Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

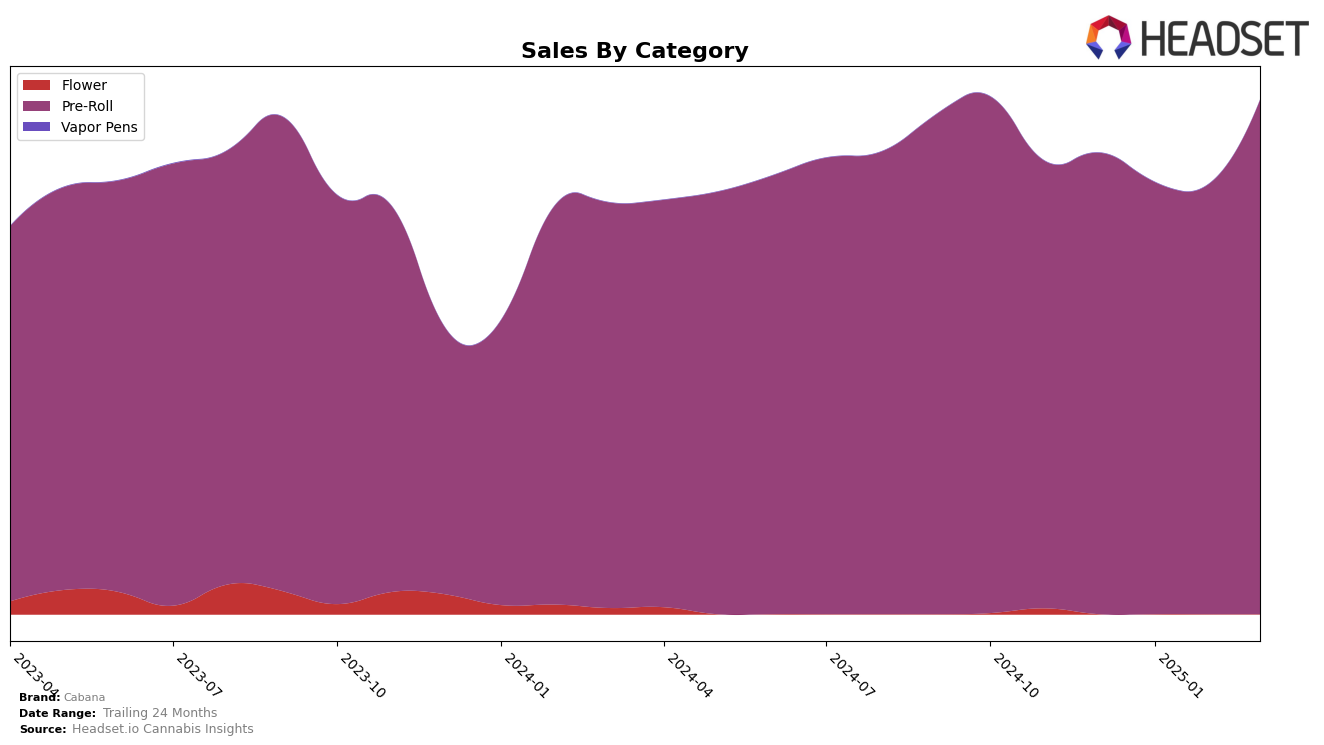

In the Oregon market, Cabana has shown consistent performance in the Pre-Roll category, maintaining a steady ranking at 11th place from December 2024 through February 2025. However, a notable improvement occurred in March 2025, where Cabana climbed to the 9th position. This upward movement indicates a positive trend, suggesting that Cabana's strategies or product offerings might be resonating more with consumers in Oregon. Despite a slight dip in sales from December to January, the brand rebounded strongly by March, reflecting a potential seasonal trend or successful promotional efforts.

While Cabana's performance in Oregon's Pre-Roll category shows promise, the absence of rankings in other states or categories suggests areas where the brand is either not focusing its efforts or not yet achieving significant market penetration. The lack of top 30 rankings in other regions could be seen as a potential opportunity for expansion or a challenge that needs addressing. Understanding the dynamics of these markets could provide valuable insights into where Cabana might focus its future efforts to replicate its success in Oregon.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Cabana has shown a notable improvement in its market position, climbing from 11th place in December 2024 to 9th place by March 2025. This upward movement is significant, especially considering the competitive pressure from brands like PRUF Cultivar / PRŪF Cultivar, which consistently ranked higher, peaking at 4th place in January 2025. Meanwhile, Benson Arbor experienced fluctuations, dropping from 6th to 10th place before recovering to 7th, indicating a volatile performance that Cabana could capitalize on. Additionally, Decibel Farms and Kites maintained stable positions, with Decibel Farms briefly surpassing Cabana in February 2025. Despite these challenges, Cabana's sales saw a positive trend, with a notable increase in March 2025, suggesting effective strategies that could be further leveraged to enhance its competitive edge in the Oregon market.

Notable Products

In March 2025, Cabana's top-performing product was Fatso Pre-Roll (1g), securing the number one rank with sales of 2621 units. Blue Dream Pre-Roll (1g) followed closely in second place, showing strong performance. Sour Candy Lope Pre-Roll (1g), which previously held the top spot in February, ranked third in March with a notable decrease in sales. The Rizz Pre-Roll (1g) entered the top five for the first time, landing in fourth place. Sour Diesel Pre-Roll (1g) dropped to fifth place, marking a decline from its previous high rankings in December and January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.