Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

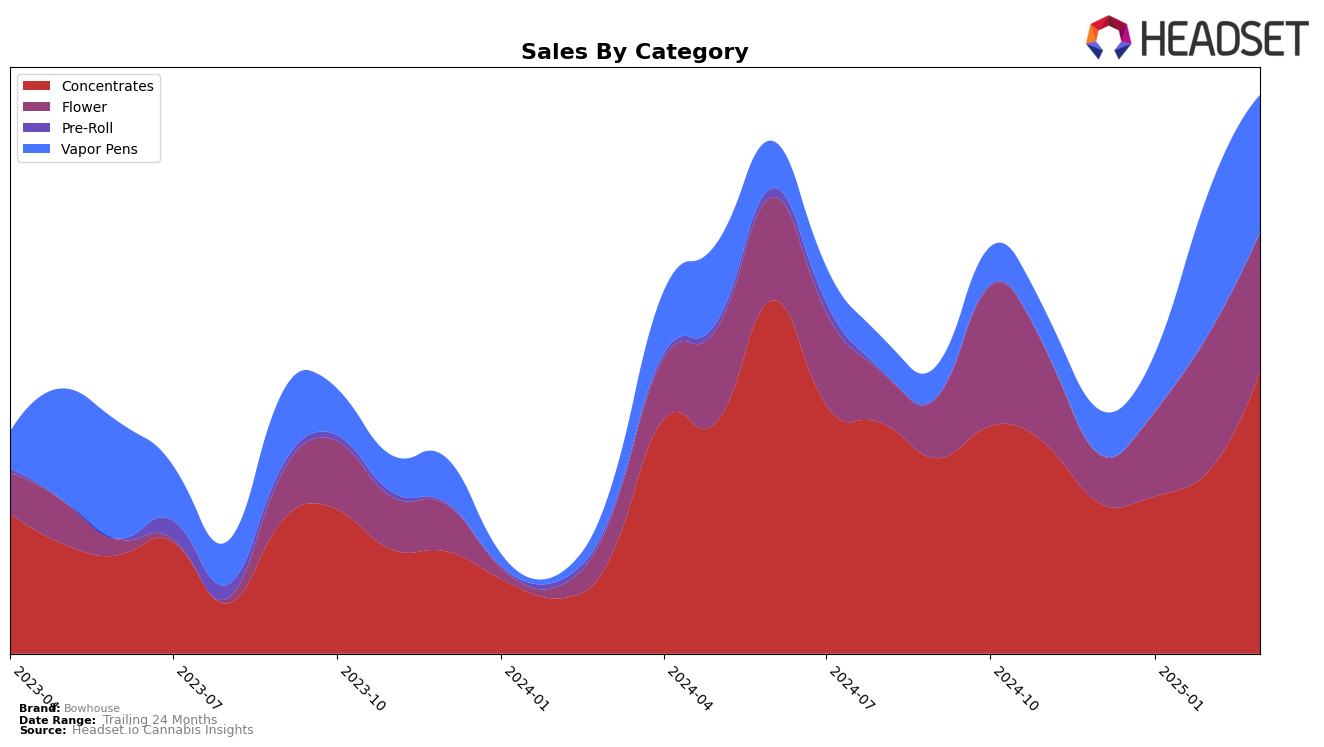

In the state of Michigan, Bowhouse has shown a noteworthy upward trajectory in the Concentrates category. Starting from a ranking of 19th in December 2024, the brand climbed to 10th place by March 2025. This impressive rise is underscored by a significant increase in sales, highlighting a growing consumer preference for Bowhouse's concentrate products. In contrast, the Vapor Pens category tells a different story. While Bowhouse improved its position from 86th in December to 41st in February, it slipped slightly to 47th in March. This fluctuation suggests a competitive landscape in the Vapor Pens category, where maintaining a top position requires continuous innovation and consumer engagement.

It's important to note that Bowhouse did not make it into the top 30 brands in the Vapor Pens category in Michigan during the months analyzed, except for a brief appearance at 41st in February. This absence from the top rankings could indicate challenges in gaining a foothold in the highly competitive vapor pen market. However, the brand's performance in the Concentrates category is a clear indicator of its potential and growing popularity among consumers. While the data provides valuable insights into Bowhouse's market dynamics, a deeper dive into consumer preferences and market strategies could offer further understanding of the brand's positioning and future opportunities.

Competitive Landscape

In the Michigan concentrates market, Bowhouse has demonstrated a significant upward trajectory in both rank and sales, particularly evident from December 2024 to March 2025. Initially ranked 19th in December 2024, Bowhouse climbed to 10th by March 2025, showcasing a notable improvement in market positioning. This ascent is particularly impressive when compared to competitors like 710 Labs, which fluctuated between ranks 7 and 11, and Traphouse Cannabis Co., which saw a decline from 3rd to 11th place over the same period. Additionally, Bowhouse's sales growth trajectory is commendable, with a consistent increase each month, contrasting with the sales volatility experienced by Society C, which fell out of the top 20 in February 2025. Meanwhile, Mac Pharms made a remarkable leap from 79th to 9th, indicating a highly competitive landscape. Bowhouse's strategic advancements in rank and sales suggest a strengthening brand presence and a promising outlook in the Michigan concentrates category.

Notable Products

In March 2025, Bowhouse's top-performing product was Lemon Cherry Runtz (3.5g) in the Flower category, which ascended to the number one spot from its previous second place in January 2025, achieving sales of 3,012 units. Pink Runts (3.5g), also in the Flower category, secured the second position, showing a significant climb from its earlier absence in the rankings for February 2025. Platinum Lemon Runtz Cured Resin Badder (1g) emerged as a new contender in the Concentrates category, capturing the third rank with notable sales. Jelly Donuts Live Resin Badder (1g) maintained a consistent performance, holding steady at fourth place. All Gas Cured Resin Badder (1g) entered the top five for the first time, indicating a growing interest in Bowhouse's Concentrates offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.