Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

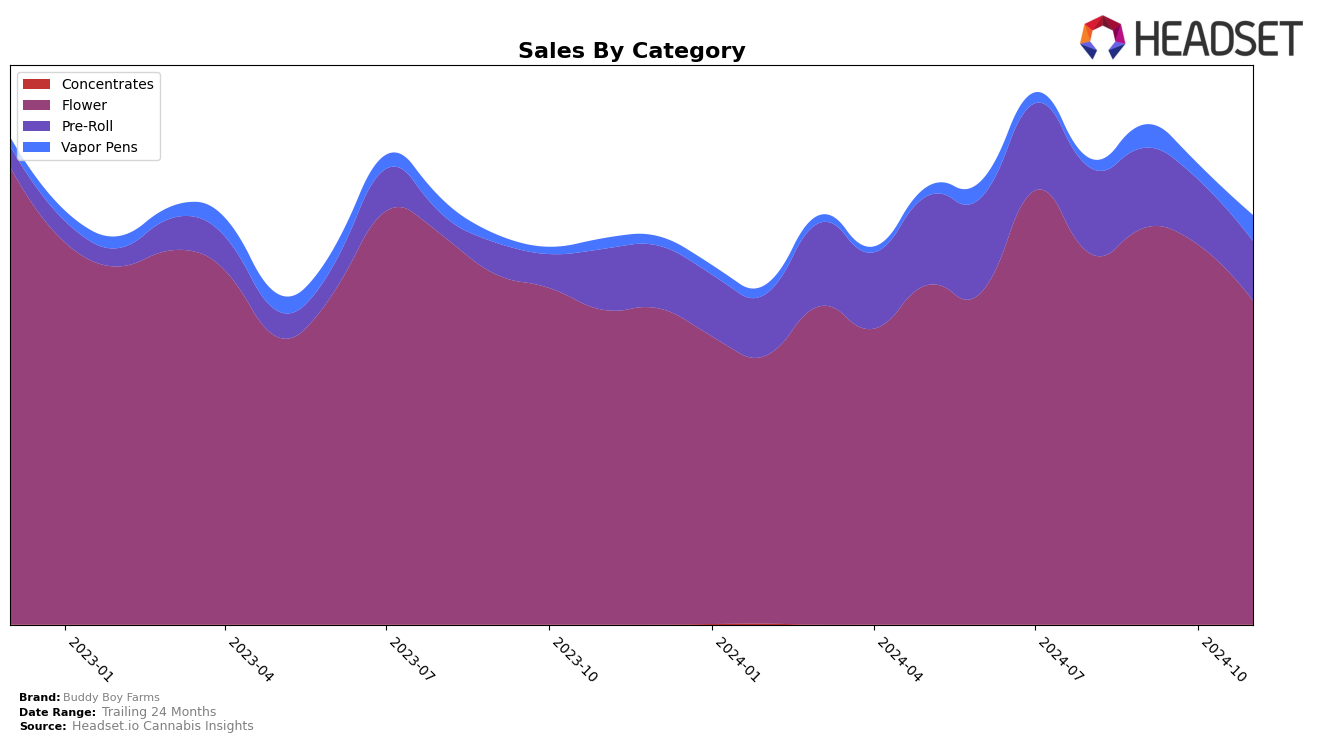

In the state of Washington, Buddy Boy Farms has shown fluctuating performance across different product categories. In the Flower category, the brand experienced a notable rise in the rankings from August to September 2024, moving from 29th to 19th place. However, this upward trend did not sustain, as the ranking slipped back to 22nd in October and further down to 30th by November. This indicates a potential challenge in maintaining consistent market presence or possibly increased competition in the Flower category. On the other hand, the Pre-Roll category tells a different story, where Buddy Boy Farms did not make it into the top 30 brands, hovering around the 70s and 80s in rankings. This consistent lower ranking suggests a need for strategic adjustments or possible expansion efforts to boost their standing in the Pre-Roll market.

Overall, the sales figures for Buddy Boy Farms in Washington reflect the ranking trends observed. The Flower category saw a peak in sales in September, aligning with their highest ranking during that period, but experienced a decline in the following months. The Pre-Roll category, while not breaking into the top 30, also saw a decreasing trend in sales from August to November. This decline might indicate either a shift in consumer preference or increased competition impacting their market share. While these insights provide a glimpse into Buddy Boy Farms' performance, further analysis could uncover more about underlying factors and potential strategies for improvement.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Buddy Boy Farms has experienced notable fluctuations in its ranking over recent months. Starting from a rank of 29 in August 2024, Buddy Boy Farms improved to 19 in September, indicating a positive trend in sales performance. However, this upward momentum was not sustained, as the brand's rank slipped to 22 in October and further to 30 in November. This volatility contrasts with competitors like Sky High Gardens, which started at rank 19 in August but fell out of the top 20 by November, and Gabriel, which showed a more stable presence, maintaining a rank within the top 30 throughout the period. Meanwhile, Good Earth Cannabis demonstrated a consistent upward trajectory, improving from rank 43 in August to 28 in November, potentially posing a growing competitive threat. These dynamics suggest that while Buddy Boy Farms has shown potential for strong sales, maintaining a steady rank amidst fluctuating market conditions remains a challenge.

Notable Products

In November 2024, Gorilla Glue #4 (4g) maintained its top position as the best-selling product for Buddy Boy Farms, with sales reaching 1797 units. Maui Wowie Shake (28g) emerged as the second best-selling product, a new entry in the rankings for this month. Alaskan Thunder Fuck (4g) held steady in third place, consistent with its ranking from October 2024. GG #4 Shake (28g) dropped to fourth place after being the second best-seller in October, indicating a slight decline in its popularity. Presidential Kush Shake (28g) remained in fifth place, showing stable performance compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.