Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

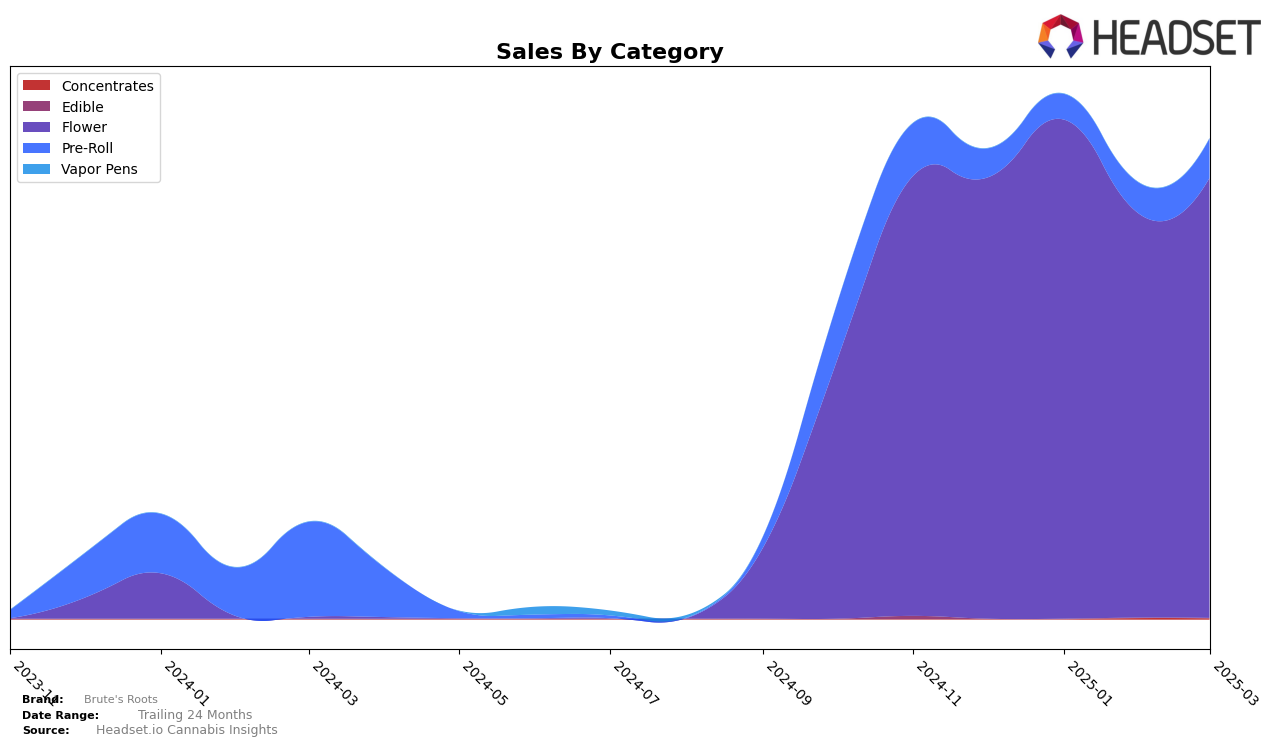

Brute's Roots has demonstrated a consistent performance in the New Jersey market, particularly within the Flower category. The brand maintained a stable ranking of 15th place from December 2024 through February 2025, before a slight dip to 16th in March 2025. This indicates a strong foothold in the Flower category, although the minor drop in March suggests potential competition or shifting consumer preferences. The sales figures reflect a peak in January 2025, followed by a dip in February, and a recovery in March, which could imply seasonal variations or promotional influences affecting consumer buying patterns.

In contrast, Brute's Roots' performance in the Pre-Roll category in New Jersey has been more volatile. The brand did not secure a spot in the top 30, with rankings hovering around the 40th position, indicating a less dominant presence in this category. Despite this, there was an observable increase in sales from January to March 2025, suggesting an upward trend in consumer interest or effective promotional strategies. The brand's ability to improve its sales figures despite not breaking into the top 30 highlights a potential area for growth and strategic focus in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Brute's Roots has maintained a consistent presence, ranking 15th from December 2024 through February 2025 before slightly dropping to 16th in March 2025. This stability in rank is noteworthy given the fluctuations experienced by other brands. For instance, Cookies saw a decline from 13th to 18th place over the same period, indicating potential challenges in maintaining market share. Meanwhile, Old Pal improved its position from 25th in December 2024 to 17th in March 2025, showcasing a significant upward trend in sales performance. Kind Tree Cannabis experienced a downward trajectory, moving from 10th to 15th place, which may reflect a decrease in consumer preference or increased competition. Notably, The Lid showed a strong performance by climbing from 20th to 14th place by February 2025 and maintaining that rank in March, likely due to strategic marketing or product offerings. Brute's Roots' ability to hold its ground amidst these shifts suggests a solid customer base and effective market strategies, although the slight dip in March indicates a need for vigilance against rising competitors.

Notable Products

In March 2025, Brute's Roots saw Brute's Blend Pre-Roll (1g) climb to the top spot, securing the number one rank with impressive sales of 5883 units. Blue Zushi Smalls (3.5g), which held the first rank in previous months, dropped to second place, reflecting a decrease in sales to 2429 units. Wildberry Fusion (3.5g) made a notable entry into the rankings, securing the third position with sales of 2063 units, despite being unranked in earlier months. Miracle Mints Popcorn (3.5g) maintained a consistent presence, ranking fourth in March, showing a slight increase from its January rank. Rainbow Runtz Smalls (3.5g) slipped to fifth place, indicating a marginal decline in sales performance compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.