Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

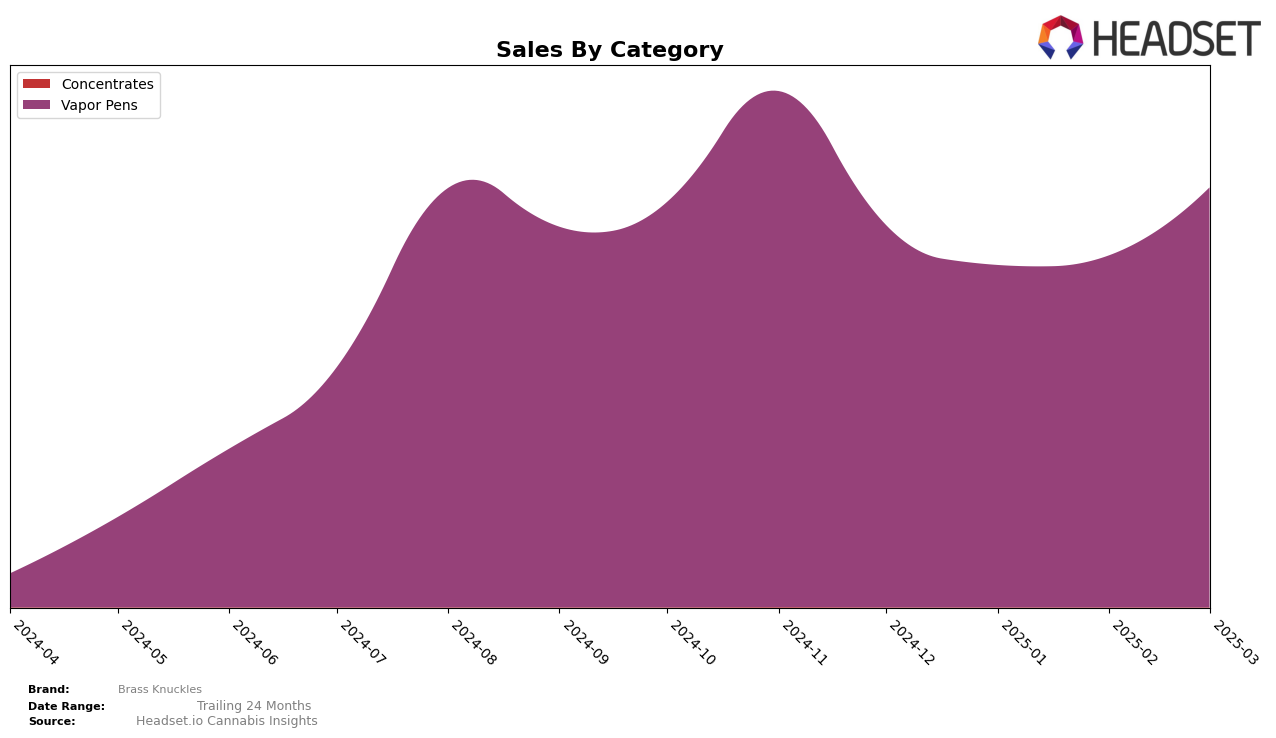

Brass Knuckles has shown a noteworthy performance in the Vapor Pens category across various states, particularly in New York. The brand experienced a fluctuation in its rankings from December 2024 to March 2025, starting at 12th place in December, dropping slightly to 15th in January, and then climbing back up to 11th in February, finally reaching 10th place in March. This upward trend in March is significant, indicating a positive reception and growing market presence in New York. Despite the initial dip in January, the brand's ability to recover and improve its ranking suggests a strong consumer base and effective market strategies.

While Brass Knuckles has managed to secure a spot within the top 30 brands in the Vapor Pens category in New York consistently, the absence of rankings in other states or provinces implies challenges in expanding their market reach beyond New York. This could be seen as a limitation in their current market strategy or competition from other brands in those regions. The sales trend in New York also highlights a substantial increase from February to March, reflecting an effective response to market demands or seasonal factors that favor the brand. However, without further data on other states, it's challenging to provide a comprehensive picture of their national performance.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Brass Knuckles has shown a notable upward trajectory in its market rank from December 2024 to March 2025. Initially ranked 12th in December, Brass Knuckles improved its position to 10th by March, indicating a positive trend in consumer preference and market penetration. Despite this progress, the brand faces stiff competition from brands like Magnitude and Holiday, which consistently held higher ranks, with Magnitude maintaining a steady position around 8th and Holiday around 7th throughout the period. Meanwhile, PAX and New York Honey (NY Honey) have shown fluctuations in their rankings, with PAX experiencing a slight decline and NY Honey improving towards March. Brass Knuckles' sales figures reflect a recovery from January's dip, culminating in a significant increase by March, suggesting effective marketing strategies or product enhancements that have resonated well with consumers. This competitive analysis highlights the dynamic nature of the vapor pen market in New York and underscores the importance for Brass Knuckles to continue innovating to maintain and improve its market position.

Notable Products

In March 2025, Brass Knuckles maintained its position at the top of the sales chart with Skywalker OG Liquid Live Diamonds Disposable (1g) ranking first, achieving a notable sales figure of 1566 units. Maui Wowie Live Liquid Diamond Cartridge (1g) consistently held the second position throughout the months leading up to March, demonstrating stable performance with 1274 units sold. East Coast Sour Diesel Distillate Disposable (1g) showed improvement by climbing to the third spot from its previous rank of fourth in February. Melonade Liquid Live Diamonds Disposable (1g) secured the fourth rank, having improved from a fifth-place ranking in February. Alaskan Thunder Fuck Distillate Disposable (1g) experienced a slight decline, slipping to fifth place after being third in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.