Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

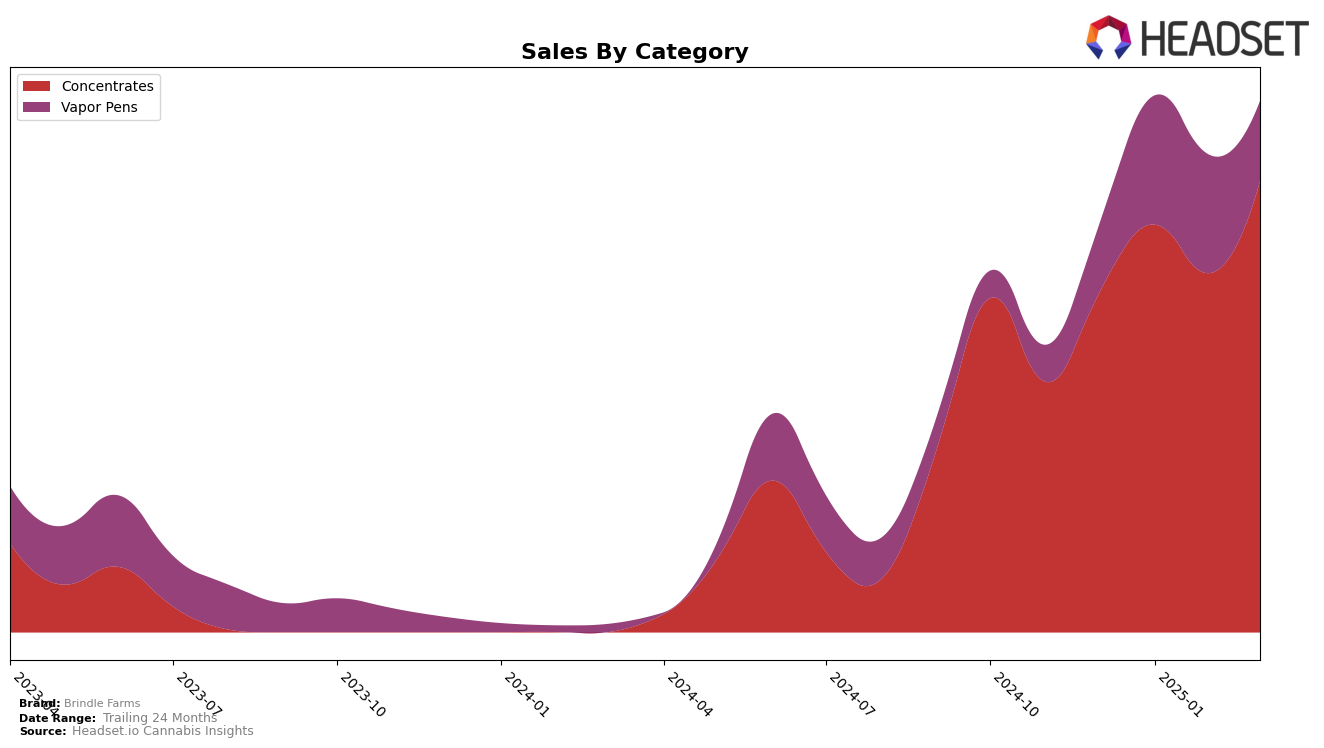

Brindle Farms has shown notable performance in the British Columbia market, particularly in the Concentrates category. Throughout the months from December 2024 to March 2025, the brand maintained a strong presence, consistently ranking third until March, when it climbed to the second position. This upward movement in the rankings is indicative of a positive trend, reflecting a growing consumer preference for Brindle Farms' concentrates. This consistent performance in a competitive category highlights the brand's ability to maintain and grow its market share.

In contrast, the Vapor Pens category in British Columbia presents a different story for Brindle Farms. Despite a brief appearance in the top 30 in January 2025, where it secured the 30th spot, the brand struggled to maintain its position, falling out of the top 30 rankings in both February and March. This fluctuation suggests challenges in sustaining consumer interest or competition from other brands in this category. The inability to consistently remain in the top 30 could be a point of concern for Brindle Farms as they strategize to strengthen their position in the vapor pens market.

Competitive Landscape

In the competitive landscape of the British Columbia concentrates market, Brindle Farms has demonstrated a promising upward trajectory. From December 2024 to March 2025, Brindle Farms consistently held the third position until March, when it ascended to the second rank, surpassing Vortex Cannabis Inc., which dropped to third. This shift highlights Brindle Farms' growing market presence and effectiveness in capturing consumer interest. Despite the consistent dominance of Endgame in the top spot, Brindle Farms' sales have shown a positive trend, particularly in March 2025, where they recorded a notable increase, closely rivaling the sales figures of Vortex Cannabis Inc. This competitive edge suggests that Brindle Farms is effectively leveraging its market strategies to enhance its brand appeal and sales performance in the concentrates category.

Notable Products

In March 2025, Strawberry Banana Live Rosin (1g) maintained its position as the top-performing product from Brindle Farms, continuing its lead from February with sales of 1,052 units. Brindle Farms x Old Growth Collective - Sour Animal Live Rosin (1g) climbed back into the rankings, securing the second position with a sales increase to 1,043 units after being unranked in January and February. La Kush Cake x Animal Style Live Rosin (1g) consistently held the third rank, showing steady growth from December's lower sales figures. Strawberry Guava Full Spectrum Live Rosin (1g) slipped to fourth place after a strong performance in February. The Strawberry Banana Live Rosin Cartridge (1g) dropped to fifth place, experiencing a decline in sales compared to its previous months, highlighting a shift in consumer preference within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.