Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

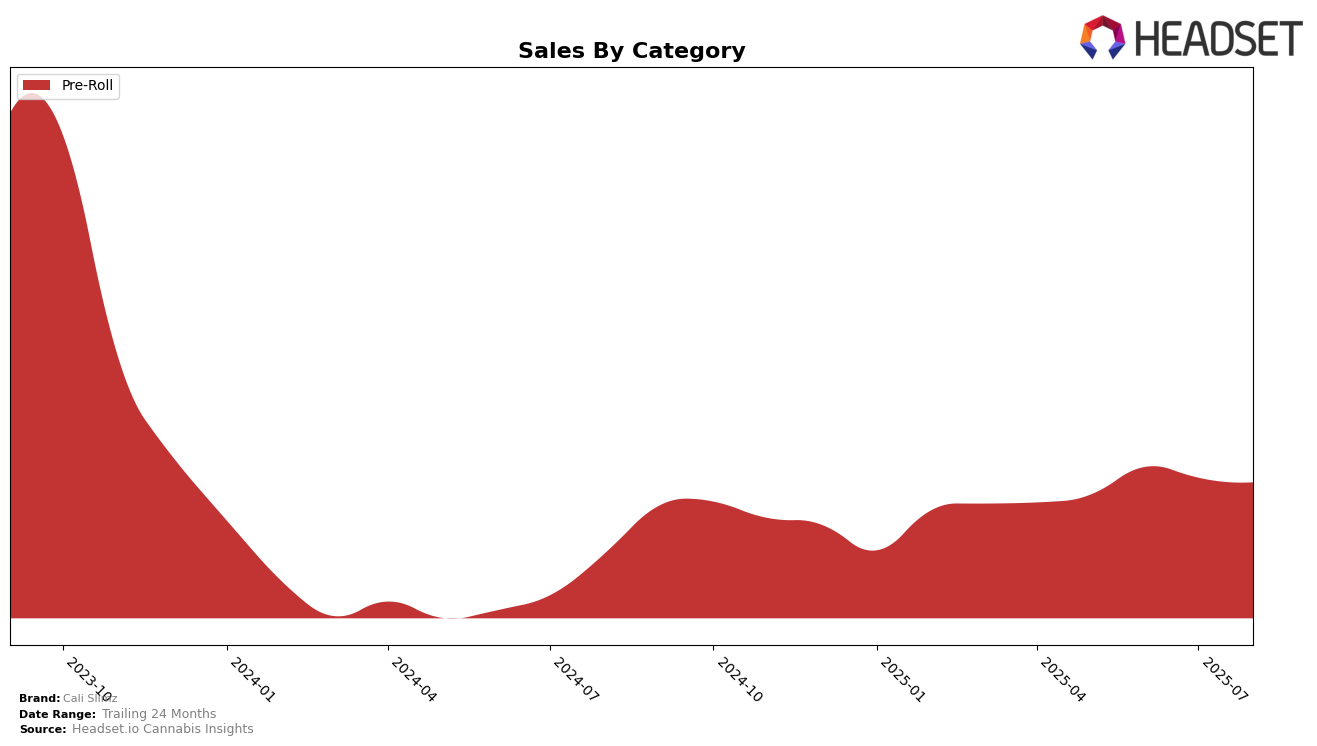

Cali Slimz has demonstrated varied performance across the Canadian provinces, particularly in the Pre-Roll category. In Ontario, the brand has struggled to break into the top 30, with rankings fluctuating between 71 and 83 from May to August 2025. This indicates a challenging market presence in Ontario, where competition is likely fierce, and Cali Slimz has yet to establish a strong foothold. Despite this, the sales figures show a slight recovery in August after a dip in July, suggesting potential for growth if strategic adjustments are made.

In contrast, Saskatchewan presents a more optimistic scenario for Cali Slimz. The brand has made significant strides, achieving a top 30 ranking by June and maintaining a strong presence through August, with ranks of 19 and 20. This upward trajectory in Saskatchewan is complemented by a notable increase in sales from May to July, although there was a slight decline in August. This performance suggests that the brand's strategies in Saskatchewan are resonating well with consumers, offering a promising outlook for continued success in this province.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Cali Slimz has experienced notable fluctuations in its ranking and sales performance. From May to August 2025, Cali Slimz's rank shifted from 74th to 82nd, indicating a slight decline in its market position. Despite this, Cali Slimz managed to maintain a competitive edge in sales, with figures closely rivaling those of brands like 7 Acres and Coterie, which also showed fluctuations in their ranks. Notably, Lamplighter initially held a stronger position in May but saw a significant drop by August, suggesting potential volatility in the market. Meanwhile, Pepe demonstrated a gradual improvement in rank, surpassing Cali Slimz in July. These dynamics highlight the competitive pressures Cali Slimz faces, emphasizing the importance of strategic positioning and marketing efforts to regain and sustain higher rankings in the Ontario Pre-Roll market.

Notable Products

In August 2025, the top-performing product from Cali Slimz was the Tangerine Sunset Pre-Roll 10-Pack (3.5g), maintaining its number one rank from July with sales of 2030 units. Fritter Glitter Pre-Roll 10-Pack (3.5g) followed closely in second place, dropping from its top position in July. The Cake Boss Pre-Roll 10-Pack (3.5g) held steady in third place, showing a consistent upward trend in sales over the months. Watermelon Zkittlez Pre-Roll 10-Pack (3.5g) secured the fourth position, consistent with its rank from the previous month. Lion's Breath Pre-Roll 10-Pack (3.5g) remained in fifth place, showing stable performance since June.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.