Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

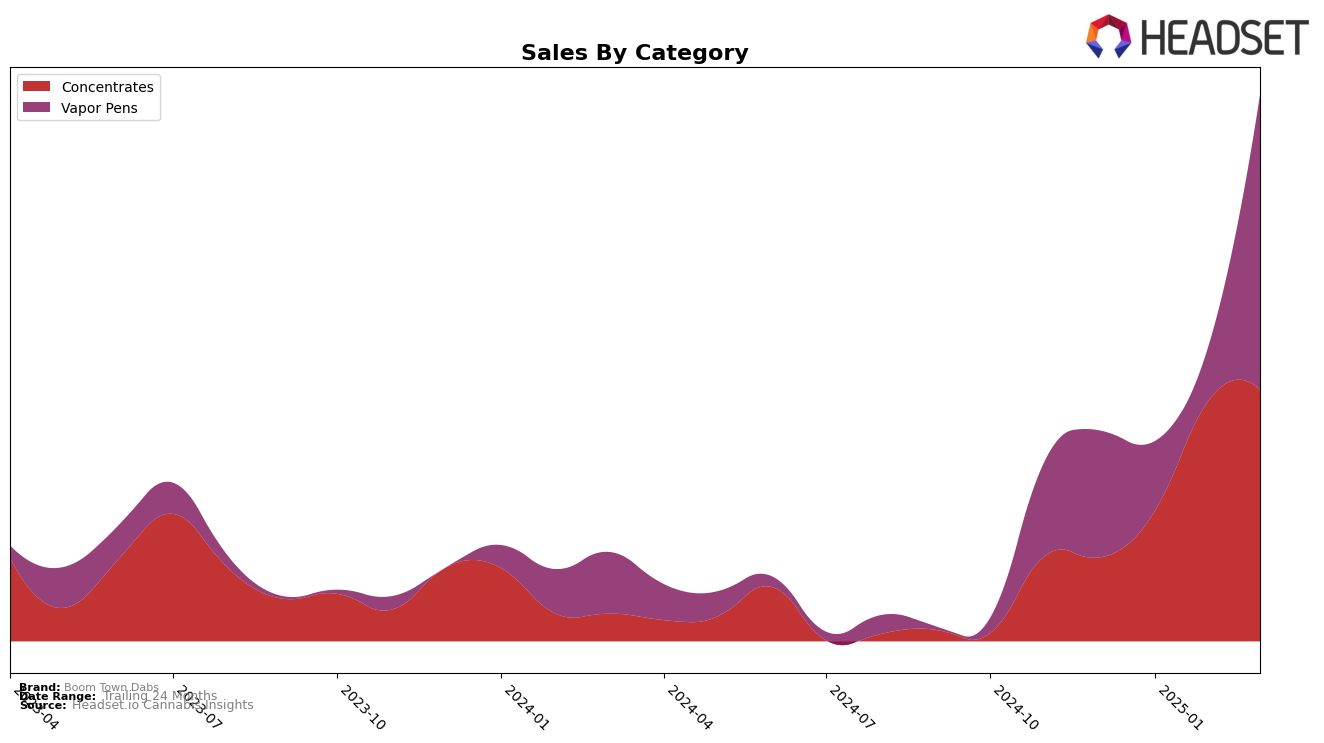

Boom Town Dabs has exhibited a noteworthy upward trajectory in the Concentrates category within the state of Nevada. Starting from a rank of 20 in December 2024, the brand ascended to the 9th position by February 2025 and maintained this rank in March 2025. This significant climb in the rankings is mirrored by a substantial increase in sales, indicating a strong market presence and consumer preference for their products in this category. In contrast, their performance in the Vapor Pens category did not initially show the same strength, as they did not rank within the top 30 until March 2025, when they reached the 29th position. This late entry into the top 30 suggests a potential turnaround or strategic shift that may have bolstered their performance in this segment.

In examining the broader market dynamics, Boom Town Dabs' performance in Nevada's Concentrates category is particularly impressive, given the competitive nature of the market. The brand's ability to break into the top 10 and sustain its position highlights its growing influence and potential for further growth. However, the delayed improvement in the Vapor Pens category could signal challenges or a slower adoption rate by consumers, despite a sharp increase in sales in March 2025. This mixed performance across categories underscores the importance of strategic positioning and product differentiation in maintaining competitive advantage. Readers interested in a more detailed breakdown of Boom Town Dabs' market strategies and sales performance can explore further insights through the available market data.

Competitive Landscape

In the Nevada Vapor Pens category, Boom Town Dabs has experienced a dynamic shift in its market position from December 2024 to March 2025. Initially ranked 41st in December, Boom Town Dabs saw a decline in rank to 45th and 49th in January and February, respectively, before making a significant leap to 29th in March. This improvement in rank suggests a positive turnaround in sales performance, contrasting with competitors like High Heads, which experienced a decline from 12th to 30th over the same period. Meanwhile, Beboe and Matrix NV maintained relatively stable positions, with Beboe fluctuating between 23rd and 28th, and Matrix NV moving from 33rd to 27th. Notably, Locals Only Concentrates showed a consistent upward trend, climbing from 55th to 32nd, indicating a growing presence in the market. Boom Town Dabs' recent surge in rank, particularly in March, highlights its potential for increased market share, especially as it outpaces some of its competitors in the latest month.

Notable Products

In March 2025, Boom Town Dabs saw Dante's Inferno Live Resin Cartridge (1g) leading the sales with a top rank of 1 in the Vapor Pens category, achieving a notable sales figure of 563 units. Gush Mints Live Resin Cartridge (1g) followed closely in second place within the same category. Amoretto Sour Live Resin Batter (1g) ranked third in Concentrates, showing a slight drop from its previous second position in February. The 8 Inch Bagel Live Resin Sugar (1g) and Dante's Inferno Live Resin Batter (1g) both tied for fourth place in Concentrates. These rankings indicate a strong preference for live resin products, with some fluctuations in product popularity from February to March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.