Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

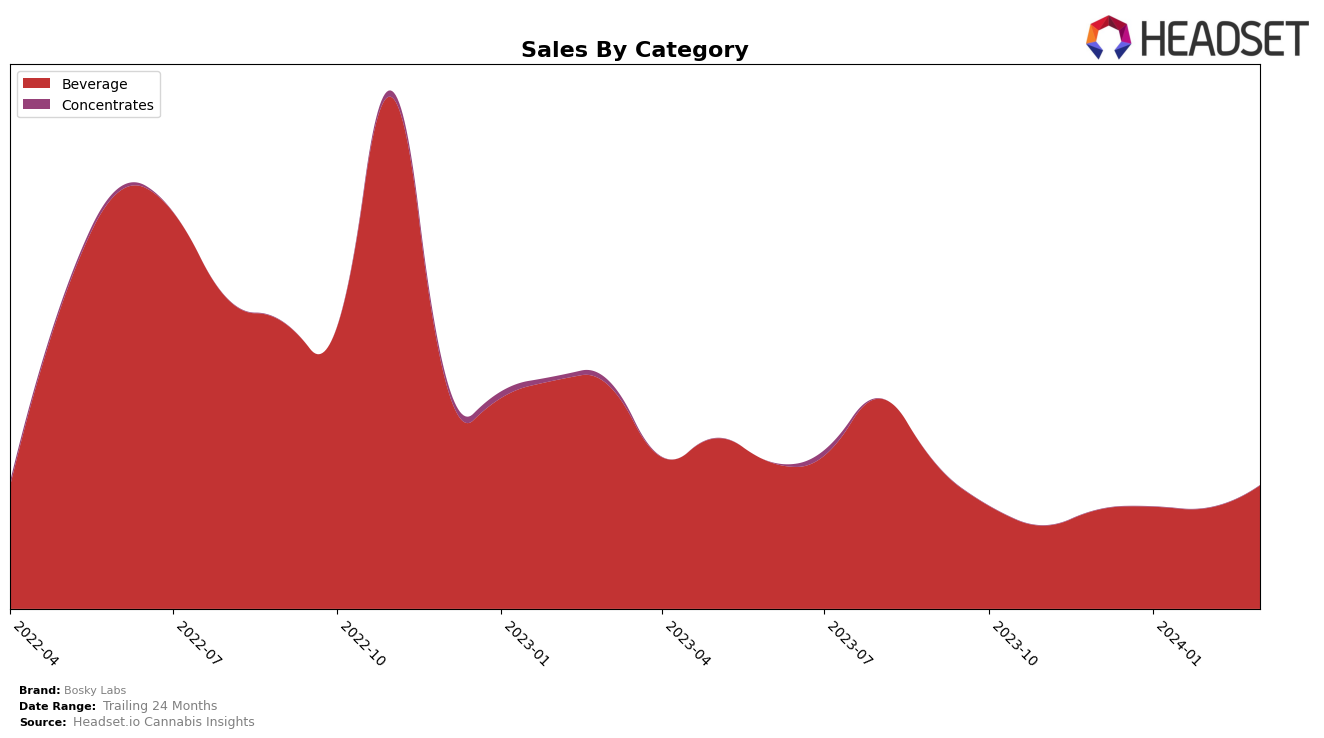

In the competitive cannabis market of Colorado, Bosky Labs has shown a consistent performance within the Beverage category, maintaining its position in the top 10 over the last four months. The brand saw a slight dip in ranking from December 2023 to January 2024, moving from 7th to 8th place, but managed to hold steady at the 8th position through February and March 2024. This consistency in ranking, despite the highly competitive nature of the Colorado cannabis market, suggests a stable demand for Bosky Labs' beverage offerings. Notably, the brand experienced a significant increase in sales from February to March 2024, jumping from 6373.0 to 7831.0, indicating a growing consumer preference or possibly a successful marketing effort during this period.

While the data provided focuses solely on Bosky Labs' performance in the Beverage category within Colorado, it's indicative of the brand's ability to maintain a strong presence in a specific market segment. The absence of data for other states or provinces suggests that Bosky Labs may be concentrating its efforts and resources on the Colorado market, or possibly that it has not yet penetrated other markets to a degree that would place it within the top 30 brands. The consistent ranking within the top 10, coupled with the notable sales increase in March 2024, positions Bosky Labs as a brand worth watching in the Colorado beverage space. However, the lack of information on performance across other categories or states leaves room for speculation on the brand's overall market strategy and potential areas of growth or improvement.

Competitive Landscape

In the competitive landscape of the beverage category in Colorado, Bosky Labs has shown a consistent performance, maintaining its rank within the top 10 brands from December 2023 through March 2024. Despite a slight drop from 7th to 8th position between December 2023 and January 2024, Bosky Labs managed to hold its rank in February and March, even seeing a significant increase in sales in March. Competitors like Major and Ript have demonstrated strong performances, with Major consistently ranking higher than Bosky Labs and Ript making a notable entrance in January 2024, quickly ascending to the 6th position by March. The Myx and Highgrade Brands also remain significant competitors, with The Myx closely trailing Bosky Labs in rankings and Highgrade Brands showing steady improvement. This competitive analysis underscores the importance of Bosky Labs' need to innovate and adapt to maintain and improve its market position amidst fierce competition.

Notable Products

In March 2024, Bosky Labs saw Grape Rosin Syrup (100mg) leading its product sales in the Beverage category, with a significant jump to the top position from its previous second rank in February, achieving sales of 139 units. Following closely behind, Mango Rosin Syrup (100mg) moved down to the second rank after leading in February, showcasing the competitive nature of the Beverage category. Strawberry Syrup 10-Pack (100mg) made a notable entrance into the top three, despite not being ranked in the previous two months, indicating a growing consumer interest. Dosidos Watermelon Syrup (100mg) and Blue Raspberry Rosin Syrup (100mg) rounded out the top five, maintaining a consistent presence in the market despite fluctuating sales figures. These shifts highlight the dynamic market preferences within Bosky Labs' product range, with the Grape Rosin Syrup (100mg) emerging as the month's standout product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.