Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

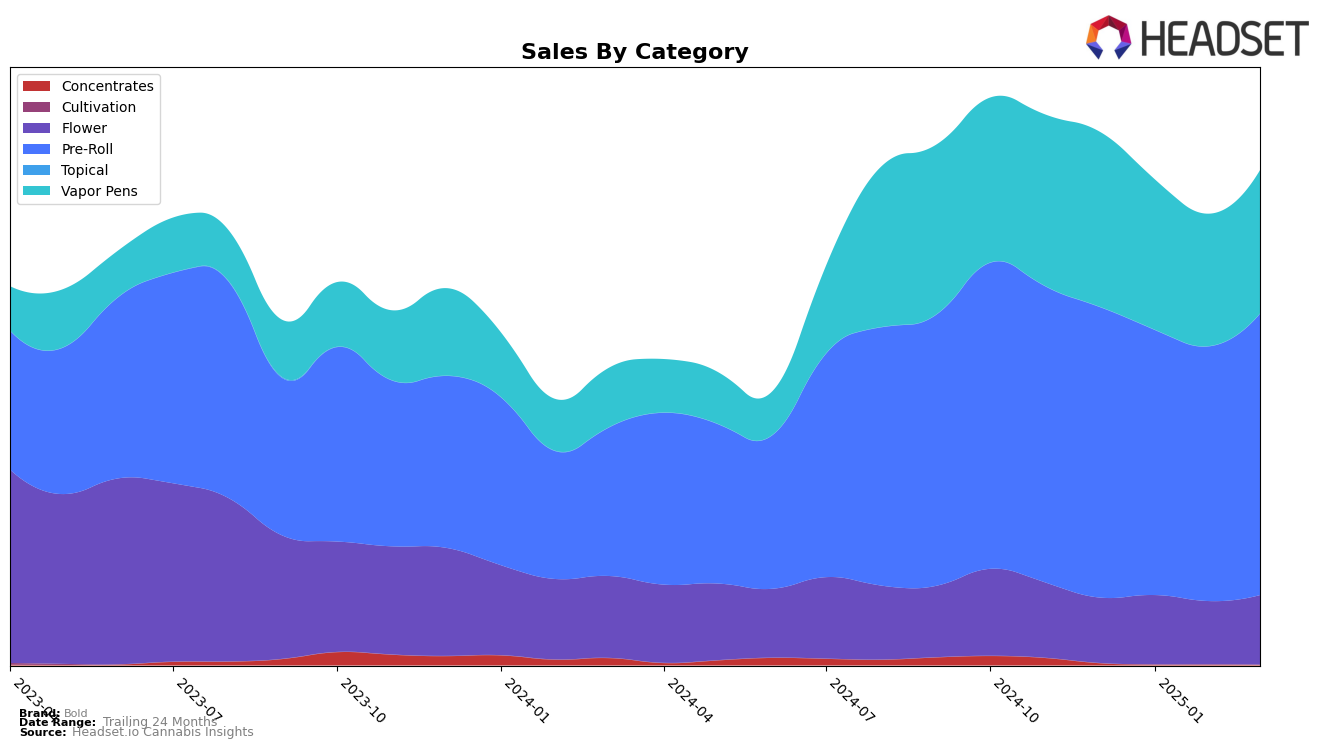

Bold's performance across different Canadian provinces and product categories shows a mix of upward and downward trends. In Alberta, Bold's Flower category has shown a notable improvement, climbing from a rank of 92 in December 2024 to 58 by March 2025, indicating a growing market presence. Meanwhile, the Pre-Roll category in Alberta experienced a slight fluctuation, peaking at rank 17 in February 2025 before dropping back to 23 in March. Conversely, the Vapor Pens category in Alberta remained relatively stable, although it did see a minor dip in rank during the early months of 2025. In British Columbia, Bold's Pre-Roll category demonstrated a strong performance, with ranks improving from 22 in January to 17 by March, suggesting a strengthening consumer preference for this product.

In Ontario, Bold's presence in the Flower category was notably absent from the top 30 until March 2025, when it entered at rank 98, indicating a late but emerging presence in this segment. The Pre-Roll category in Ontario maintained consistent ranks around the 61-62 mark throughout the observed months, while Vapor Pens showed a slight decline in rank, suggesting potential challenges in this category. In Saskatchewan, Bold's Flower category experienced a steady performance, maintaining ranks in the mid-20s, whereas the Pre-Roll category saw a drop from rank 4 in December 2024 to 8 in March 2025, potentially indicating increased competition. The Vapor Pens category in Saskatchewan, however, remained strong, consistently ranking within the top 5, showcasing Bold's solid market position in this product category.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Bold experienced notable fluctuations in its ranking, indicating a dynamic market presence. Starting at 18th place in December 2024, Bold's rank dropped out of the top 20 in January and February 2025, before rebounding to 17th place in March 2025. This recovery suggests a positive trend in sales momentum, as evidenced by a significant increase in sales from February to March. In contrast, Redecan maintained a more stable position, consistently ranking between 12th and 16th, albeit with a slight sales decline over the period. Meanwhile, Claybourne Co. showed a steady improvement in rank, moving from 24th in December to 18th in March, with a consistent upward sales trend. Pure Sunfarms and BC Doobies also demonstrated competitive resilience, with BC Doobies notably climbing to 12th place in January. These dynamics highlight Bold's potential for growth amidst strong competition, underscoring the importance of strategic positioning and market adaptation to enhance its standing.

Notable Products

In March 2025, the top-performing product for Bold was the Root Beer Float Blunt 3-Pack (1.5g) in the Pre-Roll category, maintaining its consistent first-place ranking from previous months with sales reaching 20,012 units. The Death Star Pre-Roll 3-Pack (1.5g) climbed to the second position, showing improvement from its third-place ranking in January and February. Root Beer Float (3.5g) in the Flower category dropped to third place, despite holding the second position in the prior two months. The Orange Crush Pre-Roll 3-Pack (1.5g) maintained its fourth-place ranking from February, indicating stable performance. Notably, the Glazed- Melted Strawberries Liquid Diamonds Cartridge (1g) debuted in the rankings at fifth place, reflecting growing interest in Vapor Pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.