Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

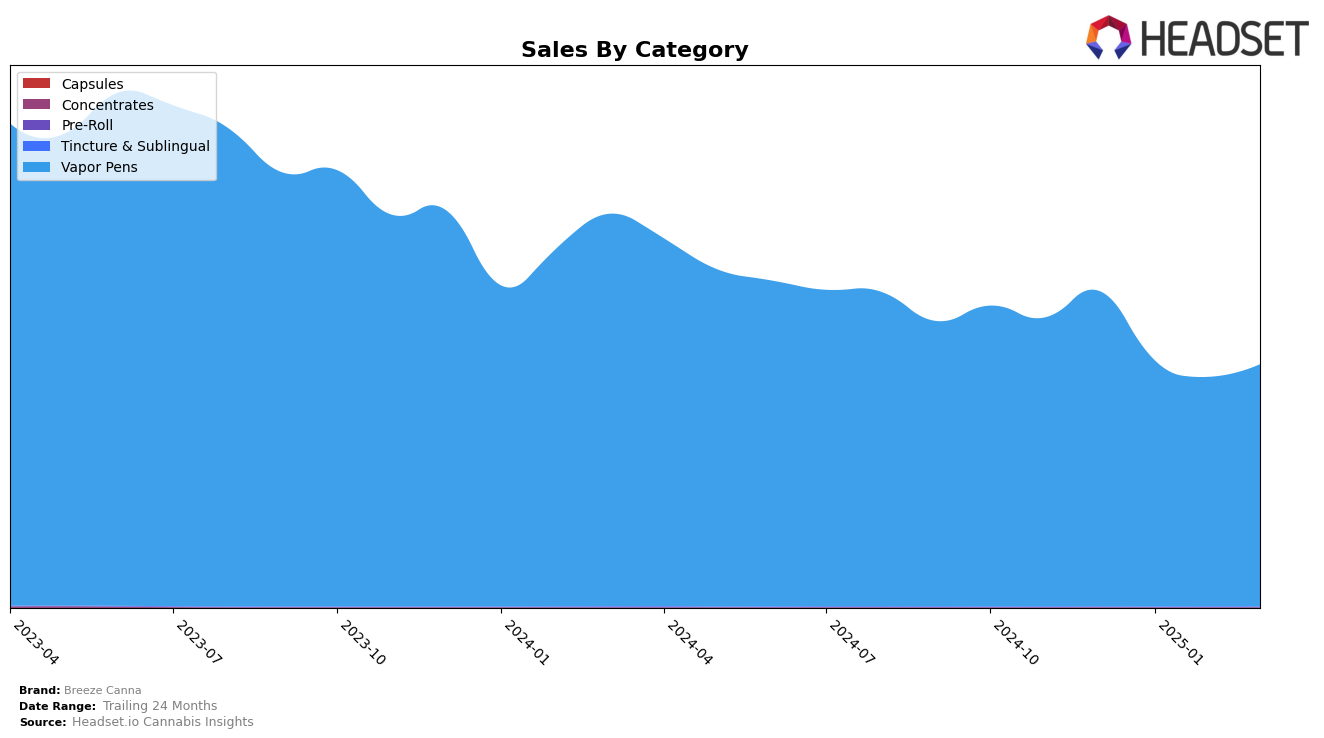

Breeze Canna's performance in the Vapor Pens category varies significantly across different states. In Arizona, the brand has consistently hovered outside the top 30, with rankings fluctuating between 40 and 47 from December 2024 to March 2025. This indicates a struggle to break into the more competitive ranks within the state. Meanwhile, in Illinois, Breeze Canna has experienced a slight decline in its ranking, dropping from 22 in January 2025 to 31 by March 2025. This downward trend suggests increased competition or possible shifts in consumer preferences that the brand might need to address.

In contrast, Michigan presents a more favorable scenario for Breeze Canna, where the brand has consistently maintained a top 5 position in the Vapor Pens category. Despite a brief dip to rank 5 in January and February 2025, Breeze Canna reclaimed the 4th position by March. This stability in a highly competitive market like Michigan highlights the brand's strong foothold and consumer loyalty in the state. The sales data further corroborates this, with Michigan showing substantial sales figures that dwarf those in other states, indicating a robust market presence. However, the specific strategies leading to this success remain an area for further exploration.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Michigan, Breeze Canna has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Starting strong in December 2024 at rank 3, Breeze Canna saw a decline to rank 5 in January and February 2025, before recovering slightly to rank 4 in March 2025. This movement reflects a competitive pressure from brands like MKX Oil Company, which consistently held the 3rd position, and Platinum Vape, which closely followed Breeze Canna's trajectory. Meanwhile, Muha Meds maintained a strong hold on the 2nd position throughout this period, indicating a stable consumer preference. Although Breeze Canna's sales showed a downward trend from December 2024 to February 2025, there was a positive uptick in March 2025, suggesting a potential recovery in consumer demand. This dynamic environment highlights the importance for Breeze Canna to strategize effectively to regain and maintain its competitive edge in the Michigan market.

Notable Products

In March 2025, the top-performing product from Breeze Canna was the Breeze x Astro Hippie - Tropical Rainbow Beltz Live Resin Disposable (1g) in the Vapor Pens category, achieving the number one rank with a sales figure of 6415. The Breeze x Astro Hippie - Neon Straw Guava Distillate Disposable (1g) followed closely in second place. The Granddaddy Purple Live Resin Disposable (1g) climbed to the third spot from its previous fifth position in February, showing a notable increase in popularity. The Watermelon Wave Distillate Disposable (1g) maintained a steady presence, ranking fourth, consistent with its performance in February. Lastly, the Tangerine Dream Live Resin Disposable (1g) entered the top five for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.