Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

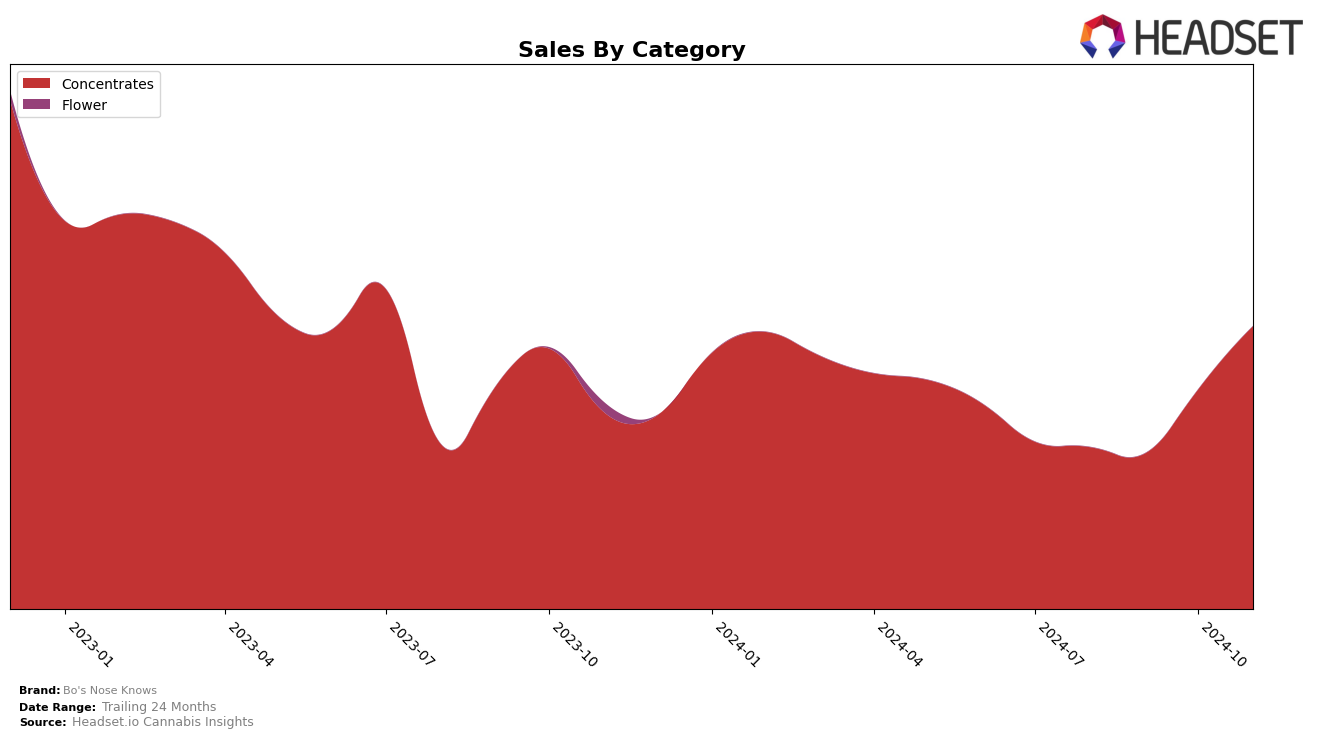

In the state of Oregon, Bo's Nose Knows has shown a noteworthy upward trajectory in the Concentrates category over the past few months. Starting from a rank of 47 in August 2024, the brand has steadily climbed to reach the 29th position by November 2024. This improvement is indicative of a significant increase in market presence and consumer preference, with sales more than doubling from August to November. The brand's ability to break into the top 30 by November is a positive indicator of its growing influence and acceptance in the Oregon cannabis market.

Despite this strong performance in Oregon, it is important to note that Bo's Nose Knows has not made it into the top 30 brands in other states or provinces within the same period. This could suggest a concentrated effort or stronger foothold in the Oregon market, while leaving room for potential growth in other regions. The absence from the top rankings in other areas might be viewed as a challenge or an opportunity for expansion, depending on the brand's strategic objectives. The data suggests that while Bo's Nose Knows is gaining momentum in Oregon, there is still significant potential for growth and market penetration elsewhere.

Competitive Landscape

In the Oregon concentrates market, Bo's Nose Knows has shown a notable upward trajectory in its ranking over the past few months, moving from 47th place in August 2024 to 29th place by November 2024. This improvement is significant when compared to competitors like Happy Cabbage Farms, which experienced a decline from 22nd to 31st place during the same period. Meanwhile, Forte Farms and Farmer's Friend Extracts have maintained relatively stable positions, with Forte Farms moving from 30th to 27th and Farmer's Friend Extracts dropping slightly from 24th to 28th. Bo's Nose Knows' sales have also seen a positive trend, with a notable increase from September to November, indicating a growing consumer interest and market presence. This growth positions Bo's Nose Knows as a rising contender in the Oregon concentrates category, suggesting potential for continued market share gains if the trend persists.

Notable Products

In November 2024, Chile Verde Full Spectrum Badder (1g) emerged as the top-performing product for Bo's Nose Knows, achieving the highest sales rank with notable sales of 221 units. Following closely, Cherry Cocktail Full Spectrum Rosin Badder (1g) secured the second position, showing strong market presence. Both 24K Rosin (1g) and Apple Truffle Rosin (1g) tied for third place, maintaining a consistent rank from previous months. Garlic Breath Full Spectrum Badder (1g) also shared the third spot, indicating a competitive market for concentrates. Overall, the rankings reflect a stable pattern in consumer preferences for Bo's Nose Knows products from October to November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.