Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

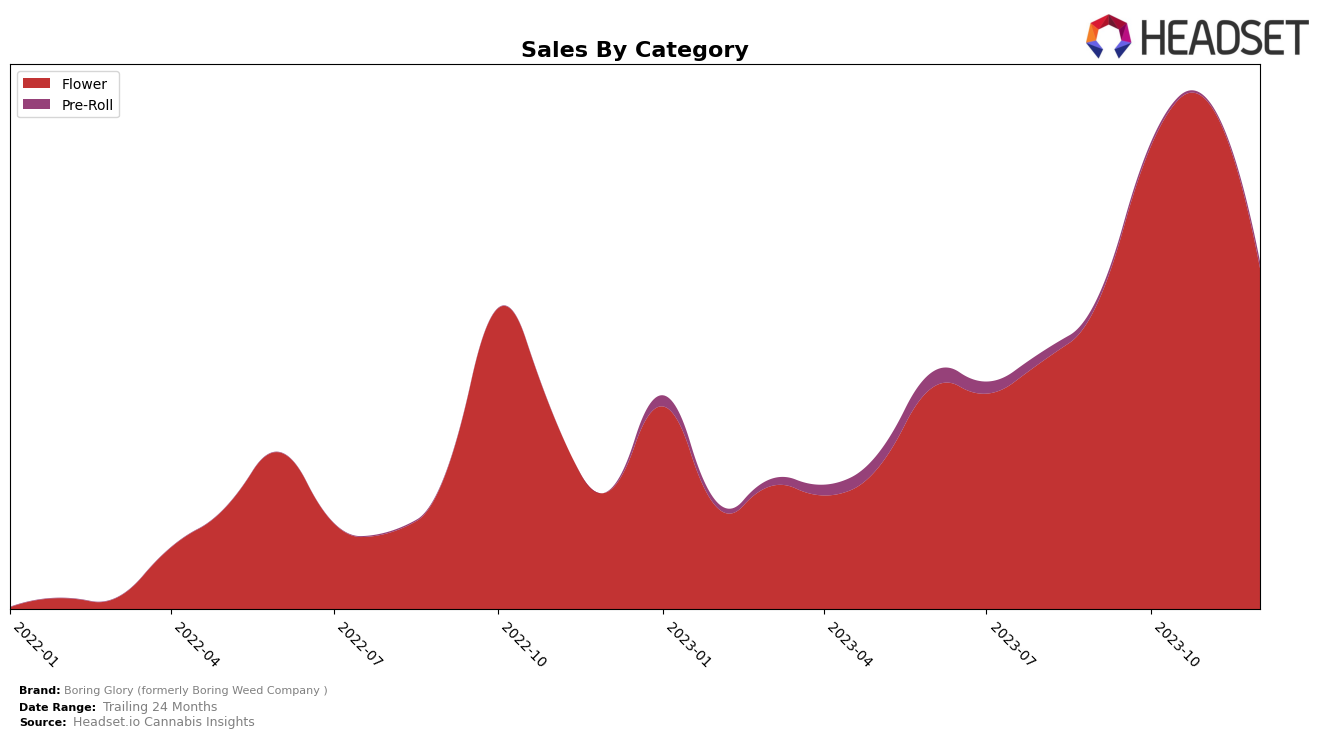

In the Flower category, Boring Glory (formerly Boring Weed Company) has shown some notable movements in the Oregon market. The brand started off in September 2023 outside of the top 20, ranking 23rd, but has shown positive momentum rising to 15th in October and further to 11th in November. However, there was a slight dip in December, with the brand falling back to 14th place. This movement is reflected in their sales figures as well, with a significant increase from September to November, followed by a drop in December.

While the brand's ranking fluctuated towards the end of the year, the overall upward trend in their performance is worth noting. Despite not making it into the top 10 in the Flower category in Oregon, the progression from 23rd to 14th place within a span of just four months demonstrates a strong potential for growth. It's also important to highlight that the dip in December does not necessarily indicate a negative trend, as many factors could have contributed to this slight setback. The brand's performance should continue to be monitored closely in the coming months for a more accurate understanding of its market position.

Competitive Landscape

In the Oregon Flower category, Boring Glory (formerly Boring Weed Company) has shown a significant upward trend in the latter part of 2023, moving from a rank of 23 in September to 14 in December. However, it's worth noting that the brand's rank fluctuated, peaking at 11 in November before dropping slightly in December. This could indicate a highly competitive market. Comparatively, Oregon Roots and Cosmic Treehouse have maintained a more stable presence in the top 20, with Cosmic Treehouse consistently ranking higher than Boring Glory. Meanwhile, PDX Organics and Earl Baker have shown steady improvement, with PDX Organics making a significant leap from rank 46 to 15, and Earl Baker maintaining a steady position in the mid-teens. The data suggests that while Boring Glory has made notable strides, the competition remains fierce in the Oregon Flower market.

Notable Products

In December 2023, the top-performing product for Boring Glory (formerly Boring Weed Company) was 'Illikoi B-buds (Bulk)' from the Flower category, with a staggering 6538 units sold. The second place was secured by 'Death Peach (Bulk)', also from the Flower category. The third spot was taken by 'Gaslight (Bulk)', which maintained its ranking from November. 'Holy Schnikes (Bulk)' and 'Ricky Bobby (Bulk)', both from the Flower category, ranked fourth and fifth respectively. This analysis suggests a strong preference for bulk Flower products among Boring Glory's customers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.