Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

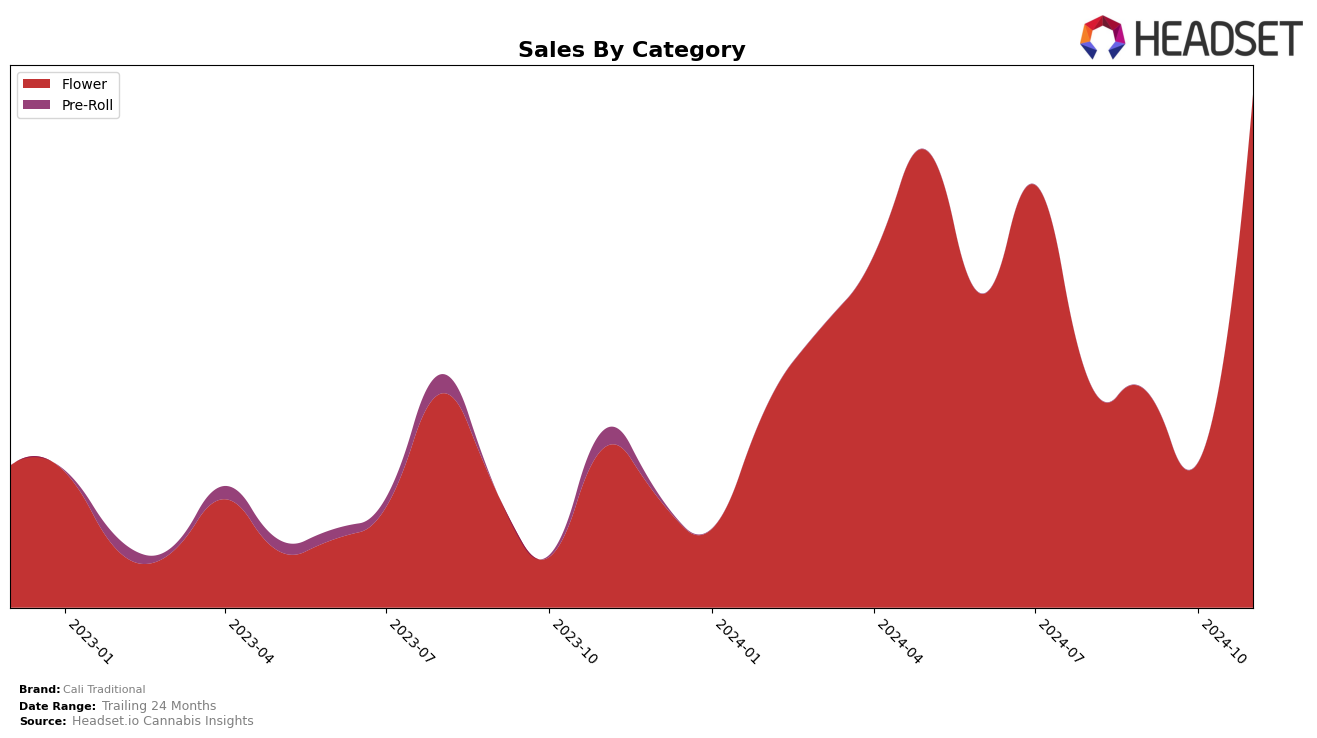

Cali Traditional has demonstrated notable performance shifts across different states and product categories in recent months. In Nevada, the brand has shown a significant improvement in the Flower category. Starting from a rank of 52 in August 2024, it climbed to 23 by November 2024. This upward movement is indicative of a strategic positioning or perhaps an effective marketing campaign that resonated well with the consumer base in Nevada. Such a leap into the top 30 rankings highlights the brand's growing influence and acceptance in the region, especially considering it was not even in the top 30 just a few months prior.

While Nevada showcases a positive trajectory for Cali Traditional, the absence of rankings in other states or categories suggests areas where the brand might need to enhance its presence or rethink its strategy. The Flower category in Nevada seems to be a stronghold, but the lack of visibility in other categories or states could be a concern if the brand aims for broader market penetration. The sales spike in November 2024, with a notable increase to $248,650, underscores a successful period that could serve as a foundation for further expansion. However, for sustained growth, the brand might need to replicate this success in other regions and diversify its category strengths.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Cali Traditional has shown a notable improvement in its ranking and sales performance over the past few months. Despite starting at a lower rank of 52 in August 2024, Cali Traditional surged to 23 by November 2024, indicating a significant upward trajectory. This improvement is particularly impressive when compared to brands like The Grower Circle, which only moved from rank 34 to 25 in the same period, and Srene, which experienced a more volatile journey, ultimately reaching a higher rank of 21. Meanwhile, Superior (NV) saw a decline from rank 16 to 22, and Dope Dope maintained a relatively stable presence, ending at rank 24. The sales figures for Cali Traditional also reflect this positive trend, with a substantial increase in November, suggesting effective strategies in capturing market share and consumer interest. This data highlights Cali Traditional's potential for continued growth and competitiveness in the Nevada flower market.

Notable Products

In November 2024, Kush Mints (3.5g) reclaimed the top spot among Cali Traditional's products, with sales reaching 1,330 units. Animal Mints x Permanent Marker Popcorn (14g) entered the rankings at second place, showing a strong performance with notable sales figures. Animal Mints x Permanent Marker (3.5g) climbed to third place, improving from its fourth position in October. Garlic Cocktail (3.5g) slipped to fourth place after leading in October. Kush Mints Popcorn (14g) made its debut in the rankings at fifth position, indicating a growing interest in popcorn-style products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.