Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

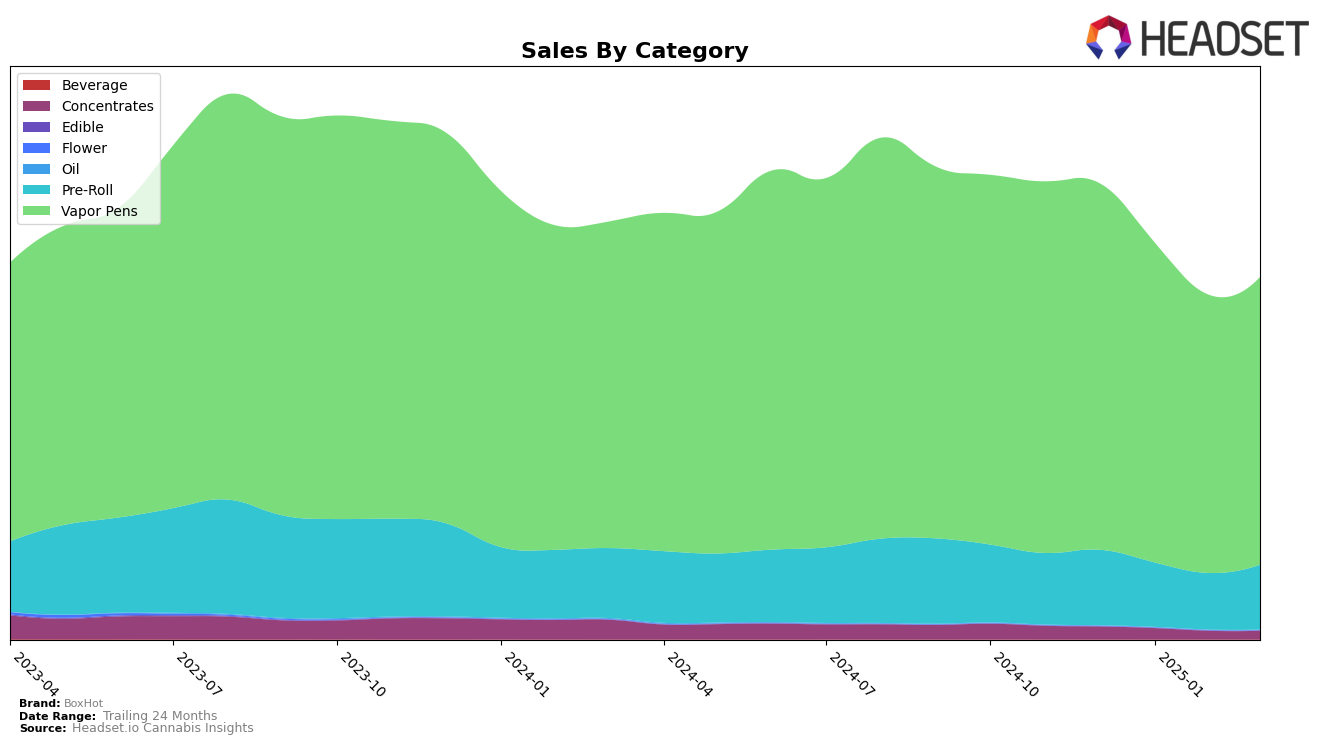

BoxHot demonstrates a strong presence in the vapor pen category across several Canadian provinces. Notably, in both Alberta and British Columbia, BoxHot consistently holds the top rank in the vapor pen category from December 2024 through March 2025. This sustained leadership indicates a robust market positioning and consumer preference for their vapor pen products. In Ontario, BoxHot maintains a solid second-place rank, further underscoring its competitive edge in this category. However, in Saskatchewan, there is a slight downward trend, with BoxHot moving from third to fifth place over the same period, suggesting potential challenges or increased competition in that market.

In contrast, BoxHot's performance in the pre-roll category shows more variability. In Alberta and Ontario, BoxHot fluctuates around the 16th to 19th ranks, indicating a stable yet less dominant market presence compared to vapor pens. Meanwhile, in British Columbia, BoxHot's rank varies more significantly, suggesting a competitive and dynamic market environment in the pre-roll category. The absence of BoxHot from the top 30 brands in the pre-roll category in Saskatchewan highlights an area of potential growth or reevaluation for the brand. This mixed performance across categories and provinces suggests strategic opportunities for BoxHot to capitalize on its strengths in vapor pens while addressing challenges in the pre-roll market.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, BoxHot consistently holds the second rank from December 2024 through March 2025, indicating a stable market position. Despite a decline in sales from December 2024 to February 2025, BoxHot's sales slightly rebounded in March 2025, suggesting resilience in a competitive market. The leading brand, Back Forty / Back 40 Cannabis, maintains a strong hold on the top position, with sales figures consistently higher than BoxHot's, which may influence BoxHot's strategies to close the gap. Meanwhile, XPLOR and General Admission remain in the third and fourth positions respectively, with sales figures notably lower than BoxHot's, indicating that while BoxHot faces strong competition from the top, it maintains a comfortable lead over its lower-ranked competitors. This competitive analysis highlights the importance for BoxHot to innovate and strategize effectively to challenge the market leader and capitalize on its current market position.

Notable Products

In March 2025, the top-performing product from BoxHot was the Peach OG Distillate Cartridge (1.2g) in the Vapor Pens category, maintaining its first-place ranking for four consecutive months with sales of 19,426 units. Coming in second was the Cherry Kush CO2 Cartridge (1.2g), which consistently held its position from December 2024 through March 2025. The Alien OG Distillate Cartridge (1.2g) also showed stability, remaining in third place across the same period. Notably, the Highlighters - Dragon's Breath Distillate Disposable (1g) held steady at fourth place from February to March 2025, after climbing up from fifth place in January. The Highlighter - Alien OG Distillate Disposable (1g) entered the rankings at fifth place in March 2025, marking its first appearance on the list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.