Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

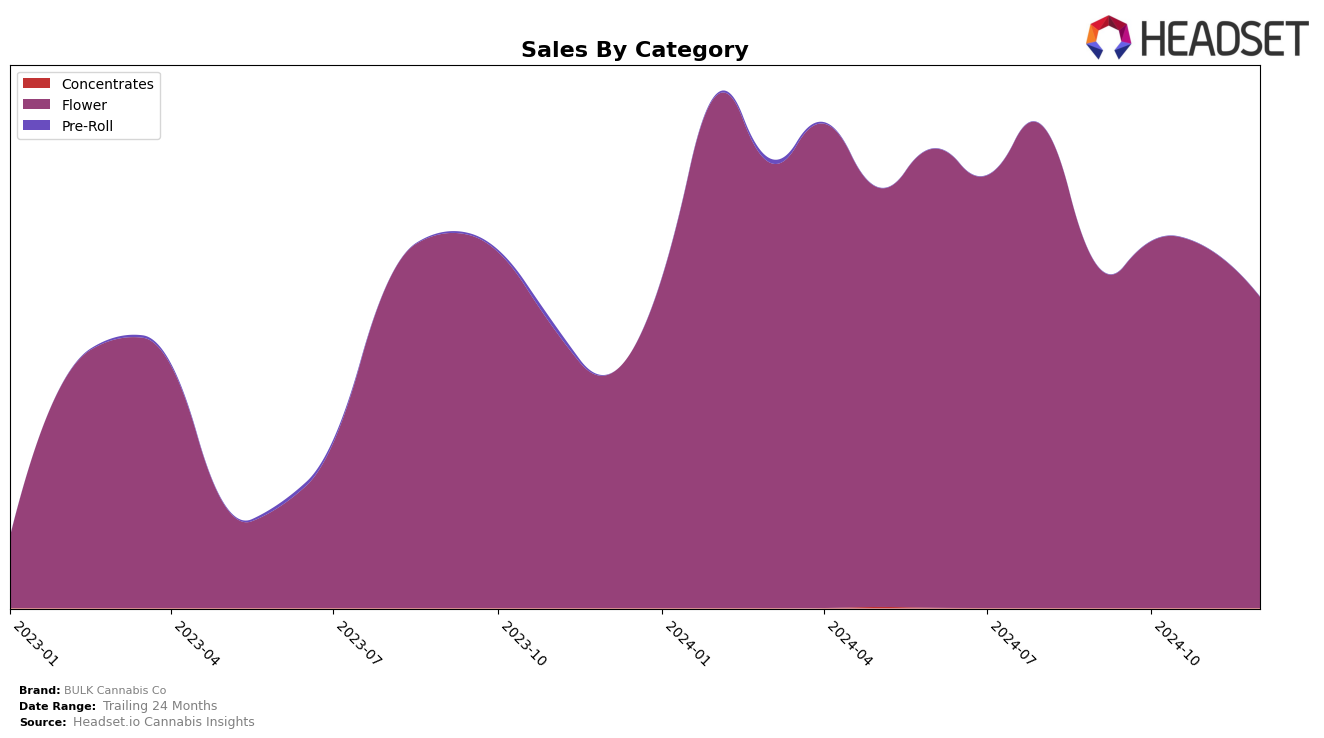

BULK Cannabis Co has shown notable progress in the Colorado market, particularly within the Flower category. Over the last four months of 2024, the brand has climbed from a rank of 45 in September to 29 by December. This upward trajectory indicates a significant improvement in their market position, suggesting increased consumer interest or a strategic shift that has resonated well with their audience. The brand's sales figures reflect this positive movement, with a peak in October followed by a slight decline in the following months, yet maintaining a strong presence in the top 30 by December.

While BULK Cannabis Co has successfully entered the top 30 rankings in Colorado's Flower category, it is important to note that their presence in other states and categories has not been as prominent, as they do not appear in the top 30 for any other state or category during this period. This absence could be viewed as a potential area for growth or a strategic decision to focus efforts on strengthening their position in Colorado's competitive Flower market. The brand's ability to break into the top 30 in Colorado suggests they have the potential to replicate this success in other markets, should they choose to expand their focus.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, BULK Cannabis Co has demonstrated a notable upward trajectory in rankings over the last few months of 2024. Starting from a rank of 45 in September, BULK Cannabis Co improved to 29 by December. This positive shift indicates a growing market presence and possibly an increase in consumer preference. In contrast, The Colorado Cannabis Co. and Antero Sciences experienced fluctuations, with both brands not consistently maintaining a top 20 position, suggesting potential volatility in their sales performance. Meanwhile, TREES maintained a stronger position, ranking as high as 7 in November before dropping to 27 in December, which may reflect seasonal sales trends or shifts in consumer preferences. Boulder Built also showed variability, peaking at rank 22 in October but not sustaining this momentum. These dynamics underscore the competitive nature of the market, where BULK Cannabis Co's consistent improvement could signal strategic advantages or successful marketing efforts that are resonating with consumers.

Notable Products

In December 2024, Grape Balls of Fire (Bulk) emerged as the top-performing product for BULK Cannabis Co, climbing from a fifth-place rank in November to first place, with notable sales of 6254 units. Dante's Inferno (14g) maintained a strong presence, holding steady in second place after bouncing back from fourth in November. Trop Cherries (Bulk) experienced a slight dip, moving from first in November to third in December. G Code (7g) appeared in the rankings for the first time, securing the fourth spot. Georgia Pie (Bulk) rounded out the top five, dropping from third in November to fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.