Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

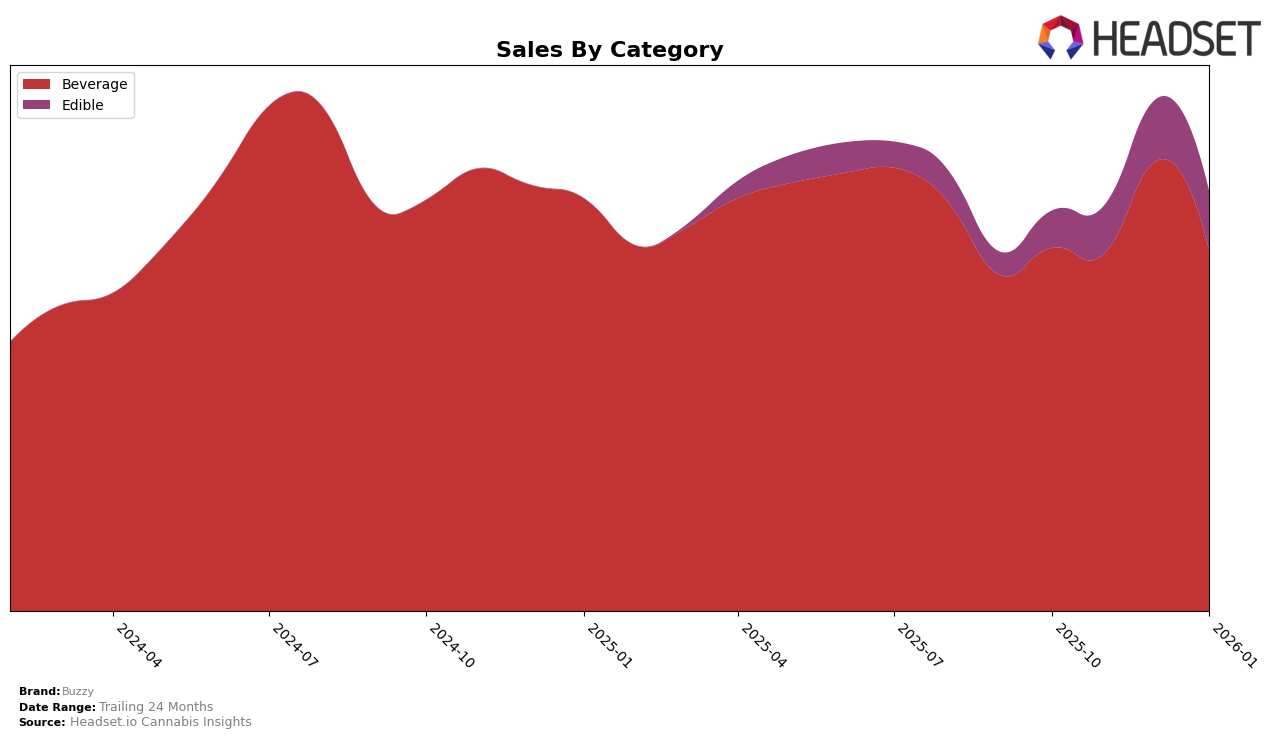

In the Massachusetts market, Buzzy has shown a strong and consistent performance in the Beverage category. Over the span from October 2025 to January 2026, Buzzy maintained a solid presence, ranking fourth in three out of the four months, with a slight improvement to third place in December 2025. This indicates a stable consumer base and effective market strategies in this category. Notably, December 2025 saw a significant spike in sales, suggesting a successful campaign or seasonal demand. The ability to maintain a top-five position consistently underscores Buzzy's strong brand recognition and consumer loyalty in the beverage segment.

Conversely, Buzzy's performance in the Edible category in Massachusetts tells a different story. Here, the brand struggled to break into the top 30, with rankings fluctuating from 61st in October 2025 to 52nd by January 2026. Despite this, there was a noticeable upward trend in sales, indicating growing interest or improved distribution efforts. The gradual climb in rankings suggests that while Buzzy has not yet become a dominant player in the Edible category, there is potential for growth if current efforts continue. This disparity between categories highlights the varying levels of competition and consumer preferences within the market.

Competitive Landscape

In the Massachusetts beverage category, Buzzy has shown a dynamic performance over the last few months, maintaining a competitive position among its peers. While Buzzy consistently held the 4th rank in October and November 2025, it climbed to 3rd place in December 2025, only to return to 4th in January 2026. This fluctuation in rank is indicative of the competitive pressure from brands like Good Feels Inc, which also experienced a similar rank shift, dropping to 4th in December before reclaiming the 3rd spot in January. Despite these changes, Buzzy's sales trajectory remains robust, with a notable peak in December 2025, suggesting a strong market presence and consumer preference during the holiday season. Meanwhile, Hi5 Seltzer consistently dominates the top position, highlighting the competitive landscape Buzzy navigates. Brands like Chill Medicated and Pine + Star also contribute to the competitive dynamics, with their ranks and sales figures reflecting their own market strategies and consumer engagement.

Notable Products

In January 2026, the top-performing product for Buzzy was Orange Soda (5mg THC, 355ml, 12oz), which climbed to the number one rank from its consistent second-place position in the previous months, achieving sales of 4156 units. Root Beer Soda (5mg THC, 355ml, 12oz) dropped to the second position after leading the sales chart for three consecutive months. Cola Zero Sugar Soda (5mg THC, 355ml, 12oz) made its debut in the rankings, securing the third spot with notable sales. Grape Soda (5mg THC, 355ml, 12oz) improved its rank to fourth from fifth in December 2025, while THC/CBN 1:1 Blissful Berry Seltzer (5mg THC, 5mg CBN, 355ml, 12oz) slipped from third to fifth place. The beverage category continues to dominate Buzzy's sales, with all top products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.