Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

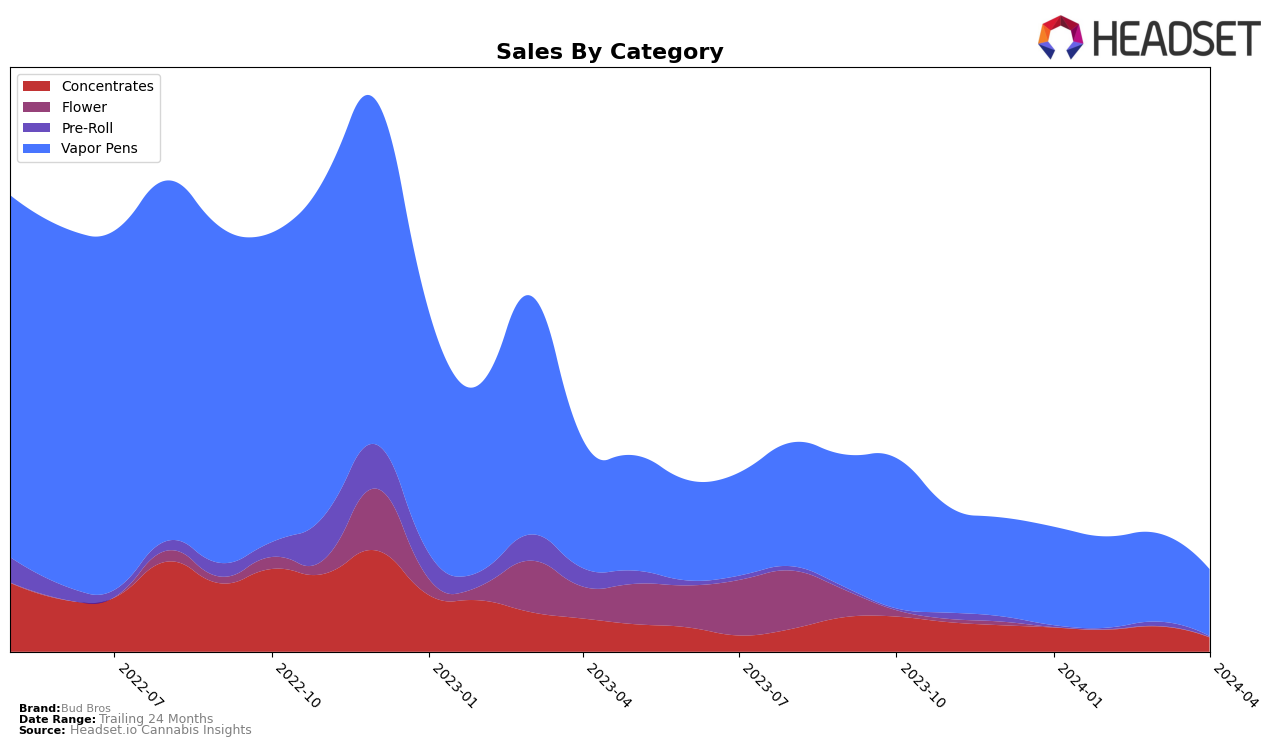

In Arizona, Bud Bros has shown a consistent presence in the competitive cannabis market, particularly within the Concentrates and Vapor Pens categories. For Concentrates, their ranking slightly declined from 28 in January 2024 to 35 by April 2024, indicating a struggle to maintain their position within the top 30 brands. This downward trend is mirrored in their sales figures, which peaked in March at 34,759 but then saw a significant drop to 19,402 by April. The Vapor Pens category tells a similar story of consistent, albeit slightly better, performance with rankings moving from 24 in January to 27 in April. The sales trajectory for Vapor Pens also declined, starting at 135,862 in January and falling to 92,208 by April, suggesting a decrease in market demand or competitive pressures affecting their standing.

While the data for Bud Bros in Arizona reflects certain challenges, it's important to note the nuances in market dynamics and consumer preferences that could be influencing these trends. The slight but consistent slip in rankings across both categories could signal a need for strategic adjustments or innovations to regain and enhance their market share. Despite these challenges, maintaining a position within the top 30 for both categories in a highly competitive market is noteworthy. However, the absence from the top 30 in February and March for Concentrates could be seen as a red flag, highlighting potential areas for improvement or a need to bolster their market strategies. This analysis hints at the broader performance of Bud Bros but leaves room for deeper exploration into other states or provinces, product innovations, and marketing strategies that could influence future success.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Arizona, Bud Bros has experienced a slight fluctuation in its ranking over the recent months, indicating a fiercely competitive market. Initially ranked 24th in January 2024, Bud Bros maintained a relatively stable position until April 2024, when it slightly dropped to 27th. This shift can be attributed to the dynamic performances of its competitors, such as Vapen, which saw a significant rise to the 25th position in April from being ranked lower than Bud Bros in the preceding months. Similarly, PuraEarth (AZ) and High Vibrations have shown remarkable upward movements in rankings, with PuraEarth climbing to the 26th position by April and High Vibrations entering the rankings at 46th in February and jumping to 28th by April. IO Extracts, another notable competitor, although starting stronger than Bud Bros in January, experienced a drop to 29th by April. These shifts highlight the volatile nature of the market and underscore the importance of Bud Bros needing to innovate and adapt to maintain or improve its market position amidst growing competition.

Notable Products

In April 2024, Bud Bros saw Maui Wowie Distillate Cartridge (1g) as its top-performing product, reclaiming its number one position with sales figures reaching 319 units. Following closely, Northern Lights Distillate Cartridge (1g) improved its ranking to second place, a notable rise from its consistent third-place position in the previous months. Blackberry Kush Distillate Cartridge (1g) made a significant entry by securing the third rank in its debut month. White Widow Distillate Cartridge (1g) maintained its fourth position, demonstrating steady demand among consumers. Meanwhile, Blue Dream Distillate Cartridge (1g), despite being a strong contender in earlier months, dropped to fifth place, highlighting shifting consumer preferences within Bud Bros' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.