Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

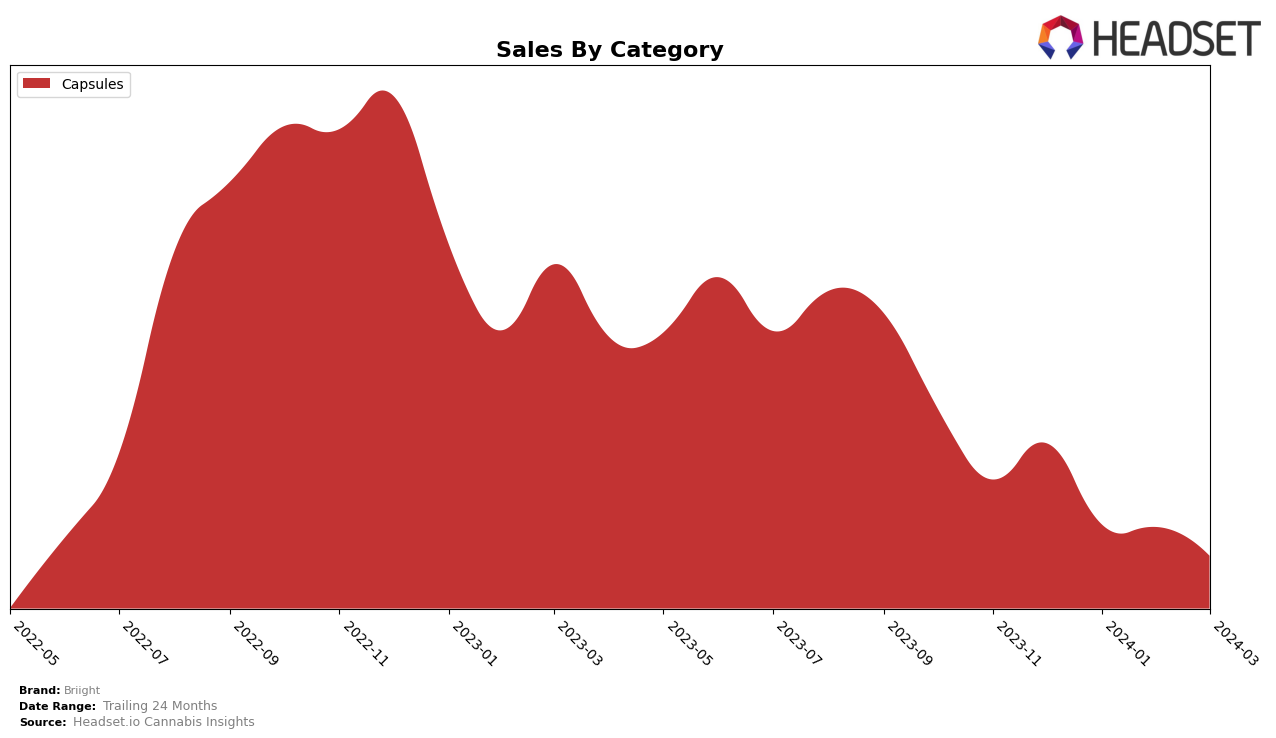

In Ontario, Briight's performance in the Capsules category has shown a consistent downward trend in rankings from December 2023 to March 2024, moving from 16th to 22nd place. This decline is mirrored in their sales figures, with a significant drop from 14,043 units in December 2023 to 4,503 units by March 2024. The consistent decline in both rankings and sales suggests that Briight may be facing increased competition or losing market share in Ontario's capsule market. Notably, their ranking in January 2024 at 20th and maintaining the same rank into February before slipping further in March highlights a struggle to regain or improve their market position during this period.

Conversely, in Saskatchewan, Briight's trajectory in the Capsules category presents a more volatile pattern. The brand was not ranked in January 2024, indicating they were not among the top 30 brands in that state and category for that month, which could be seen as a significant setback. However, they managed to re-enter the rankings in February 2024 at 12th place and slightly adjusted to 14th by March 2024. The sales figures in Saskatchewan, although starting from a lower base compared to Ontario, show a positive leap from 130 units in December 2023 to 495 units in February 2024, before a slight decrease to 154 units in March 2024. This recovery and subsequent positioning within the top 15 by March 2024 suggest a potential rebound or effective strategic adjustments in Saskatchewan, contrasting their performance in Ontario.

Competitive Landscape

In the competitive landscape of the cannabis capsules category in Ontario, Briight has experienced fluctuations in its market position, indicating a dynamic and challenging environment. Initially ranked 16th in December 2023, Briight saw a decline to the 22nd position by March 2024, despite starting with strong sales. Competitors such as Daily Special and MediPharm Labs have shown resilience and improvement in their rankings, with MediPharm Labs notably climbing to the 20th position by March 2024, suggesting a robust recovery and potential threat to Briight's market share. WholeHemp and Ollopa have also experienced volatility, but their movements indicate a competitive edge that Briight must navigate. The shifting dynamics underscore the importance for Briight to strategize effectively against these competitors to regain and enhance its market position in the ever-evolving Ontario cannabis capsules market.

Notable Products

In March 2024, Briight's top-performing product was the CBD Omega Softgels 30-Pack (750mg CBD) within the Capsules category, maintaining its number one rank consistently from December 2023 through March 2024. The sales figures for this product in March were 135 units, indicating a slight decline from previous months but still holding the top spot. This product has shown remarkable stability at the forefront of Briight's sales, underscoring its popularity and consumer trust in its efficacy. There were no other products mentioned to compare rankings or sales figures for a broader analysis. The data suggests that while there might have been fluctuations in the quantity sold, the CBD Omega Softgels 30-Pack (750mg CBD) has remained a favorite among Briight's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.