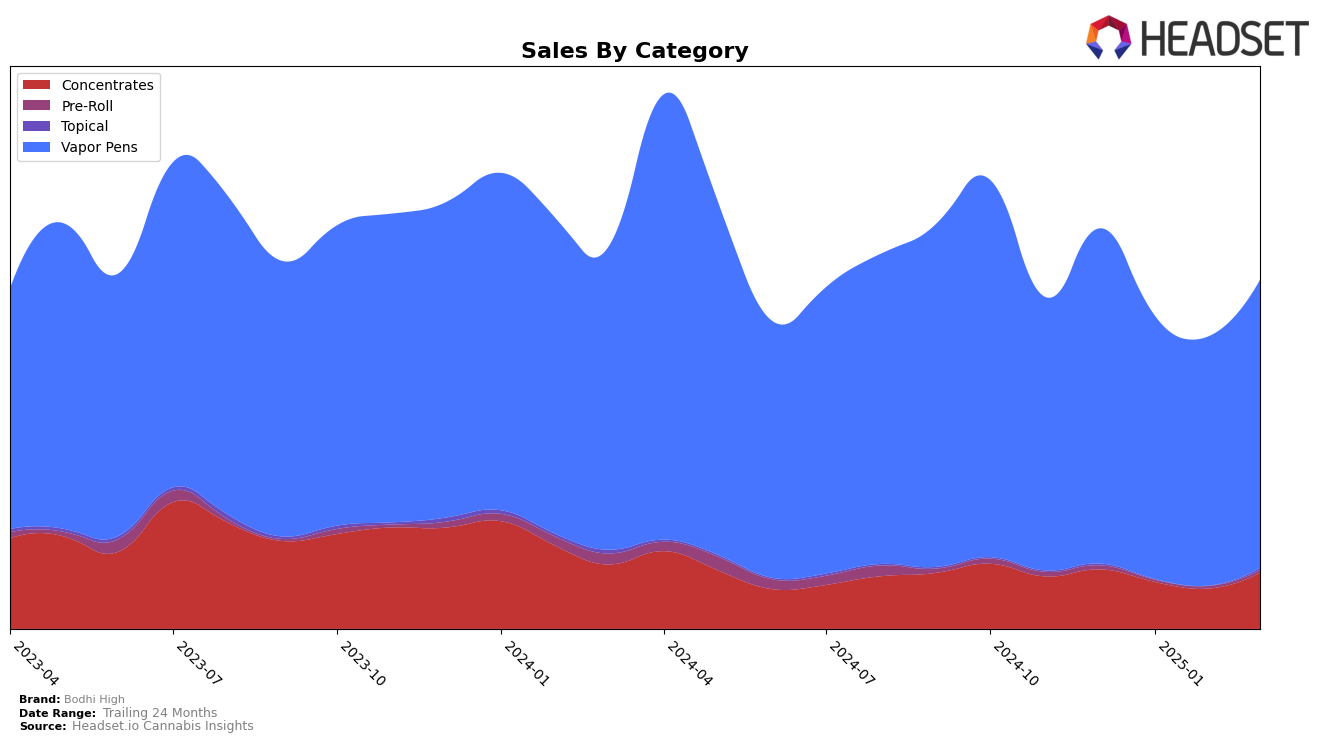

Bodhi High's performance in the Washington market reveals a mixed trajectory across different product categories. In the Concentrates category, the brand experienced fluctuations in its ranking, moving from 41st in December 2024 to 42nd by March 2025. Notably, Bodhi High did not make it into the top 30 in this category during this period, which could indicate challenges in maintaining a competitive edge. Despite these fluctuations in rank, the sales figures saw a notable increase from February to March, suggesting a potential rebound or seasonal demand shift.

Conversely, Bodhi High's performance in the Vapor Pens category in Washington shows a more consistent upward trend. Starting at 23rd place in December 2024, the brand climbed to 21st by March 2025. This steady improvement in ranking highlights Bodhi High's growing presence and potential strength in the Vapor Pens market. The sales figures support this trend, with a noticeable increase from February to March, pointing towards a positive momentum that could be capitalized on in the coming months. The absence of top 30 rankings in other states or provinces suggests that Bodhi High might currently be focusing its efforts predominantly in Washington, or it could indicate room for expansion in other markets.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Bodhi High has shown a steady improvement in its ranking from December 2024 to March 2025, moving from 23rd to 21st place. This upward trend indicates a positive shift in market presence, despite not breaking into the top 20. In contrast, Fire Bros. experienced a decline, dropping from 13th to 19th, which might suggest a potential opportunity for Bodhi High to capture some of their market share. Meanwhile, Lifted Cannabis Co and Cookies have shown more volatility in their rankings, with Lifted Cannabis Co falling out of the top 20 in February 2025 and Cookies showing a slight improvement. Hitz Cannabis, although starting lower, has been climbing steadily, which could pose a future challenge for Bodhi High if this trend continues. Overall, Bodhi High's consistent sales performance and slight rank improvement suggest a resilient position in the market, with potential for further growth if they can capitalize on the weaknesses of their competitors.

Notable Products

In March 2025, the top-performing product from Bodhi High was the Kush Cake Live Resin Cartridge (1g) in the Vapor Pens category, which ascended to the number one rank from third in February, with a notable sales figure of 682 units. The Mandarin Sunset Live Resin Cartridge (1g) made a strong debut, securing the second position without previous rankings. Lemon OG Kush Live Resin Cartridge (1g) slipped to third place from its top position in February, while Strawberry Cough Ultra Pure Live Resin Cartridge (1g) climbed to fourth place from fifth. Blueberry Haze Live Resin Cartridge (1g) rounded out the top five, dropping from second place in February. These shifts indicate dynamic changes in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.